Doosan Bobcat Split-Merger Plan Fails

Alternative Investment Needed for Growth Businesses like

Gas Turbines, SMR, and Robots

The planned spin-off and merger of Doosan Bobcat, which was being promoted as a future growth engine, has fallen through, putting Doosan Group's future business funding in jeopardy. As a 'Plan B,' the group is considering the sale of non-core assets that can be executed without a merger and sharing Doosan Bobcat's global sales network.

According to industry sources on the 11th, Doosan Enerbility is reviewing the sale of non-core assets to secure investment funds without going through the merger process. Doosan Enerbility urgently needs to invest in growth businesses such as small modular reactors (SMR) and gas/hydrogen turbines. By selling non-operating assets such as shares in Doosan Cubex and D20 Capital to Doosan Corporation, it can secure about 500 billion KRW as investment funds.

However, investment in large nuclear power plants has become uncertain. This is because the continuity of nuclear power policies is likely to be shaken due to the martial law and impeachment political situation. According to the original business restructuring plan, Doosan Enerbility aimed to secure an investment capacity of about 1.2 trillion KRW, including a 720 billion KRW reduction in borrowings through the separation of Doosan Bobcat, to invest in large nuclear power plants and growth businesses. There is a possibility of winning orders for a total of 10 large nuclear reactors: two in the Czech Republic (with potential for two additional follow-up units), 2 to 4 in the United Arab Emirates (UAE), two in Poland or Saudi Arabia, and two in Northern European countries such as Sweden or the Netherlands. However, concerns are rising that reduced investment capacity and changes in government policy may cause a loss of competitiveness.

Doosan Robotics is facing difficulties in securing investment funds as the merger with Doosan Bobcat, which would have served as a 'cash cow,' has failed. However, it is considering sharing Doosan Bobcat's global sales network as an option. Ryu Jeong-hoon, CEO of Doosan Robotics, stated at the announcement of the second business restructuring plan, "If Doosan Bobcat, which has established 17 production bases worldwide and 1,500 sales networks, is incorporated as a subsidiary, our presence in the North American and European markets will be further strengthened." Although the subsidiary incorporation was canceled, synergy can be created by strengthening collaboration among affiliates. Doosan Robotics has set a strategy to quickly capture the market for the 'forklift-palletizer solution,' which combines Doosan Bobcat's forklifts and Doosan Robotics' collaborative robots.

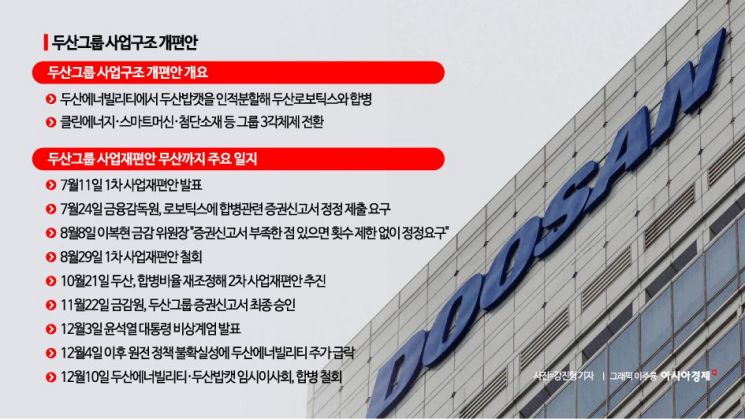

In July, Doosan Group announced a business restructuring to maximize business synergy and enhance future competitiveness, focusing on three pillars: clean energy, smart machines, and semiconductors/advanced materials. The core of the restructuring was the spin-off and merger among Doosan Enerbility, Doosan Bobcat, and Doosan Robotics. However, as criticisms continued that the restructuring infringed on the interests of general shareholders of Doosan Enerbility and Doosan Bobcat, Doosan Group withdrew the plan at the end of August and re-pursued a second spin-off and merger plan with adjusted merger ratios starting in October. Last month, the Financial Supervisory Service gave final approval to the securities registration statement, and Doosan Group's business restructuring seemed to be progressing smoothly, but an unexpected variable of martial law emerged. As uncertainty over nuclear power policies increased, Doosan Enerbility's stock price plummeted, and the burden of stock purchase claims was larger than expected, eliminating the benefits of the merger.

The prevailing view is that it will be difficult to re-pursue the merger in the near future. Doosan Group is also cautious about the possibility of re-pursuit. A Doosan Enerbility official said, "The withdrawal of the company's spin-off and merger plan was a decision due to sudden external circumstances, and it is too early to discuss the future schedule," adding, "It will take considerable time as it is a matter that requires reviewing and deciding based on future internal and external conditions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.