Indonesia Lifts Import Restrictions on Korean Ramen

Korean Ramen Industry Plans Aggressive Entry into Indonesian Market

Indonesia, World's 2nd Largest Noodle Market...Great Potential

Recently, South Korea was excluded from Indonesia's 'Strengthened Safety Management Measures for Instant Noodle Products,' which is expected to accelerate the domestic ramen industry's penetration into the Indonesian market.

According to the food industry on the 5th, the Ministry of Food and Drug Safety announced on the 2nd that Indonesia's requirement for ethylene oxide (EO)-related test and inspection certificates for Korean instant noodles has been lifted. EO is a substance used as a fumigant and sterilizer for agricultural products, and some countries such as the United States and Canada manage residue standards.

Nongshim held a "Shinsational Day" last month at the POS Block in Jakarta, Indonesia, to promote the Shin Ramyun brand.

Nongshim held a "Shinsational Day" last month at the POS Block in Jakarta, Indonesia, to promote the Shin Ramyun brand. [Photo by Nongshim]

This regulatory relief has eased the export of Korean ramen to Indonesia. Previously, Indonesia required submission of EO test and inspection certificates for each export of Korean ramen since 2022 after detecting a non-carcinogenic substance potentially generated from EO in Korean ramen exported to the European Union (EU), which caused export delays. A ramen industry official explained, "A certified institution's test report must be attached for each production lot, which took about two weeks to issue," adding, "The time required for document preparation, inspection, and storage not only incurred inspection costs but also shortened the product's shelf life."

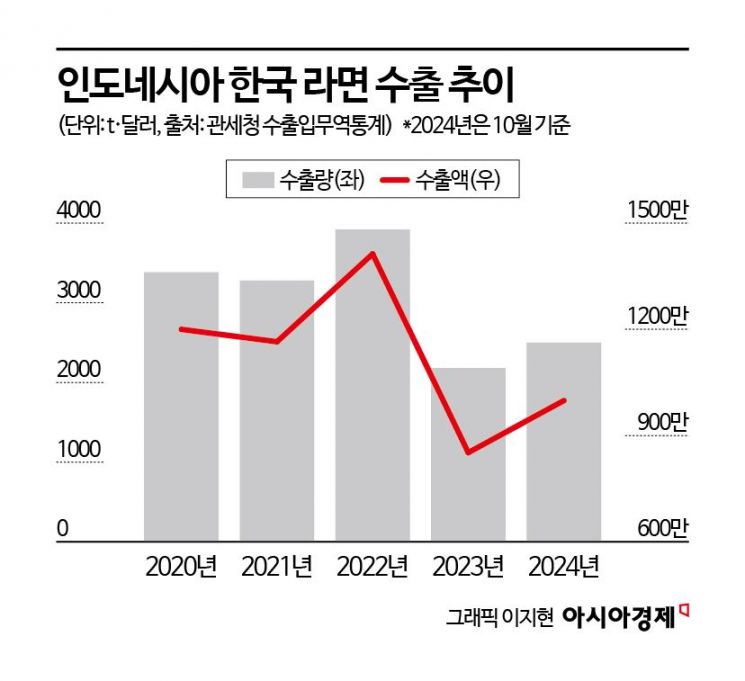

Due to additional procedures and costs, the previously growing export of ramen to Indonesia showed a temporary slowdown after the regulation. According to the Korea Customs Service, the export volume of ramen to Indonesia dropped by 44.3% from 3,919 tons in 2022 to 2,181 tons the following year, and export value decreased by 39.7% from $14.13 million to $8.52 million. Consequently, the Ministry of Food and Drug Safety has continuously requested the Indonesian Food and Drug Authority (BPOM) to lift the strengthened management measures on Korean instant noodles, and with this recent action, rapid customs clearance is now possible without submitting additional certificates when exporting instant noodles.

The domestic ramen industry welcomes this regulatory relief due to Indonesia's market size. Although the export volume by domestic companies is not yet large, there is no disagreement about its world-class potential. According to the World Instant Noodles Association (WINA), Indonesia's ramen consumption last year was 14.54 billion units, ranking second globally after China (42.21 billion units), and more than three times that of South Korea (4.04 billion units), which ranks eighth worldwide. More importantly, consumption increased by 15.0% over three years compared to 2020 (12.64 billion units), indicating a highly growing market.

Indonesia's food market is attracting attention for its high growth potential due to the expanding young population with strong consumption tendencies and increased household income. According to market research firm Statista, Indonesia's food market size is expected to reach $250.2 billion (approximately 353 trillion KRW) this year, with an annual growth rate of about 6% projected until 2029. Recently, the popularity of K-food, including ramen, has been rising due to the Korean Wave.

A representative example is the ramen brand 'Arirang,' manufactured and distributed by the Indonesian food company PT Jakarana Tama. Arirang is a local Korean-style ramen with Korean packaging, which started online sales of three flavors?Bulgogi, Beef Bone Soup, and Curry?in November 2020 and expanded to offline stores from 2021. According to the Korea Trade-Investment Promotion Agency (KOTRA), the company recently requested KOTRA to find suitable Original Equipment Manufacturing (OEM) partners in Korea to launch various additional Korean food products. It is known that negotiations are currently underway with about two to three companies regarding various products.

With this regulatory relief, the domestic ramen industry is expected to accelerate its efforts to capture the Indonesian market. Previously, Nongshim held a 'Shinsational Day' event last month in Jakarta targeting Indonesians in their 20s and 30s, who are potential main consumers of ramen, to raise awareness of the Shin Ramyun brand. A Nongshim official said, "Despite Indonesia's large population and ramen consumption, Korean ramen is still in the early stages of market entry, so we see very high growth potential," adding, "We expect to enter the market more aggressively following this regulatory resolution." The official also stated, "We plan to promote the Shin Ramyun brand through various online and offline promotional events such as brand ambassadors, online viral marketing, and pop-up stores."

Samyang Foods also plans to expand sales and increase brand awareness through local branding, direct sales, and marketing management. Especially considering the large Muslim population, the company intends to respond appropriately to market characteristics such as strict halal certification. A Samyang Foods official said, "We plan to design thorough localized brand marketing and expand halal certification acquisition for new products from MUI, Indonesia's official halal certification body, to distribute products across various categories," adding, "We will increase sales through promotions and marketing activities and also launch new products."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)