Russia's Production Drops 6.8% Amid War, Ranking 1st

Response to 'Facility and Factory Closures'... Watchful on Tariff Imposition

This year, South Korea's crude steel production has seen the largest decline since 2020. Among the world's six major steel-producing countries, it showed the second-largest drop after Russia, which is currently at war with Ukraine. This confirms the steel industry's complaints that the situation is "worse than during the COVID-19 crisis" through statistical evidence.

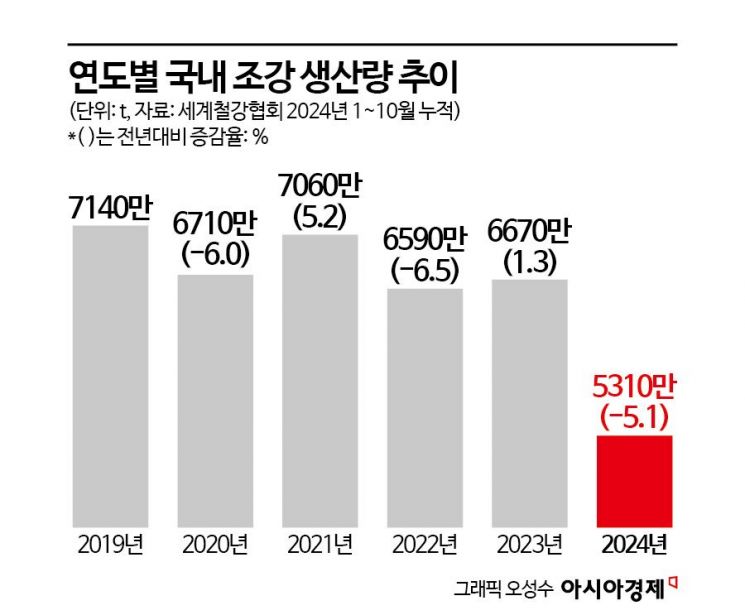

According to the World Steel Association (WSA) on the 4th, South Korea's crude steel production from January to October this year was 53.1 million tons, a 5.1% decrease compared to the same period last year. Global crude steel production during the same period was 1.5473 billion tons, down 1.6% year-on-year, indicating that South Korea's steel industry has been hit harder. If the current trend continues until the end of the year, South Korea's crude steel production is expected to be in the low 60 million tons range, the lowest volume in the past five years since the COVID-19 pandemic.

The country with the largest production decrease was Russia (6.8%), likely affected by the emergency situation of the ongoing war with Ukraine. Steel powerhouse Japan saw a 3.7% decline, while the United States experienced a smaller decrease of 1.9%.

China, the world's largest steel producer, also saw its crude steel production fall by 3.0% compared to the previous year, totaling 85.07 million tons. Due to prolonged domestic real estate market stagnation and shrinking steel demand, China is maintaining a certain operating rate while pushing excess production into exports.

On the other hand, India, the world's second-largest producer, recorded growth of 5.6%, supported by its large domestic market with growth potential. Germany (5.0%) and Turkey (12.4%) also saw increases in production.

South Korea's domestic crude steel production, which reached 71.4 million tons in 2019, dropped significantly to 67.1 million tons in 2020 due to the spread of COVID-19. It recovered to the 70 million ton range in 2021 thanks to pandemic-related demand, then maintained levels around 65.9 million tons in 2022 and 66.7 million tons in 2023.

▲The No. 3 blast furnace of Hyundai Steel. [Photo by Asia Economy DB]

▲The No. 3 blast furnace of Hyundai Steel. [Photo by Asia Economy DB]

Domestic steel companies are responding to China's volume offensive by adjusting production and closing non-core facilities and plants, but these measures are seen as only short-term solutions. POSCO closed its Pohang No. 1 steelworks in July and then shut down the Pohang No. 1 wire rod mill last month. Moving forward, it plans to reduce production of low-priced products and focus wire rod production on high value-added products such as high-strength bolts for automobiles, spring steel, and bearing steel.

Hyundai Steel recently decided to close its Pohang No. 2 plant, but labor-management negotiations have not progressed since. The company plans to guarantee employment and support job transfers for employees, but workers strongly oppose the closure and are demanding its cancellation. Approximately 400 employees, including 260 regular workers, are employed at this plant. Additionally, subsidiaries such as Hyundai IFC and Hyundai Steel Pipe are being mentioned as potential assets for business restructuring.

The steel industry is also closely watching whether the government will impose anti-dumping duties on Chinese steel products. The Trade Commission of the Ministry of Trade, Industry and Energy is reviewing the imposition of provisional anti-dumping duties on low-priced Chinese heavy plates (steel plates thicker than 6 mm). An industrial damage investigation began in October, and a preliminary ruling is scheduled for January next year to decide on the imposition of provisional anti-dumping duties.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)