Check Total Salary, Deduction Details, and Refund Amount Instantly via Simple Authentication

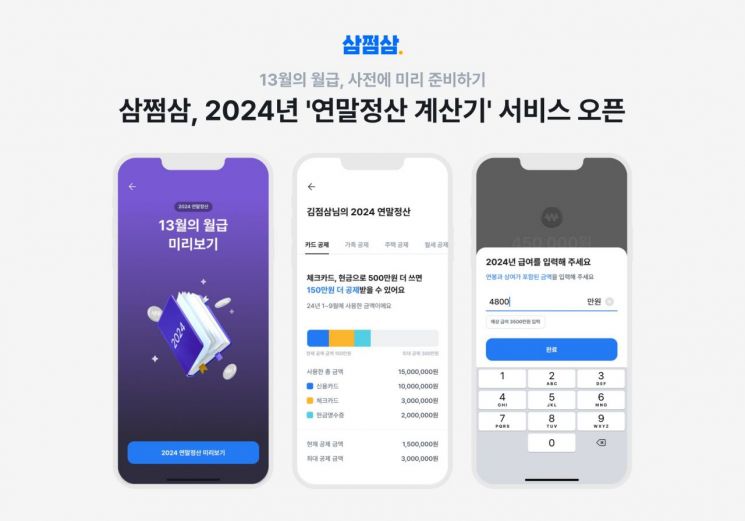

Javis & Villains, the operator of the tax assistance service Samzzumzzum, announced on the 17th the launch of the 'Year-end Tax Settlement Calculator' service. This service helps salaried workers with earned income to check their expected year-end tax refund or payment amount in advance and to review their year-end tax settlement ahead of time. Through simple authentication, users can quickly check the refund amount based on their total annual salary and deduction details all at once.

Starting with this service, customers can directly modify their salary information. If there are no changes, the default value reflects the annual salary calculated by doubling the salary from January to June of this year, applying earned income and comprehensive income deductions, and showing the expected refund results based on the taxes already paid.

Users can directly enter their monthly rent or select dependents to immediately see any changes in the refund amount. Additionally, through separately prepared tax deduction items, they can review deductions for cards, insurance, medical expenses, etc., and receive tips to maximize deduction benefits such as housing subscription savings and pensions.

Last season, the number of users of this service reached 1.11 million. Oh Gayoung, the Product Manager (PM) who planned this service, said, “The new Year-end Tax Settlement Calculator service has improved the accuracy of refund amounts by adding deduction items and salary modification features,” and added, “We will do our best to equip it with various benefits and tips that allow customers to receive actual additional deductions, making it an essential service for salaried workers.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)