Strategic Investment and Acquisition by Local Financial Firms

Loan Scale Growth Along with Profit Gains

Only Additional Branches Opened by Four Major Domestic Banks

"High Hurdle for Establishing Local Corporations"

Japan's three major banks are showing strong interest in the Indian market and are actively expanding their presence. Although domestic banks are also making active inroads, their efforts remain largely limited to supporting Korean companies. As a result, there are calls for more proactive business diversification.

Jung Yoon-young, Senior Researcher at Hana Financial Research Institute, recently highlighted this in the report "Accelerating Entry of Japanese Mega Banks into India." Japan's three mega banks (MUFG, SMFG, and Mizuho) are not only supporting Japanese companies but are actively seeking to enter the Indian consumer finance market. Most of these efforts are carried out through partnerships with local financial firms, strategic investments, and acquisitions.

Mitsui Sumitomo Financial Group (SMFG) expanded its service scope beyond providing financing to large corporations through branches in India by fully acquiring Fullerton India Credit in March and launching its subsidiary, SMFG India Credit, to enter the retail finance market. Mitsubishi UFJ Financial Group (MUFG) has expanded its investment and formed a partnership with DMI Finance, a company specializing in India-focused technology. DMI Finance is an Indian digital financial services provider with 15.2 million customers. Utilizing cutting-edge technology, it operates consumer finance businesses such as POS loans (loans that determine lending approval within seconds). After investing 33.8 billion yen (approximately 315.2 billion KRW) in 2023, MUFG made an additional investment of 49 billion yen in August to strengthen its platform finance business in India. Mizuho acquired a 15% stake in a credit loan specialist company for 145 million USD (approximately 208.5 billion KRW) in February and has been hosting events attended by Indian corporate executives.

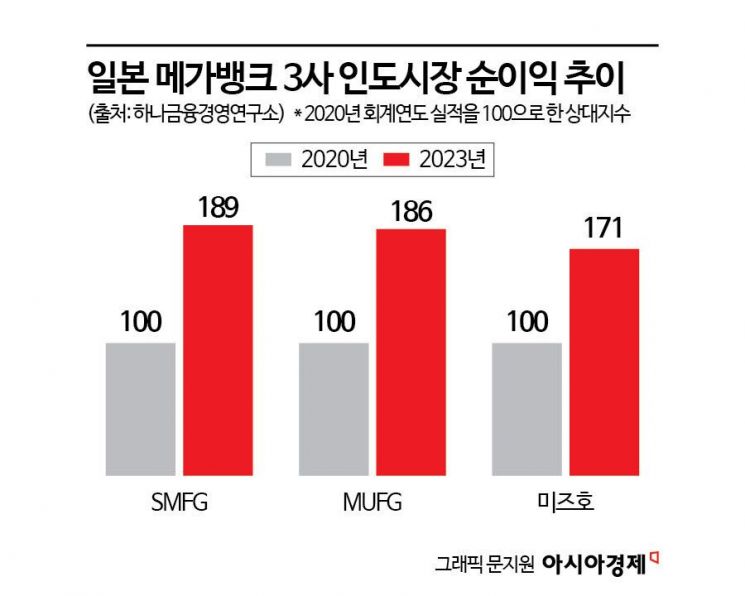

By continuously expanding loans and strengthening their presence, these banks are also generating profits. As of March, MUFG's loan portfolio in India stood at 1.4 trillion yen, larger than its loan assets in other Southeast Asian countries such as Indonesia (1.1 trillion yen) and the Philippines (300 billion yen). Consequently, MUFG's ranking for loan portfolio size in the ASEAN region rose from 6th place in 2020 to 3rd place last year. SMFG expanded its loan portfolio from approximately 378.2 billion yen in 2020 to 877 billion yen last year. The combined profits of the three banks increased by 71% to 89% compared to 2020.

The reason Japan's three major banks are entering the Indian market is due to India's rapid growth and increasing demand for mobile finance. According to data from the International Monetary Fund (IMF), India's economic growth rate is projected to be 6.5% in 2025, higher than the global average (3.2%) and emerging markets (4.2%). The mobile phone penetration rate was estimated at 79% last year and continues to rise. This has led to high demand for retail finance and mobile financial services among small and micro enterprises in India.

South Korea's four major banks (KB Kookmin, Shinhan, Hana, and Woori) are also accelerating their entry into the Indian market by increasing local branches. This year, KB Kookmin Bank opened new branches in Chennai and Pune. Woori Bank added branches in Pune and Ahmedabad. Hana Bank is currently discussing with local financial authorities the opening of two additional branches in Mumbai and Bengaluru.

However, most domestic banks only provide deposit and loan services and trade finance to Korean and global companies. Other expansion strategies, such as establishing local subsidiaries, are reportedly not being considered beyond opening additional branches. A banking industry official said, "Establishing a local subsidiary in India faces many barriers, such as policy finance loan size requirements set by authorities. Acquiring local financial firms might be the fastest way, but considering the difficulties some domestic banks have faced after acquiring Southeast Asian financial firms, it might still be premature."

There are opinions that a more aggressive strategy is needed for the Indian market, which is smaller in scale compared to Japanese banks but shows strong growth potential. Senior Researcher Jung stated, "Domestic banks should not limit themselves to serving Korean companies but should consider market penetration strategies through local business diversification." Among domestic banks, Shinhan Bank was the first to diversify its business. Shinhan Bank entered India in 1996, the earliest among Korean banks, and currently operates six branches. To expand retail operations, it launched a mobile app and signed a share acquisition agreement in April with the leading Indian student loan company.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.