Policy Finance Support and Tax Benefits

Consideration of Applying the Corporate Vitality Act

Industry Points Out Effectiveness Limits

Companies Selling Non-Core Assets

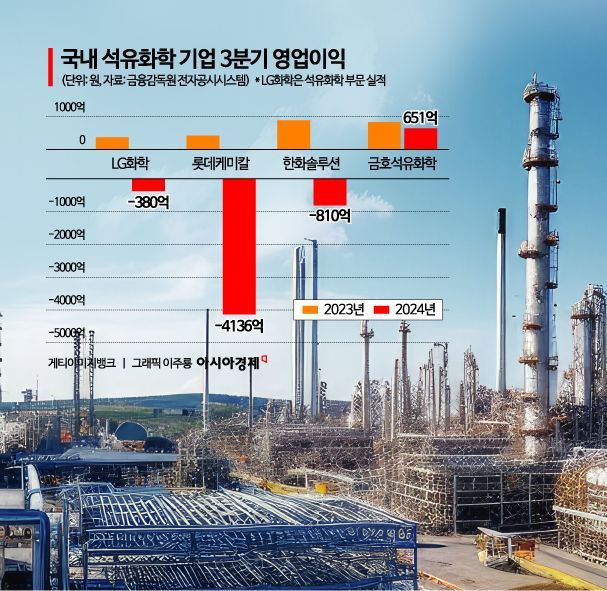

The government is sticking to the industry's voluntary principles regarding measures to strengthen the competitiveness of the petrochemical business to be announced this month. The plan is to induce restructuring of petrochemical companies through policy financial support and tax benefits, but there are concerns that if government intervention is delayed, a ‘chicken game’ scenario could unfold among companies.

According to the industry on the 2nd, the government has not budged from its stance that the petrochemical industry's business restructuring should be "pursued autonomously." The current measures include low-interest policy financial support for companies attempting business restructuring and tax benefits during mergers and acquisitions, with an official from the Ministry of Trade, Industry and Energy stating, "The focus is on creating an environment where companies can restructure on their own."

The government intervened in restructuring during the 1998 International Monetary Fund (IMF) crisis by splitting and selling Hyundai Petrochemical to LG Chem and Honam Petrochemical (now Lotte Chemical). However, since this is not a national crisis now, the government is drawing a line on intervention.

It is also reported that the government is considering applying the Special Act on Corporate Vitalization (Corporate Vitality Act) to the petrochemical sector to promote voluntary restructuring. The Corporate Vitality Act is a system where the government supports companies in oversupplied industries that voluntarily reduce facilities or pursue mergers and acquisitions (M&A).

Eligible companies receive benefits such as ▲simplified business restructuring procedures ▲regulatory exemptions under the Fair Trade Act ▲employment stability support ▲tax and financial support. The support targets under the Corporate Vitality Act include oversupply, industrial crisis, new industry entry, carbon neutrality, and supply chain stability, but there have been no cases where petrochemical companies have utilized this for restructuring.

In September, the government expanded the scope of application by revising the criteria for determining oversupplied industries under the Corporate Vitality Act. Previously, only long-term 10 years and short-term 3 years of performance were considered, but after the revision, a method comparing 20 quarters (5 years) and 4 quarters (1 year) was added. The previous method was criticized for being unable to reflect rapidly changing industrial environments.

However, the industry points out that inducing voluntary restructuring has its limitations in effectiveness. An industry official said, "Companies are making efforts for business restructuring, but without government intervention, active restructuring is difficult due to issues such as responsibility attribution." LG Chem is considering selling its naphtha cracking center (NCC) plant but has not found a suitable buyer. Some speculate that, given the petrochemical industry's cycle, an upswing may come again, raising the possibility of a ‘chicken game’ where factories operate at a loss.

Companies are securing cash by selling non-core businesses. LG Chem sold its IT materials division’s polarizer and materials business to a Chinese company for about 1.1 trillion won last year and halted operations at its Yeosu styrene monomer (SM) plant in March this year. Lotte Chemical secured about 1.3 trillion won through overseas subsidiary share sales and recently decided to liquidate its Malaysian synthetic rubber production subsidiary (LUSR).

There is also a possibility that the government will support restructuring as an extension of the carbon neutrality business restructuring measures announced in 2021. At that time, the government presented comprehensive measures including ▲deferral of capital gains corporate tax on asset sale proceeds if used for new investments by restructuring companies ▲expansion of research and development (R&D) cost support ▲creation of a dedicated financial program for business structure reorganization.

An industry official said, "With the US-China conflict intensifying, restructuring is an unavoidable task," adding, "We expect active and practical support from the government."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)