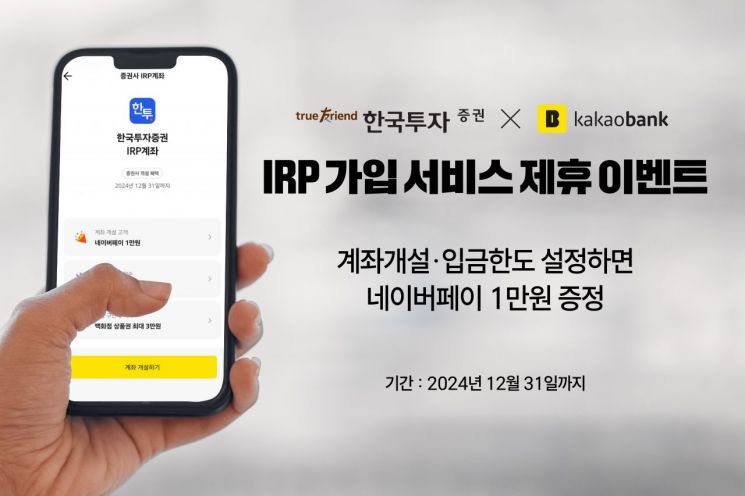

Korea Investment & Securities announced on the 13th that it will hold a promotional event to celebrate the launch of the IRP (Individual Retirement Pension) subscription service through the KakaoBank app until December 31.

The IRP subscription service, which was temporarily offered last December through a partnership between the two companies, officially opened on the 9th of this month after improvements and enhancements. Unlike the previous method of using the service by moving to an external webpage via a link, it is now embedded in-app, allowing users to easily check IRP-related benefits and subscribe directly within the KakaoBank app.

To commemorate the service launch until the end of the year, a promotional event is also being held. When subscribing to IRP through KakaoBank, the first 30 people each day will receive a KakaoTalk Emoticon Plus usage voucher, and if they set the deposit limit for the account after subscription, they will receive a 10,000 KRW Naver Pay voucher. Additionally, department store gift certificates worth up to 30,000 KRW will be given as extra rewards depending on the payment amount.

IRP is a personalized pension account that allows flexible management of retirement funds and surplus assets. While employed, users can contribute up to 9 million KRW annually and receive a tax credit benefit of up to 1,485,000 KRW. After retirement, the funds can be received as a pension or lump sum.

Hong Deok-gyu, Head of the Retirement Pension Division, said, "We expect this service to significantly improve customers' access to pension investments," adding, "We plan to actively support customers to manage their pension assets more easily and conveniently by partnering with various internet banks and platforms in the future."

Meanwhile, Korea Investment & Securities has partnerships for IRP subscription services with all three internet banks. Furthermore, it is expanding features to enhance convenience, such as introducing the industry's first ETF installment automatic investment service for retirement pensions.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)