Wall Street Titans Gradually Shift Stance

"Alternative Gold VS Pet Rock"...Opinions Divided

As Bitcoin, the leading cryptocurrency, surpassed $106,000 to reach an all-time high, remarks about Bitcoin by Wall Street heavyweights are being revisited. Among them, some still hold negative views on Bitcoin, but others have recently changed their perception of it.

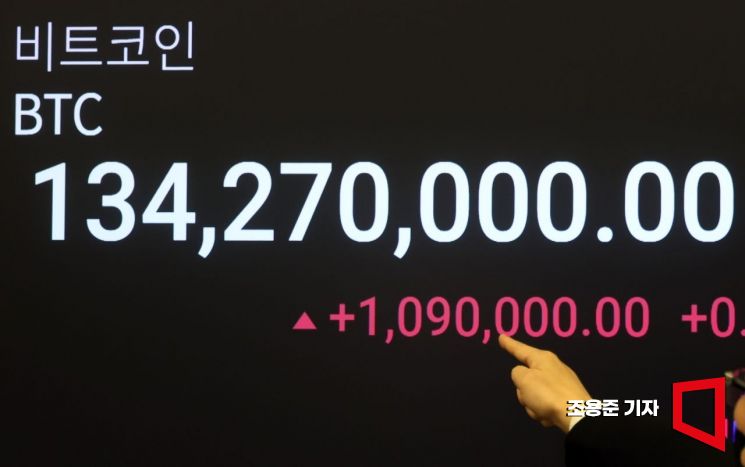

On the 21st, when Bitcoin, the leading cryptocurrency that has been on a soaring run, surpassed $94,000 to reach an all-time high, the price was displayed on the market status board at the Upbit Customer Center in Gangnam, Seoul. Photo by Jo Yongjun

On the 21st, when Bitcoin, the leading cryptocurrency that has been on a soaring run, surpassed $94,000 to reach an all-time high, the price was displayed on the market status board at the Upbit Customer Center in Gangnam, Seoul. Photo by Jo Yongjun

According to the Wall Street Journal (WSJ) on the 15th (local time), Larry Fink, CEO of BlackRock, the world's largest Bitcoin spot exchange-traded fund (ETF) manager, said in an interview with U.S. economic media CNBC last July, “(Bitcoin) is a response tool when countries are believed to be devaluing their currencies due to excessive fiscal deficits,” and described it as “an asset to invest in when feeling fear.”

He had expressed a negative stance in 2017, calling Bitcoin a “money laundering index.” However, he recently referred to Bitcoin as “digital gold” and views it as a means to hedge against currency devaluation and political instability.

Ray Dalio, founder of Bridgewater Associates, the world's largest hedge fund, also shifted to a positive stance on Bitcoin in 2021. Until 2017, he called Bitcoin a “speculative bubble,” but in 2021, he described it as “an alternative asset like gold.” While he questions Bitcoin’s economic utility, he said earlier this month, “I wish I had bought an asset trading at 100 times the price compared to a few years ago.”

On the other hand, Jamie Dimon, chairman of JP Morgan, the largest bank in the U.S., is still known to be skeptical about Bitcoin. In 2017, he called cryptocurrency a “decentralized Ponzi scheme,” and recently referred to Bitcoin as a “useless pet rock.” In an interview with CNBC earlier this year, he said, “My personal advice is not to get involved,” but added, “Since we are a free country, I don’t want to tell you what to do.”

Warren Buffett of Berkshire Hathaway, an investment company, is also a prominent Bitcoin pessimist. In 2018, he called Bitcoin “rat poison” and said he would not buy any Bitcoin even at $25 worldwide. In an interview with CNBC last April, he said, “People like lotteries,” and evaluated Bitcoin as “appealing to the gambling instinct.”

Meanwhile, on the 12th (local time), Donald Trump, the U.S. President-elect, responded “Yes” to a question in an interview with CNBC about whether he plans to create a Bitcoin strategic reserve fund similar to the oil reserve fund, expressing his intention to accumulate Bitcoin as a strategic reserve asset like oil. He said, “We will do great things related to cryptocurrency,” adding, “Because we don’t want China or other countries to take the lead.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)