Samsung Securities, NH Investment & Securities, and Korea Financial Group All Hit Record Highs

Securities Industry Index Rises Over 4%... Up 24% This Year

Increase in Overseas Stock Trading Volume Offsets Domestic Slump

Dividend Expectations Also Reflected

Although the domestic stock market continues to underperform, securities stocks are showing strong performance, with many hitting new highs. This is expected to offset the impact of the sluggish domestic market as overseas stock investments increase. Additionally, dividend expectations are cited as a factor driving the strength of securities stocks.

According to the Korea Exchange on the 4th, Samsung Securities, NH Investment & Securities, and Korea Financial Group all hit 52-week highs the previous day. Samsung Securities closed at 50,700 KRW, up 6.62% from the previous session, marking a 52-week high. This is the first time in three years since December 2021 that Samsung Securities' stock price has surpassed 50,000 KRW. NH Investment & Securities rose 5.14%, reaching an intraday 52-week high of 14,530 KRW. Korea Financial Group also rose 5.62%, hitting an intraday 52-week high of 80,900 KRW. This is the first time since March 2022 that Korea Financial Group has recovered the 80,000 KRW level.

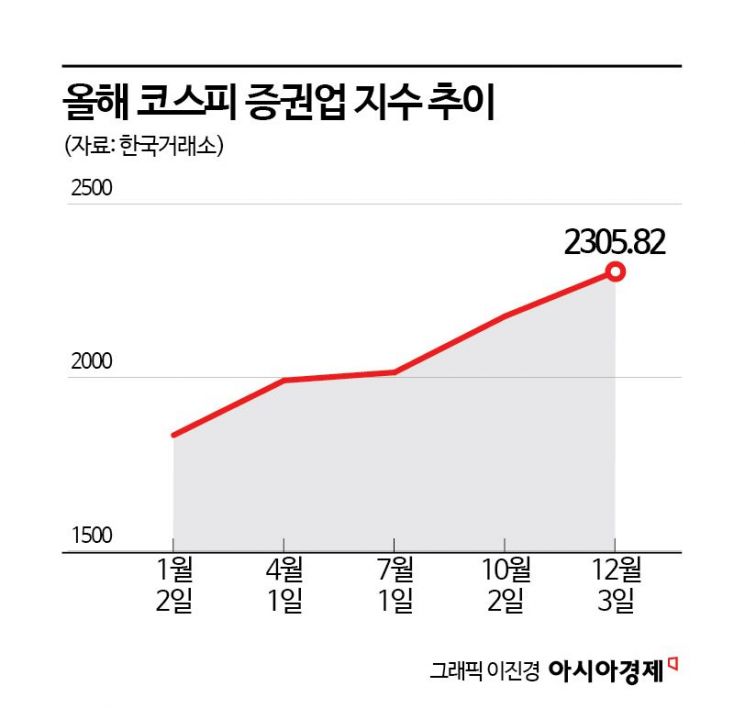

In addition, securities stocks broadly showed strength, with Mirae Asset Securities up 3.76% and Kiwoom Securities up 2.56%. The KOSPI Securities Industry Index rose 4.22%.

Despite this year's market downturn, securities stocks have performed well. The KOSPI has fallen 5.84% year-to-date, but the Securities Industry Index has risen 24.31%. Especially amid continued stock price weakness and shrinking trading volumes in the second half, securities stocks have maintained a relatively favorable price trend. Taejun Jeong, a researcher at Mirae Asset Securities, analyzed, "Due to the market downturn, domestic stock trading volumes and credit balances have continued to decline. The cumulative average domestic stock trading volume in Q4 fell 10.1% from the previous quarter to 16.4 trillion KRW, and just before the U.S. presidential election, it even dropped to 13.1 trillion KRW."

The sharp increase in overseas stock trading volumes is expected to offset the sluggish domestic market. Researcher Jeong stated, "The cumulative average overseas stock trading volume in Q4, converted to KRW, was 3.7 trillion KRW, up 27.9% from the previous quarter. Since overseas stock commission rates are about 2 to 3 times higher than domestic stock commission rates, strong overseas stock trading is expected to significantly offset the impact of weak domestic stock trading, as was the case in Q3."

Improved earnings and valuation upgrade expectations are cited as factors for the relative strength of securities stocks. Baeseung Jeon, a researcher at LS Securities, analyzed, "Despite trading volume and market adjustments, recent securities stock performance has been relatively favorable. This is due to improved earnings and valuation upgrade expectations, with solid earnings trends continuing thanks to strong performance in the trading division and improvements in corporate finance (IB) results. The reduction of real estate project financing (PF) risks has also contributed to the favorable stock prices."

Year-end dividend expectations also appear to be reflected. Researcher Jeong said, "The Q4 dividend yield is expected to be highest for Samsung Securities at 7.4%, followed by NH Investment & Securities at 7.1%. Korea Financial Group is expected to show a 6.0% dividend yield based on improved earnings strength despite a low dividend payout ratio, while Kiwoom Securities' dividend yield will remain at 5.4% due to shareholder returns being dispersed through treasury stock. However, the annual shareholder return yield, including treasury stock cancellations throughout the year, is expected to be highest for Kiwoom Securities at 8.7%, followed by NH Investment & Securities at 8.3%," he added.

Additionally, there is a low likelihood of further contraction in business indicators. Researcher Jeon stated, "With the market adjustment in the second half of this year, inflows into the stock market have been limited. Customer deposits and individual credit balances have also stagnated, indicating somewhat reduced activity among individual investors. However, since the market capitalization turnover rate has already reached a historically low level, the possibility of further contraction in business indicators is considered low."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.