Virtual Assets 'Bull Market' Doubles Valuations in One Year

Over 100x Recovery vs Peak-Trapped VCs... Mixed Fortunes

Exit Activity Stretches Amid 'Decacorn' Reclaim Hopes

The corporate value (valuation) of Dunamu, which once plummeted from a peak of 20 trillion won to around 3 trillion won, has rebounded, bringing cheer to the venture capitalists (VCs) who invested in the company. After several years of the "crypto winter" (a downturn in virtual assets), Bitcoin surpassed $100,000 for the first time ever, causing Dunamu's valuation to double vertically within a year. Some VCs are now considering exits, which had been difficult to expect for a while.

According to the unlisted stock trading platform "Securities Plus Unlisted" on the 6th, Dunamu's stock price surpassed 200,000 won the previous day. This is the first time in 28 months since August 2022 that the 200,000 won level has been recovered. Compared to 105,000 won on December 5, 2023, nearly a year ago, it has nearly doubled. The lowest price traded on this platform was 73,000 won, recorded in November of the same year. Dunamu's current estimated market capitalization is 6.6212 trillion won.

The Love-Hate Relationship VCs Had with Dunamu

Dunamu is known as a "love-hate company" among VCs. Dunamu, which operates the virtual asset exchange Upbit, peaked at a valuation of 20 trillion won during the virtual asset boom in 2021. The "price tag" recorded at that time remains unmatched by other ventures or startups. It was truly the emperor of unlisted companies. In 2021, its operating profit reached 3.2713 trillion won.

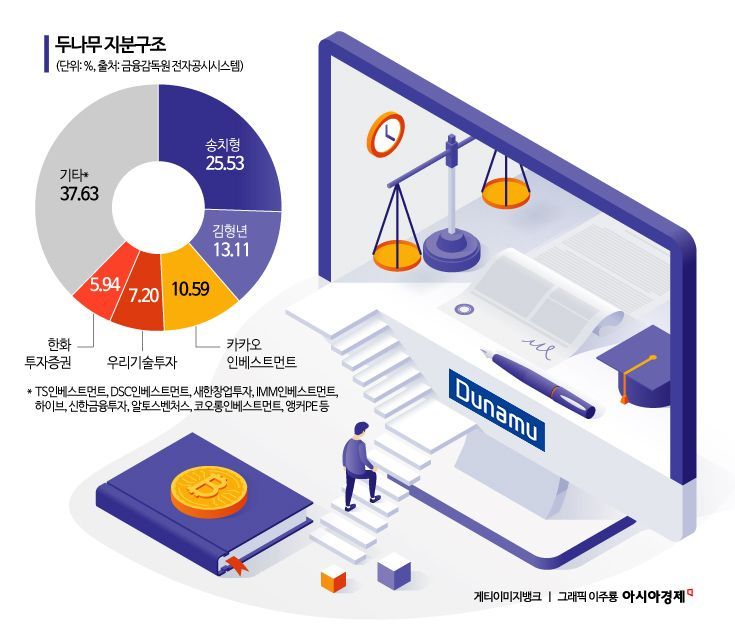

The fortunes of VCs who invested around 2021 diverged. Atinum Investment, which invested 7 billion won in 2017 when the valuation was under 100 billion won, recovered about 500 billion won, leaving a legendary track record. Kakao Ventures invested 200 million won when the stock price was 40 won per share, achieving over 100 times return, and remains the third-largest shareholder of Dunamu (with a 10.59% stake) through "in-kind (stock) liquidation."

However, as the valuation plummeted by more than 80% from 20 trillion won to 3 trillion won in two years, VCs that purchased old shares at valuations exceeding 10 trillion won after 2021 suffered massive equity method losses. These include VCs such as Altos Ventures, Saehan Startup Investment, IMM Investment, as well as private equity (PE) firms like the Hong Kong-based Anchor Private Equity and HYBE, which bought old shares during this period. As the "crypto winter" prolonged, some investors sold all their old shares or cut losses partially. In particular, Saehan Startup Investment faced a liquidity crisis and hurriedly disposed of Dunamu's old shares.

Striding Toward 'Decacorn' Status... Exit Expectations Rise

The reason Dunamu's valuation is rebounding is due to the hot "bull market" in virtual assets this year. Over 90% of Upbit's revenue, operated by Dunamu, comes from transaction fees. Dunamu recorded cumulative sales of 977.4 billion won and operating profit of 578.5 billion won through the third quarter. Considering that Upbit's daily trading volume reached 40 trillion won after Donald Trump, who calls himself the "virtual asset president," won the U.S. presidential election, there is a strong possibility that operating profit will exceed 1 trillion won this year.

VCs who have been anxious about Dunamu for years are now toying with exit options. Woori Technology Investment, the fourth-largest shareholder of Dunamu with a 7.20% stake, is reportedly starting to recruit investors to transfer its old shares. The acquisition cost was 5.5 billion won (2.51 million shares), and at the current price of 200,000 won per share, the simple calculation is 502 billion won. This is close to 100 times the principal. If the decacorn status (unlisted company valued over 10 trillion won) is reclaimed, surpassing most investors' principal, the exit process is expected to accelerate. A VC industry insider said, "Since a virtual asset boom is expected during the Trump era, the favorable environment is likely to continue," adding, "If the conservative stance of financial authorities toward virtual assets also changes, Dunamu's future will be even brighter."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.