Lotus PE, HL Group Investment-Only Fund

Chairman's Two Daughters Hold 100% Stake

Initial Registered Executives Are HL Group Employees

Four Years of Performance Since Establishment at End of 2021

Only Serve as Joint GP...Questions on Management Capability

HL Holdings, led by Chairman Chung Mong-won, has been revealed to have invested a large sum of money in private equity funds (PEFs) owned by the chairman's children. Amid doubts about the independent management capabilities of these PEFs, suspicions have arisen that the group’s assets may have been used for the private interests of the owner family.

The Only Shareholders of Lotus PE Are the Two Daughters

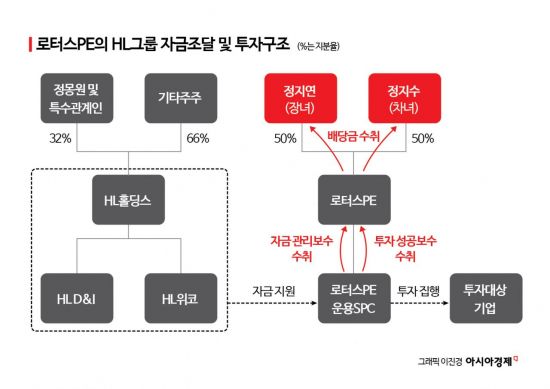

According to the financial investment industry on the 18th, HL Holdings made a total investment of 217 billion KRW in funds co-managed (GP) by Lotus Private Equity (Lotus PE), which is 100% owned by Chairman Chung’s two daughters, from 2021 to 2023. This amount is approximately 2.4 times HL Holdings’ consolidated operating profit of 92.2 billion KRW last year.

Lotus PE was established as a company owned by Chairman Chung Mong-won’s children from its inception in November 2020. Looking at the shareholding structure, the eldest daughter Chung Ji-soo (50%) and the second daughter Chung Ji-yeon (50%) are the sole shareholders, with no changes over four years. Among the initial registered executives, except for CEO Lee Sang-min, the others were employees of the Halla Group at the time. Non-executive director Lee Yong-joo was an executive director at Halla, and non-executive director Jang Kyung-guk was a managing director at Halla Holdings. Executive director Lee Yong-joo currently serves as the Chief Strategy Officer (CSO) at HL D&I.

The market has expressed doubts about Lotus PE’s management capabilities. As of the end of 2023, the company had only three employees including CEO Lee Sang-min, who has no disclosed investment-related experience. The company has no internal board of directors or committees. Investment performance as of the third quarter was also poor. By the end of September, the valuation showed a loss of 43.6 billion KRW compared to the invested amount. Losses from investments in WCP (76.1 billion KRW) and Woosung Platech (18.7 billion KRW) were significant, offsetting gains from Korea Asset Valuation (26 billion KRW) and Willbes NT (25.2 billion KRW), resulting in substantial net losses. A securities industry insider pointed out, "The bigger problem is that Lotus PE only participates as a co-GP recruiting LPs in investments led by other GPs," adding, "It has never formed a fund independently, and it is estimated that all LP contributions come from the HL Group."

In fact, Lotus PE, which started as a new management company with a capital of 2 billion KRW, has grown into a PEF managing five funds with total assets under management (AUM) of 360 billion KRW in just over four years. Lotus PE has continued its growth by earning management fees and performance fees based on investment results. Its revenue increased from 800 million KRW in 2021 to 2.2 billion KRW in 2022 and 2.6 billion KRW in 2023. Net income rose even more sharply, from 300 million KRW to 1.4 billion KRW and then to 4.3 billion KRW.

Suspicions of Disclosure Evasion by Routing Through Subsidiaries Instead of Direct Investment

Some in the market suspect that this investment was used as funding for the purchase of HL Holdings shares by the owner family. Indeed, Chairman Chung’s two daughters each purchased an additional 1.14% stake in HL Holdings in January this year. At that time, they cited dividend income, investment profits, gifts, and earned income as sources of funds for the share purchases. Currently, Chairman Chung Mong-won holds about 32% of HL Holdings’ shares. A financial investment industry official criticized, "This is a so-called 'tunneling' method where the owner family uses private equity funds to make money," adding, "Losses are borne by HL Holdings’ investors, while profits are monopolized by the owner family."

However, financial supervisory authorities have taken a conservative stance on this matter. A Financial Supervisory Service official stated, "There have been no complaints regarding HL Holdings," and added, "It is difficult to make an immediate judgment at this point as the overall situation needs to be reviewed."

Meanwhile, HL Holdings recently attempted to donate about 470,000 shares, equivalent to approximately 84% of its treasury stock, to a newly established foundation free of charge, but withdrew the plan due to strong opposition from shareholders. Donating treasury stock worth about 16 billion KRW would be recorded as a loss in the company’s performance. This amount corresponds to 53.3% of HL Holdings’ cumulative controlling shareholder net profit of 30 billion KRW for the first to third quarters of this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)