Pat Gelsinger Intel CEO Abruptly Resigns... Reflecting Investor Dissatisfaction

Contributed to Biden-Led Semiconductor Strategy... Resigns Before Trump Administration Inauguration

Increased Possibility of Divisional Sale Including Foundry and CPU Design

The top semiconductor expert sharpened his knife and returned to the company that had abandoned him, but all that remained were the scars on his body and the anger of investors. This is the story of Pat Gelsinger, the former CEO of Intel. Gelsinger was abruptly and effectively dismissed during the Thanksgiving holiday period, when Americans enjoy time with their families, and left the company on the 1st (local time).

On March 20, U.S. President Joe Biden (center) is seen examining semiconductor wafers at Intel's factory in Arizona together with then-Intel CEO Pat Gelsinger (left). Both Biden, from Pennsylvania, and Gelsinger joined forces to revive U.S. semiconductor production but have since stepped down one after another. Photo by AP Yonhap News

On March 20, U.S. President Joe Biden (center) is seen examining semiconductor wafers at Intel's factory in Arizona together with then-Intel CEO Pat Gelsinger (left). Both Biden, from Pennsylvania, and Gelsinger joined forces to revive U.S. semiconductor production but have since stepped down one after another. Photo by AP Yonhap News

Until just before his dismissal, Gelsinger emphasized that Intel chips were used while touring the data center of xAI, an artificial intelligence (AI) company operated by Elon Musk, but he could not escape the sharp 'blade' of the board of directors. Gelsinger's departure immediately after the Thanksgiving holiday shocked the U.S. media and technology companies. Such announcements rarely come at the end of a holiday, suggesting that the internal situation at Intel was rapidly unfolding. It is reported that Gelsinger chose to resign after being given the options of dismissal or resignation.

Gelsinger's ousting(?) is interpreted as a reflection of investors' concerns over the blind investment in the recovery of U.S.-centered semiconductor manufacturing processes (foundry) at Intel since his return in 2021 and the resulting cost burden. It may also have been a strategic move to push out Gelsinger, who had shown a perfect alignment with President Joe Biden ahead of Donald Trump's inauguration as U.S. president.

The person who led Gelsinger's expulsion was Frank Yeary, chairman of Intel's board. Yeary, who joined Intel's board in 2009, is a UC Berkeley graduate near San Francisco but grew up as a Wall Street investor in New York. Yeary replaced engineer Omar Ishrak as board chairman in January last year.

Frank Yeary, Chairman of the Intel Board of Directors. Yeary, who comes from an investment banking background, is known to have led the push for CEO Pat Gelsinger's resignation. Photo by Intel

Frank Yeary, Chairman of the Intel Board of Directors. Yeary, who comes from an investment banking background, is known to have led the push for CEO Pat Gelsinger's resignation. Photo by Intel

The year Yeary joined Intel in 2009 was the same year Gelsinger left Intel after losing a rivalry with Sean Maloney within the company. And less than two years after Yeary took over as board chairman, Gelsinger had to give up his position.

Gelsinger seemed to have guessed that Yeary's mission was to boost the stock price. In an Intel press release about Yeary's appointment as board chairman, Gelsinger said, "Yeary's expertise in enhancing shareholder value, focus on corporate governance, and familiarity with Intel are strong assets for both the board and the company as we execute our strategy."

Yeary also emphasized shareholder value increase as his inaugural message. He stressed, "It is essential to execute our strategy well and deliver value to shareholders."

As both expressed, Yeary, who has strengths in shareholder value and corporate governance, is presumed to have had serious dissatisfaction with Gelsinger's management of Intel.

When Yeary took office, Intel's stock price was around $30. Recently, it has hovered in the low $20s. Although Intel's stock price declined, AMD, its eternal rival, and Nvidia, which was incomparable to Intel, have become the center of the global semiconductor industry, creating a significant gap in corporate value.

Currently, Intel's market capitalization is $100 billion. It is almost meaningless to compare it with Nvidia's $3 trillion. Even compared to AMD's $230 billion, it is less than half. Intel's revenue has fallen more than 30% from 2021 to 2023, and the quarterly results announced last October showed the largest loss in its history of $16.6 billion. The U.S. government reduced subsidies to Intel under the Chips Act from $8.5 billion to $7.9 billion.

Intel's press release announcing Gelsinger's retirement included Yeary's 'sharp' remarks. He stated, "Pat has continuously worked to invest in cutting-edge semiconductor manufacturing, initiate and activate process manufacturing, and drive innovation across the company." However, he added, "Intel knows there is much more to do and is committed to regaining investors' trust. The board knows that above all, product groups must be at the center of everything we do."

This statement can be read as emphasizing that Gelsinger's intensive investment in foundries to meet the Biden administration's 'Chips Made in America' strategy was a mistake, and that Intel should strengthen its semiconductor design competitiveness to compete with Nvidia and AMD.

A representative example is Intel's GPU, Gaudi. At the Computex event held in Taiwan last June, Gelsinger claimed that Gaudi was cheaper and superior in performance compared to Nvidia GPUs, but companies willing to purchase it are hard to find. Instead, the AI industry is fiercely competing to secure Nvidia's 'Blackwell.' Even at Intel Korea, personnel who had claimed Gaudi's superiority over Nvidia GPUs have been resigning one after another.

Former Intel CEO Pat Gelsinger is holding the Gaudi GPU at the Computex event held in Taiwan last June. Gaudi is considered to have lost in competition against Nvidia and AMD. Photo by EPA Yonhap News

Former Intel CEO Pat Gelsinger is holding the Gaudi GPU at the Computex event held in Taiwan last June. Gaudi is considered to have lost in competition against Nvidia and AMD. Photo by EPA Yonhap News

Under Gelsinger's leadership, Intel made large-scale investments and used government subsidies to build foundries in Ohio and Arizona. The U.S. government encouraged Intel's challenge to solve semiconductor supply chain issues triggered by COVID-19. The result was the Chips Act, which stipulates large-scale subsidies.

Intel itself was at a time when it needed to invest in advanced process technology, which had stagnated after halting new investments beyond 7nm, falling behind Samsung Electronics and TSMC. Gelsinger actively collaborated with President Joe Biden, also from Pennsylvania, to pass the Chips Act containing subsidies.

Samsung Electronics' establishment of a semiconductor foundry in the U.S. was also largely due to Gelsinger's role. Without subsidies, there would have been no reason to build a foundry in the U.S.

However, CPUs manufactured in Intel's own foundries with new processes were ignored by consumers. The successive heat issues and error controversies cast doubt not only on the reliability of the process itself but also on Intel's core design capabilities.

If the massive investment in the foundry line cannot be filled with in-house production alone, external customers must be secured. The problem is trustworthiness. The semiconductor industry diagnoses that it is not easy to find U.S. companies willing to entrust semiconductor production to Intel, which outsources the latest CPU production to Taiwan's TSMC. Representative examples are Google, Qualcomm, and Apple. Although Intel secured orders for Amazon's AI chip production, this alone could not stop the decline. In fact, last October, Nvidia replaced Intel in the Dow Jones Index.

The Wall Street Journal (WSJ) editorial diagnosed, "Government subsidies did not save the fate of Intel's CEO." It is an evaluation that investors' anger toward companies that failed to deliver results despite government support has crossed a critical point.

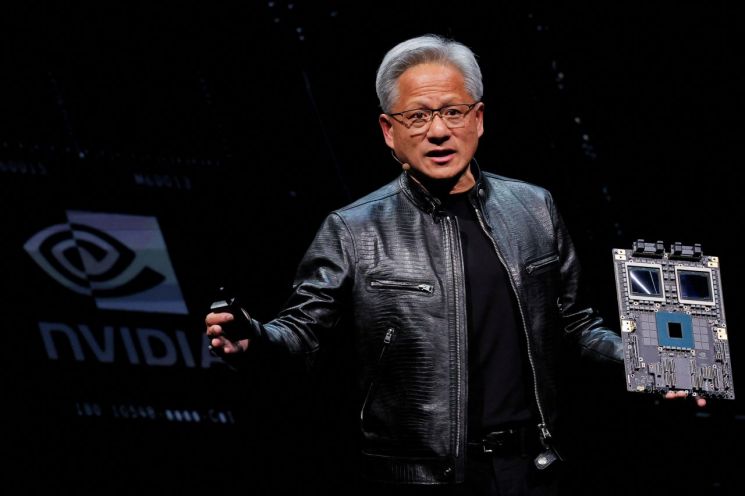

Jensen Huang, CEO of NVIDIA, is presenting the AI accelerator product 'Blackwell,' scheduled for release in the second half of this year, during his keynote speech at 'Computex 2024' held on June 2 at the National Taiwan University Sports Center in Taipei. Photo by Yonhap News

Jensen Huang, CEO of NVIDIA, is presenting the AI accelerator product 'Blackwell,' scheduled for release in the second half of this year, during his keynote speech at 'Computex 2024' held on June 2 at the National Taiwan University Sports Center in Taipei. Photo by Yonhap News

Yeary's diagnosis is simple: improving efficiency and profitability. Yeary predicted that Intel would urgently respond by prioritizing product simplification, advancing manufacturing and foundry capabilities, and optimizing operating costs and capital investments, striving to create a leaner, simpler, and more agile Intel. This is similar to the diagnosis made by Apple founder Steve Jobs when he returned as Apple's CEO in 1998.

Attention now focuses on who will be the next Intel CEO and whether the foundry and CPU businesses will be sold. Gelsinger was negative about a complete spin-off of the foundry business, but as Wall Street's dissatisfaction became clear, the foundry spin-off could happen rapidly.

Activist funds aiming to break up and sell Intel can also be expected to intervene. With Gelsinger, who was opposed to split sales, gone, U.S. media such as Bloomberg judge that Intel's board will swiftly take measures such as sales to raise the stock price. Qualcomm and Broadcom, once mentioned as potential Intel acquirers, are reportedly turning negative on acquiring Intel, indicating that a sale will not be easy. The semiconductor industry recalls that during Trump's first term, the U.S. government blocked Broadcom's attempt to acquire Qualcomm. The arrival of the Trump administration, which is negative about subsidies, could also sway Intel's fate. It is also a reality that President Biden, who co-conceived the Chips Act with Gelsinger, must leave the White House, making it difficult to take risks.

There are also expectations that U.S. government subsidies will make foundry spin-offs or sales difficult. It is reported that if Intel relinquishes majority ownership of the foundry subsidiary, the government may intervene. If external investment occurs, approval from the Department of Commerce may be required. The relationship between Intel's management and the next Trump administration is also important.

However, the consensus is that filling the CEO position at Intel will not be easy. Intel reportedly failed to recruit Johnny Srouji, Apple's head of semiconductor design, as CEO in 2021 and chose Gelsinger instead. Bloomberg predicts that Apple will try again to recruit Srouji this time but expects it to be difficult. This shows how hard it is to find someone willing to take responsibility for the sinking Intel. Stacy Rasgon, an analyst at Sanford C. Bernstein, said, "It will be difficult to fill the Intel CEO position, and a tough journey awaits whoever takes the role."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)