Rapidly Growing Retirement Pension Reserves

Subscription Rate at 53%... Increased Share of 30s and 40s Generations

Introduction Rate for Businesses with Fewer Than 5 Employees at 10.4%

28% Increase in Early Withdrawal from Retirement Pensions

Last year, the amount of retirement pension reserves reached a record high of 381 trillion won. As the growth of Individual Retirement Pensions (IRP) stood out, the increase in the IRP proportion last year was the highest ever. The number of people and the amount of early withdrawals from retirement pensions also surged, which appears to be a result of the high interest rate environment last year.

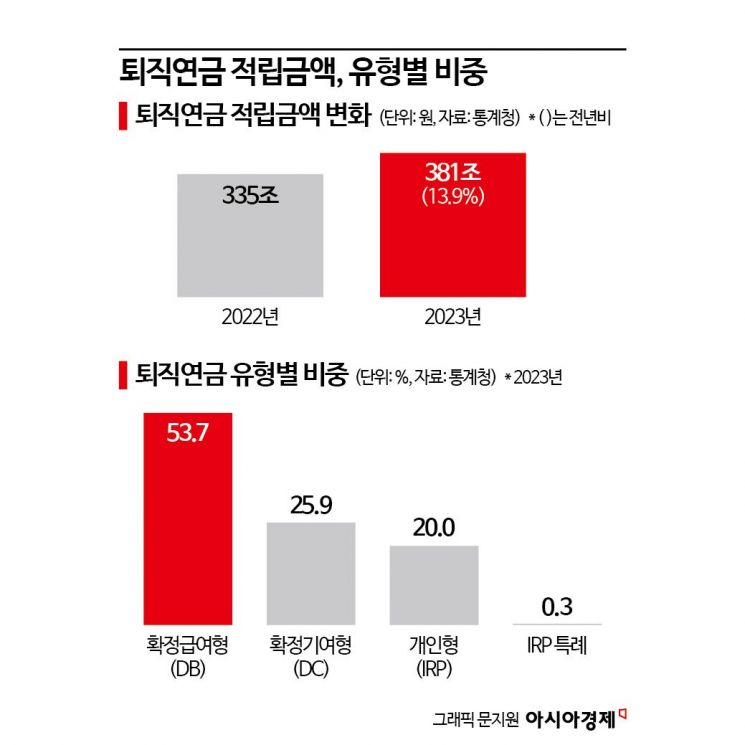

According to the "2023 Retirement Pension Statistics Results" announced by Statistics Korea on the 16th, the amount of retirement pension reserves last year was 381 trillion won, up 13.9% from the previous year. By type of retirement pension, Defined Benefit (DB) accounted for 53.7%, Defined Contribution (DC) for 25.9%, and IRP for 20.0%. The IRP composition ratio rose by 2.6 percentage points compared to the previous year, marking the highest increase ever.

A Statistics Korea official said, "The amount of retirement pension reserves continues to record a high growth rate in the 10% range." Additionally, they explained, "All types of retirement pensions are growing, but the growth of IRP is particularly prominent."

Last year, the number of IRP subscribers was 3.215 million, an increase of 7.0% from the previous year. The IRP reserve amount surged 30.9% to 76 trillion won. The number of additional subscribers to IRP due to system changes also increased by 7.3% from the previous year, reaching 1.494 million. Among the additional subscribers, self-employed individuals accounted for the majority (41.7%), followed by those subject to severance pay (37.0%) and those covered by occupational pensions (16.6%).

The distribution of management methods was 80.4% for principal-guaranteed type, 12.8% for performance-based type, and 6.8% for standby. In particular, the proportion of performance-based type increased by 1.6 percentage points compared to the previous year. By financial sector, banks accounted for 51.6%, securities 22.7%, and life insurance 20.7%. In the case of banks, their share increased by 0.9 percentage points compared to the previous year.

Last year, the total number of workplaces that introduced the retirement pension system was 437,000, similar to the previous year's 436,000. Among the total workplaces subject to retirement pension introduction (1.625 million), 429,000 actually introduced the system, resulting in an adoption rate of 26.4%. By industry, the adoption rates were highest in health and social welfare (61.1%), finance and insurance (57.0%), manufacturing (36.3%), and education services (35.3%).

By size of workforce, workplaces with fewer than 30 employees accounted for 83.1% of retirement pension adoption (363,000 workplaces). Workplaces with fewer than 5 employees accounted for 10.4%, 10?29 employees 56.8%, 50?99 employees 81.3%, and 300 or more employees 91.7%. The larger the workforce size, the higher the adoption rate.

The total number of workers enrolled in retirement pensions last year was 7.144 million, an increase of 2.8% from the previous year. Among the eligible workers (12.722 million), 6.748 million were enrolled, resulting in an enrollment rate of 53.0%. By age group, enrollment rates were highest among those in their 30s (60.5%), 40s (58.3%), and 50s (52.8%).

The number of people who made early withdrawals from retirement pensions last year was 64,000, up 28.1% from the previous year. The amount of early withdrawals surged 40.0% to 2.4 trillion won. The main reason was home purchase (52.7%), followed by housing rent (27.5%) and rehabilitation procedures (13.6%). By age group, those under their 20s mainly withdrew for housing rent, while other age groups withdrew primarily for home purchases.

A Statistics Korea official explained, "The number of early withdrawals decreased in 2022 but increased again last year," adding, "The number and amount of early withdrawals are not at their maximum levels." They further noted, "Due to the high interest rates last year, there may have been cases where people withdrew from their retirement pensions early rather than taking out loans from the market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)