Changwon Special City in Gyeongnam will impose 302,785 cases of December regular automobile tax, totaling 50.9 billion KRW, and send tax bills to taxpayers.

The December regular automobile tax is imposed on vehicle owners registered in Changwon as of the tax base date (December 1), excluding vehicles (automobiles, motorcycles, machinery equipment) that have filed and paid annual tax in advance and vehicles with an annual tax amount of 100,000 KRW or less that were fully charged in June.

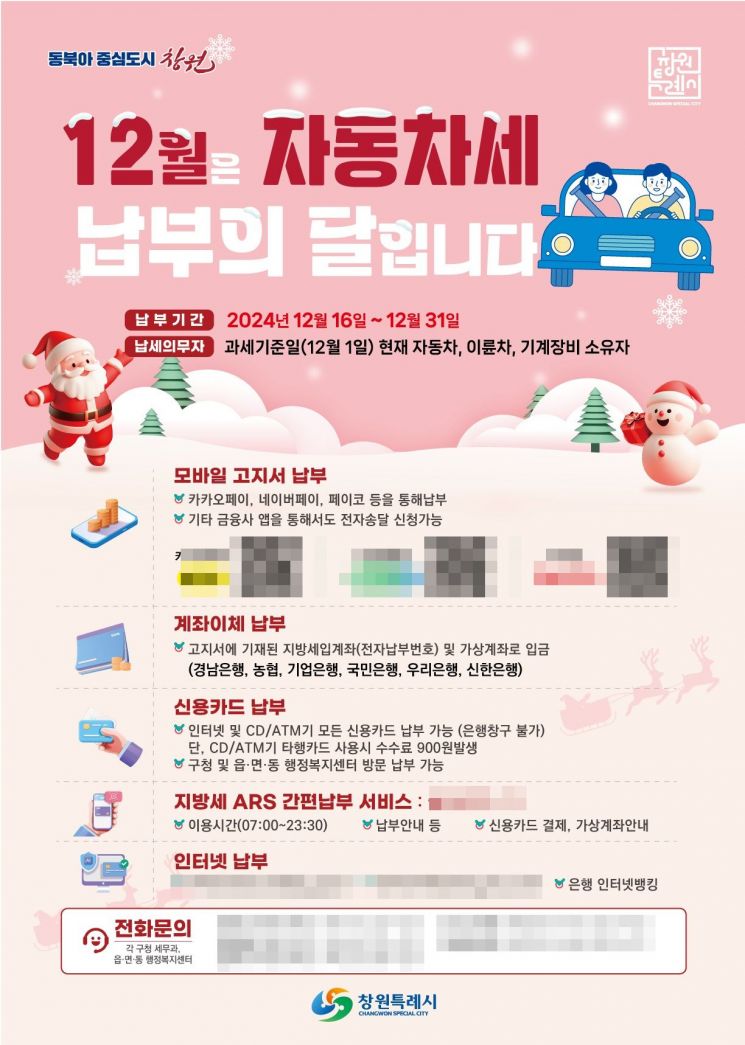

The payment period for the automobile tax is from the 16th to the 31st of this month, and a 3% late payment surcharge will be applied if the payment deadline is missed. Taxpayers who have applied for automatic transfer should check their bank account balance in advance by the payment deadline, and those who have applied for electronic delivery will not receive the tax bill by mail, so they must check the app or email.

Changwon City is promoting various convenient payment policies for local taxes, such as local tax revenue accounts (electronic payment numbers), virtual accounts, nationwide common ARS, and WETAX (internet) inquiry and payment. Even without a tax bill, payment is possible using a cash card (bankbook) or credit card at bank CD/ATM machines.

Kim Myung-gon, Director of the Taxation Division, said, “If the payment deadline is missed, a 3% late payment surcharge will be added, and disadvantages such as license plate seizure and property seizure may occur, so please pay within the deadline.” He added, “We will do our best to promote payment so that citizens can pay within the deadline.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)