Mortgage Loans Increase by 8.9%, Driving Up Total Household Loan Balance

Hana Bank Temporarily Suspends Refinancing Loans from Other Financial Institutions Starting the 9th

Woori Bank Strengthens Management by Abolishing Preferred Interest Rates on Credit Loans

Household Loan Management to Continue Next Year... Monthly and Quarterly Targets Must Be Submitted

Commercial banks are tightening household loans at the year-end. Although financial authorities have set a goal to manage the increase in household loans within the nominal growth rate (real growth rate + inflation rate), the need for management has arisen as the outstanding household loan balances have already increased significantly by bank.

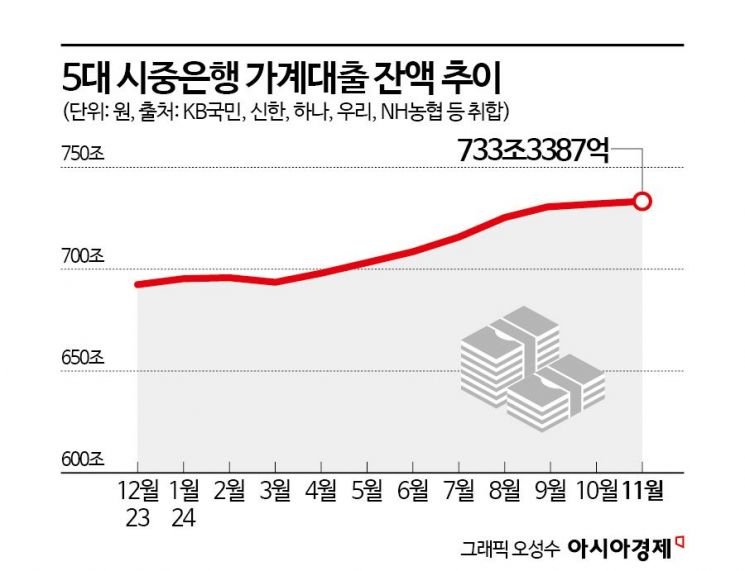

According to the financial sector on the 9th, the outstanding household loan balances of the five major commercial banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?have increased by nearly 6% this year. The outstanding household loan balance of the five major commercial banks was KRW 692.4049 trillion in December last year and increased by KRW 40.9293 trillion to KRW 733.3387 trillion as of the end of November.

By loan type, jeonse deposit loans and household credit loans decreased, but mortgage loans increased by 8.9%, raising the total household loan balance. As of the end of November, the mortgage loan balance was KRW 576.9937 trillion, an increase of KRW 47.1015 trillion compared to the end of last year. During the same period, household credit loan balances decreased by 2.3%, and jeonse deposit loans decreased by 1.4%. Group loans remained at a similar level to the end of last year.

Accordingly, individual commercial banks raised loan thresholds further to comply with the household loan management targets announced at the beginning of the year. Hana Bank decided to temporarily suspend mortgage loans, jeonse deposit loans, and credit loans for the purpose of refinancing through other financial institutions starting from this day. This follows the suspension of sales of non-face-to-face exclusive loan products on the 15th of last month, extending the freeze to refinancing loans.

Woori Bank strengthened management by abolishing preferential interest rates on credit loans. Financial consumers newly using eight credit loan products, including the 'Woori WON Working Professional Loan,' will no longer receive preferential interest rates of 0.5 to 1.4 percentage points. Additionally, preferential interest rates for consumers extending and renewing existing credit loans will be reduced by up to 0.5 percentage points. NH Nonghyup Bank has stopped selling credit loan products for office workers, and Shinhan Bank has suspended handling non-face-to-face products.

The financial sector has been striving to reduce mortgage loan balances by encouraging principal and interest repayments through waiving early repayment fees. However, the effect was not as significant as expected, and thus it appears that measures targeting relatively easier-to-manage non-face-to-face loans and credit loans are being expanded. A financial sector official explained, "Since each financial company has management targets, additional measures are being taken to meet them," adding, "Loan handling is expected to be kept to a minimum for the time being."

Financial authorities have required the financial sector to submit monthly and quarterly targets separately for household loan management next year as well. In particular, it is known that separate management targets for policy loans, which have been a stumbling block in household loan management, will also be received. Commercial banks plan to finalize household loan targets while negotiating their annual business plans.

Meanwhile, the five major commercial banks are also paying attention to managing corporate loans along with household loans. From the beginning of this year to the end of November, the outstanding loan balance growth rate for large corporations was 19.9%, for small and medium enterprises 5.6%, and for individual business owners 2.4%. However, as of the end of November, the corporate loan scale of the five major commercial banks was KRW 829.5951 trillion, a decrease of more than KRW 7.7 billion compared to the previous month. This is the first time this year that the corporate loan balance growth trend has slowed. It is analyzed that the reduction in corporate loan operations centered on Woori Bank and Hana Bank had a significant impact.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)