Ongoing Discount on Korean Stock Market Amid US Market Peak Debate

High Dollar-Won Exchange Rate Level

Need to Rebalance by Selling US Assets and Increasing Korean Stocks Allocation

As the domestic stock market continues to underperform, accelerating 'investment immigration' to the United States, securities experts analyze that now may be an appropriate time to realize profits earned from this year's U.S. stock market and allocate assets to the domestic stock market.

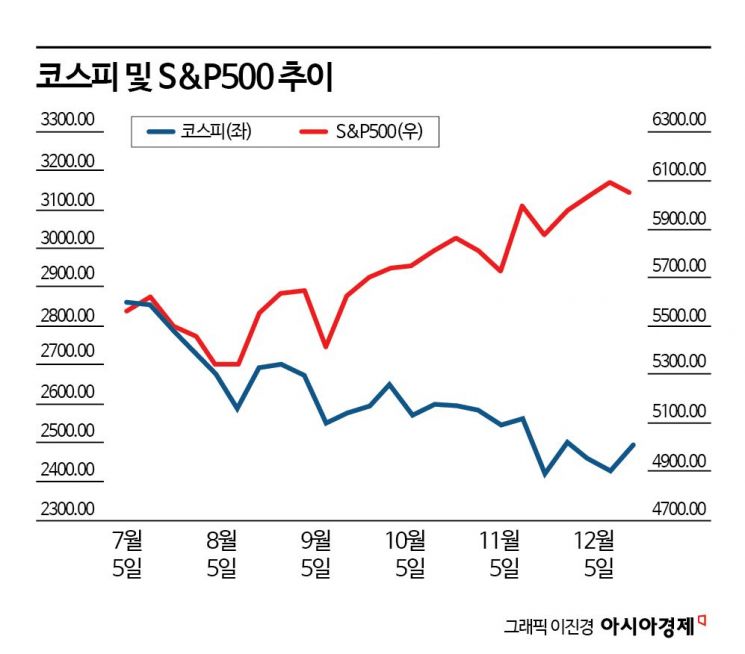

According to the Korea Exchange on the 16th, the KOSPI has fallen 12.8% over the past five months based on the previous trading day's closing price. In contrast, the S&P 500 index, representing the U.S. market, rose 7.5% during the same period. The tech-heavy Nasdaq index also surpassed the 20,000 mark for the first time ever on the 11th (local time), presenting a stark contrast to the KOSPI, which hit a new low on the 9th.

In the securities industry, there is advice that if significant profits have been made from U.S. investments so far, it may now be worth considering domestic investments. This is due to the recent emergence of factors that could boost the domestic stock market, such as the possibility of an early presidential election and the depreciation of the Korean won. Lee Woong-chan, a researcher at iM Securities, explained, "Of course, prolonged political uncertainty would be problematic, but it seems likely that an early presidential election will be held by the second quarter of next year as stability is quickly restored. Since the budget amount has been decided to be reduced, the possibility of supplementary budgets in the second half of next year is open. Additionally, the recent sharp decline in the won's value is expected to have a positive impact on export companies."

Regarding whether the domestic stock market will continue to underperform compared to the U.S. next year, Lee said, "The Korean stock market will not be at such a disadvantage." He added, "The comparison of returns with the U.S. market depends on how much the U.S. market undergoes corrections. The U.S. stock market starts from a high point after a two-year rally, whereas Korea starts from a low point after two years of stagnation." He continued, "Although the domestic stock market is unlikely to break out of its current trading range, it is a reasonable decision to realize profits from the U.S. stock market at the current exchange rate of 1,430 won, convert dollars to won, and move some funds into the Korean stock market to buy at the bottom."

Experts particularly diagnose that the U.S. stock market is in a burdensome zone from the perspective of asset allocation for risk diversification. Park Woo-yeol, a researcher at Shinhan Investment Corp., said, "Despite the continued concentration on the U.S., the rationale for asset allocation is risk diversification and long-term mean reversion. Although a myth has been created around the U.S. stock market's continuous upward trend since 2010, if you look at a sufficiently long investment horizon, the U.S. stock market also experienced a decade of sideways movement in the 2000s."

Park also mentioned the valuation of the U.S. and Korean stock markets. He said, "The cyclically adjusted price-to-earnings ratio (CAPE), which adjusts for inflation over the past 10 years, shows the U.S. price-to-earnings ratio at 38.9 times. The U.S. market capitalization relative to gross domestic product (GDP), known as the Buffett Indicator, is also at about 219%. Investors with an investment horizon longer than 10 years should be cautious rather than greedy in this zone."

Conversely, regarding the domestic market, Park said, "Although the number of analysts lowering earnings estimates (ERR) is still greater, the intensity is easing. The 12-month forward price-to-book ratio (PBR) and price-to-earnings ratio (PER) are at historically low levels, so a recovery can be expected."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)