Including Local Business Sites Such as Rental Housing and Offices

Korea Asset Management Corporation (KAMCO) announced on the 11th that it has provided support to seven distressed or at-risk project sites nationwide through the "PF Project Site Normalization Support Fund (KAMCO PF Fund)."

Specifically, it assisted the resumption of projects by restructuring and providing loans to various types of PF project sites, including rental housing and offices. Since October, it has been supporting the normalization of PF project sites nationwide, including an investment of approximately 70 billion KRW in a local project site located in Bongmyeong, Daejeon.

This fund was established in September last year with a total size of 1.1 trillion KRW, where KAMCO invested 500 billion KRW of its own resources to help normalize distressed or at-risk project financing (PF) sites, and five entrusted management companies attracted additional private funds. To date, based on total project costs, the KAMCO PF Fund has invested 370 billion KRW, and including private funds, a total of 560 billion KRW has been injected into seven distressed or at-risk project sites worth approximately 2.24 trillion KRW, actively promoting their normalization.

So far, the government, led by the Financial Services Commission, has listened to various market opinions through regular real estate PF inspection meetings, and the Financial Supervisory Service has devised market stabilization measures by encouraging rigorous project restructuring and liquidation through feasibility assessments.

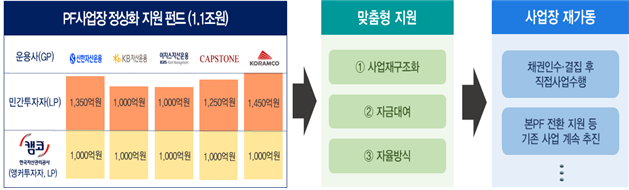

Structure diagram of the PF Project Normalization Support Fund by Korea Asset Management Corporation (KAMCO). Provided by Korea Asset Management Corporation.

Structure diagram of the PF Project Normalization Support Fund by Korea Asset Management Corporation (KAMCO). Provided by Korea Asset Management Corporation.

In line with government policies, KAMCO played a catalytic role in establishing the KAMCO PF Fund by investing 500 billion KRW of its own funds, while also operating a "Normalization Support Platform" to facilitate smooth negotiations for PF bond sales between existing creditors and entrusted management companies, actively fostering a favorable investment environment.

Since May of this year, the KAMCO PF Fund has been executing investments rapidly, focusing on six project sites. By immediately restarting projects that risk long-term suspension, it minimizes unnecessary economic costs and promptly generates economic ripple effects such as housing supply and revitalization of the construction industry.

Kwon Nam-ju, President of KAMCO, stated, "The swift establishment and investment execution of the PF Project Site Normalization Support Fund has sent a positive signal for the soft landing of real estate PF," adding, "KAMCO will continue to work closely with entrusted management companies to expand investment targets, including additional support for local project sites."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)