FOMC Rate Decision on the 18th... Small Cut Expected

Key is the Dot Plot... Number of Rate Cuts Next Year Likely Reduced from 4

November Retail Sales, PCE, and Q3 GDP Also Released

The three major indices of the U.S. New York Stock Exchange are showing an upward trend in early trading on the 16th (local time). Investors are expanding their bets in anticipation of a 0.25 percentage point interest rate cut at the Federal Reserve's (Fed) final Federal Open Market Committee (FOMC) regular meeting of the year scheduled for this week.

As of 9:31 a.m. in the New York stock market on the day, the Dow Jones Industrial Average (Dow Index), which focuses on blue-chip stocks, is trading at 43,833.05, up 0.01% from the previous trading day. The S&P 500 Index, centered on large-cap stocks, is up 0.28% at 6,067.89, and the Nasdaq Index, focused on technology stocks, is trading 0.53% higher at 20,032.36.

Last week, the New York stock market showed mixed trends. The Dow Index fell 1.8%, and the S&P 500 Index dropped 0.6%. The Nasdaq Index ended the week with a 0.3% gain. Recently, the market has seen the 'Trump rally,' which broadly lifted the market following the victory of U.S. President-elect Donald Trump, subside, with a narrow rally centered on some technology stocks driving prices up.

Joe Majola, Trading and Derivatives Strategist at Charles Schwab, said, "The breadth of the market we are seeing has started to narrow somewhat, and a rally more concentrated on a few stocks is emerging," adding, "We don't know how long the upward trend will last, but it is likely to continue at least until the end of the year."

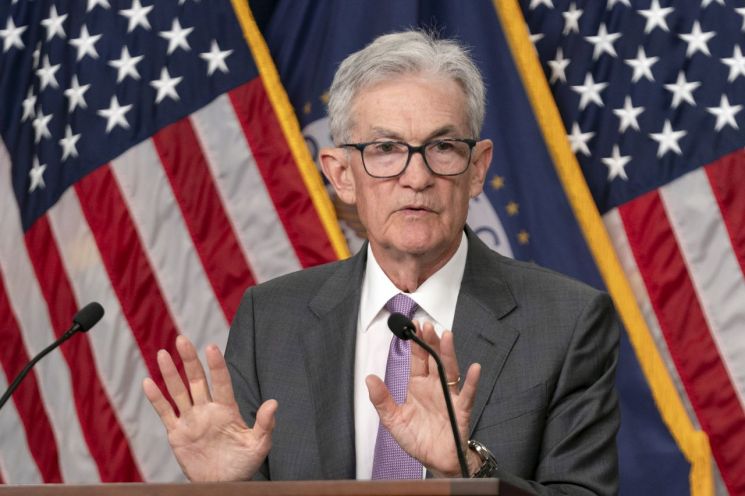

The main focus of the market this week is the FOMC regular meeting scheduled for the 17th and 18th. The market is highly anticipating a 0.25 percentage point rate cut by the Fed. According to the Chicago Mercantile Exchange (CME) FedWatch, the federal funds futures market on the day reflects a 97.1% probability that the Fed will cut rates by 0.25 percentage points at this month's FOMC. The probability of a rate hold is 2.9%.

The key points are the dot plot showing Fed members' rate forecasts and the Summary of Economic Projections (SEP), which includes growth, inflation, and unemployment rate forecasts. With the U.S. economy strong and concerns about 'Trumflation' (inflation caused by Trump's policies) rising, some on Wall Street speculate that the Fed may reduce its 2025 rate cut forecast from the previous four times (100 basis points; 1bp = 0.01 percentage points) to two or three times. Even if the Fed cuts rates this month, it is expected to be a 'hawkish cut'?a rate cut made before slowing the pace of monetary easing next year.

Michael Feroli, Chief U.S. Economist at JP Morgan, said, "This (Fed) economic outlook will show better growth and solid inflation," and added, "The median rate forecast for the end of next year is expected to be revised from four cuts presented in September to three cuts."

Key indicators that can confirm the U.S. economic situation will also be released one after another this week. On the 17th, the November retail sales data, which supports two-thirds of the U.S. economy, will be released, and on the 19th, the final GDP growth rate for the third quarter will be announced. On the 20th, the November Personal Consumption Expenditures (PCE) price index, the inflation indicator most closely watched by the Fed, will be published.

In addition to the U.S., major central banks in countries such as Japan and the United Kingdom will also hold monetary policy meetings this week to decide on benchmark interest rates.

By stock, MicroStrategy, a company investing in cryptocurrency Bitcoin, is up 3.5%. The news that the company will be included in the 'Nasdaq 100' is pushing the stock price up. Semiconductor company Broadcom, which surpassed a market capitalization of $1 trillion last week, is rising 4.78%. Ford Motors is down 3.37% after Jefferies in the U.S. downgraded its investment rating from 'Hold' to 'Underperform' due to concerns over excess inventory.

Government bond yields are slightly declining. The 10-year U.S. Treasury yield, a global bond yield benchmark, is down 1 basis point (1bp = 0.01 percentage points) from the previous trading day to 4.38%, and the 2-year U.S. Treasury yield, sensitive to monetary policy, is moving at 4.22%, down 1bp from the previous day.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.