Yen Strengthens Consecutively

Falls to 148 Yen Range After Martial Law Declaration

"Low Possibility of Liquidation Like Last August"

As the yen continues to strengthen, concerns about the unwinding of yen carry trades are emerging. Securities firms analyze that the direction of speculative yen funds is currently unclear, limiting the possibility of a sudden liquidation.

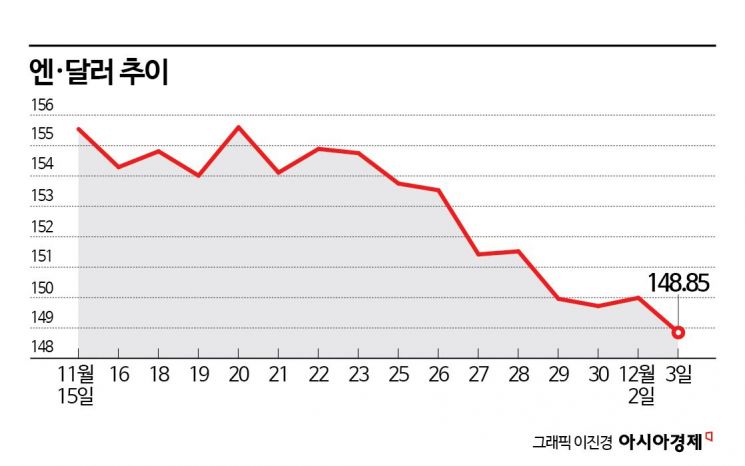

According to the financial investment industry on the 5th, the yen-dollar exchange rate closed at 148.85 yen on the 3rd, marking a drop of more than 5% from the intraday high of 156.74 yen on the 15th of last month. The yen, which had been showing strength for several days, continued its momentum on the night of the 3rd due to the won's depreciation following President Yoon Seok-yeol's declaration of martial law. Japan's Yomiuri Shimbun reported, "Following the decline in the won's value last night, movements to buy yen to avoid risk in the foreign exchange market spread, causing the yen-dollar exchange rate to temporarily plunge from the 149 yen range to the 148 yen range."

In the market, concerns are rising about the unwinding of yen carry trade funds that caused the market crash in August, along with forecasts that the Bank of Japan (BOJ) may accelerate its pace of rate hikes after last month's Tokyo Consumer Price Index (CPI) significantly exceeded the previous month's figure. However, securities firms consider these market concerns to be excessive. Min Byung-gyu, a researcher at Yuanta Securities, said, "While caution is necessary given the significant shock from yen carry trade outflows in early August, the likelihood of these concerns materializing is low. The Japanese economy, having escaped deflation for the first time in decades, is not at a stage where steep rate hikes would suppress demand," adding, "Although the BOJ is expected to raise rates this month, there is little incentive to accelerate this thereafter." He also noted, "Despite record wage increases over the past two years, retail sales have steadily declined since peaking in February last year, so the continuity of consumer recovery has not yet been confirmed, making it an inappropriate time to increase consumers' interest burdens."

Furthermore, Researcher Min pointed out that the direction of speculative yen funds is still unclear. He said, "Aggressive trading funds inferred from speculative net long positions in the yen have not established a direction since the last large-scale liquidation," and added, "The proportion of short contracts in total contracts currently stands at 61.4%, close to the long-term average of 61.8% since 2010."

Additionally, domestic funds known as 'Watanabe Wives' are characterized by long-term investments that are not sensitive to interest rate or exchange rate changes, so the possibility of withdrawal of yen funding linked to them is also considered low. Lee Ha-yeon, a researcher at Daishin Securities, explained, "Domestic yen carry trade funds are mainly invested in advanced countries' overseas bonds such as U.S. Treasury Bills (TB), so considering the attractiveness of interest rates, the possibility of rapid withdrawal by domestic investors is limited."

However, short-term volatility due to U.S. policy uncertainty should be noted. Researcher Lee pointed out, "Although the pressure for foreign investors to unwind yen carry trades has largely eased since the sharp drop in August, yen short positions have been flowing in again around the U.S. presidential election, so caution is needed regarding additional unwinding."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)