Domestic Demand Slows This Year, Exports Hit Record High

Concerns Over Contraction Next Year... "It's Time for a 'Carrot'"

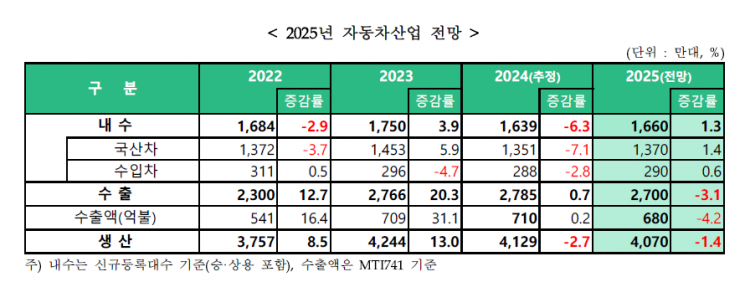

This year, South Korea's automobile industry experienced somewhat sluggish domestic sales due to the economic downturn but achieved record-breaking export performance by performing well in the North American market. Next year, it is expected to contract for the first time since COVID-19 due to worsening Korea-US trade conditions and increased overseas production.

On the 5th, the Korea Automobile Mobility Industry Association (KAMA) released the "2024 Automobile Industry Evaluation and 2025 Outlook" report containing these details.

According to the report, this year's domestic automobile market was affected by continued economic sluggishness, high interest rates, and elevated household debt, which dampened consumer sentiment. Intentions to purchase new cars also declined, and electric vehicle sales continued to underperform. Combined with production disruptions, domestic sales are estimated to have decreased by 6.3% from last year to 1.64 million units.

On the other hand, exports achieved record-breaking results. Despite decreased demand in the European region, the industry performed well in its largest export market, North America. Continued preference for domestically produced sports utility vehicles (SUVs) and hybrid electric vehicles (HEVs) led to an estimated 2.79 million units exported, a 0.7% increase compared to the same period last year. This is the highest performance since 2016.

Specifically, cumulative HEV exports as of October increased by 38.7% year-on-year. However, electric vehicle exports declined by 22.2% due to a global chasm (temporary demand slump). In particular, electric vehicle exports to the U.S. decreased by 5.0% year-on-year due to the strengthening of IRA tax credit requirements, increased consumer burden from high interest rates leading to weakened U.S. EV demand, and increased local production by Hyundai Motor and Kia (Ioniq 5, EV9, etc.).

Despite the slowdown in electric vehicle demand, finished car export value is estimated to have increased by 0.2% year-on-year to about $71 billion, driven by expanded exports of high-priced vehicles such as HEVs and SUVs. This marks an all-time high.

Production is estimated to have declined somewhat, down 2.7% year-on-year to a total of 4.13 million units. This is due to overall domestic market sluggishness, production facility adjustments and shutdowns at Hyundai Motor and Kia plants in the first half of the year, and labor-management negotiations.

Next year, the domestic market is expected to remain somewhat sluggish but benefit from a base effect. Sales are projected to reach 1.66 million units, a 1.3% increase year-on-year, due to improved consumer sentiment from easing inflation and interest rate cuts, increased HEV sales as substitutes for EVs, and the base effect from last year's weak domestic sales.

Exports are expected to decline for the first time since COVID-19. This is attributed to the worsening Korea-US trade environment after the U.S. presidential election, expansion of China, increased overseas production, and other factors reducing exports, as well as a reverse base effect following four consecutive years of export growth since COVID-19. Accordingly, sales volume is estimated to decrease by 3.1% year-on-year to 2.7 million units, and export value is projected to fall by 4.2% to $68 billion.

However, global automobile demand is forecast to slightly increase by 3.3% year-on-year to 94.71 million units, despite China's low-growth trend, due to improved purchasing conditions from price stabilization, interest rate cuts, and expanded incentives.

Gang Nam-hoon, chairman of the Korea Automobile Mobility Industry Association, stated, "The current global automobile industry environment is challenging due to leadership conflicts between China and advanced countries, strengthened domestic industry protection policies, and decreased electric vehicle demand." He emphasized, "Demand stimulation measures such as individual consumption tax cuts and support for replacing old vehicles, as well as expanded incentives including temporary electric vehicle purchase subsidies (for at least three years), charging fee discounts, and permission to operate dedicated lanes on highways, are also necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)