Direct Debate Hosted by Lee Jae-myung on the 19th

Focus on Strengthening Protection of General Shareholders' Interests

Business Community "Concerns Over Weakening Global Competitiveness"

The Democratic Party of Korea is reinitiating a revision of the Commercial Act that expands the fiduciary duties of directors. The core objective is to break the corporate-centered board practices and protect the interests of ordinary shareholders.

The Democratic Party plans to resume policy discussions on the Commercial Act revision as early as the 19th through the party's "Republic of Korea Stock Market Revitalization Task Force (Director TF)." This comes two weeks after a scheduled discussion on the 4th was indefinitely postponed due to the December 3 emergency martial law incident. The discussion will be chaired directly by party leader Lee Jae-myung. Currently, final coordination is underway with major economic organizations such as the Korea Chamber of Commerce and Industry to reflect the business community's stance.

The reason the Democratic Party is accelerating the Commercial Act revision, which was delayed during the impeachment phase, is to strengthen its leading role in revitalizing the livelihood economy as the next ruling party. On the 17th, Park Chan-dae, the Democratic Party floor leader, emphasized at the floor strategy meeting, "With the urgent issue resolved by the passage of the impeachment motion against President Yoon Seok-yeol, we will immediately form a Livelihood Recovery TF to focus on economic revival." Some interpret this as a timely opportunity to process contentious bills and domestic demand revitalization legislation that President Yoon had previously vetoed.

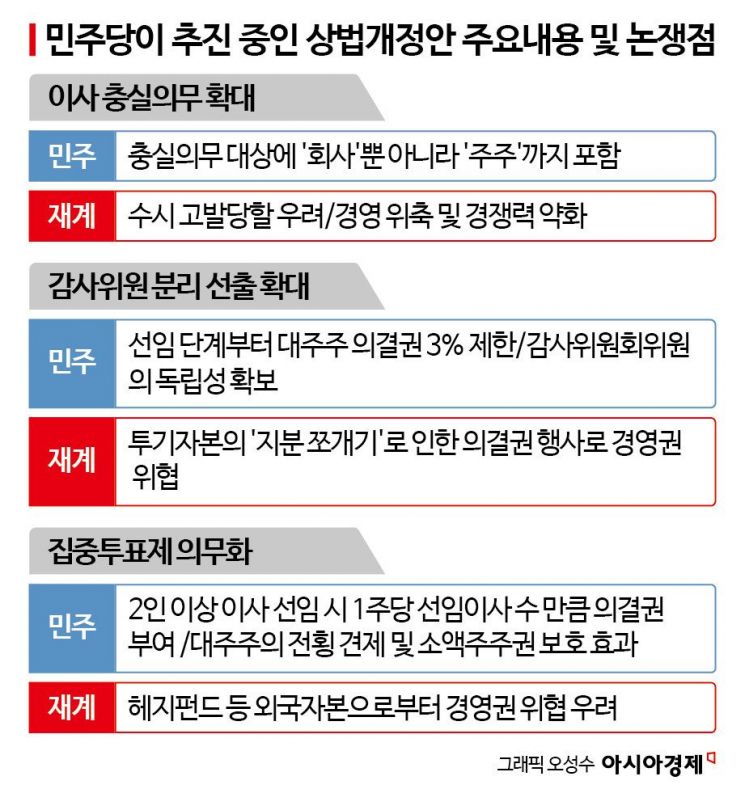

The core of the Commercial Act revision adopted as party policy by the Democratic Party lies in strengthening directors' duties toward shareholders. Specifically, it can be summarized into three main points: △ explicitly including 'shareholders' as subjects of directors' fiduciary duties △ expanding separate election of audit committee members △ mandating cumulative voting.

First, the most controversial issue is whether to amend Article 382-3 of the Commercial Act (Directors' Fiduciary Duty). The Democratic Party is considering specifying 'shareholders' as subjects of directors' fiduciary duties in addition to 'the company' in this article. Another alternative is to keep the current provision unchanged but add a separate clause stating "directors must protect the interests of all shareholders." Both options aim to expand and clarify directors' duties to actively protect shareholders.

Concerns have also been raised about the amendment. The Commercial Act applies to all companies. If the amendment expanding directors' duties passes, it will apply to all companies, including those with little relevance to the capital market. Since it applies to not only large corporations and listed companies but also unlisted companies, there are concerns about potential management constraints. The business community additionally argues that this could increase the burden by encouraging excessive litigation against board members.

The provision to expand the separate election of audit committee members refers to a system where, instead of selecting audit committee members from directors appointed by major shareholders, independent audit committee members are elected separately. This strengthens the independence of audits from major shareholder control. The amendment considers increasing the number of audit committee members, with at least two members whose voting rights are limited to 3% from major shareholders, starting from the appointment stage. The business community opposes this, arguing that the introduction of this system could increase the possibility of management interference by speculative capital. They claim that speculative capital, not major shareholders, could exercise voting rights through so-called "share splitting (below 3%)" and pose a direct threat to management control.

The mandatory cumulative voting system is also being pursued. This system grants voting rights equal to the number of directors to be appointed per share when appointing two or more directors. For example, if three directors are to be elected, a shareholder holding one share can cast three votes and concentrate all votes on a single candidate. This increases the likelihood of electing directors recommended by minority shareholders. The business community expressed concerns that hedge funds might abuse the system to achieve short-term profits, contrary to the amendment's intent. A Democratic Party official stated, "Before revising the law, we will thoroughly listen to the business community's concerns through discussions and carefully examine opposing views."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.