Statistics Korea October Industrial Activity Trends Announcement

Construction Production Index Declines for 6 Consecutive Months

Economic Indicator Also Shows No Change

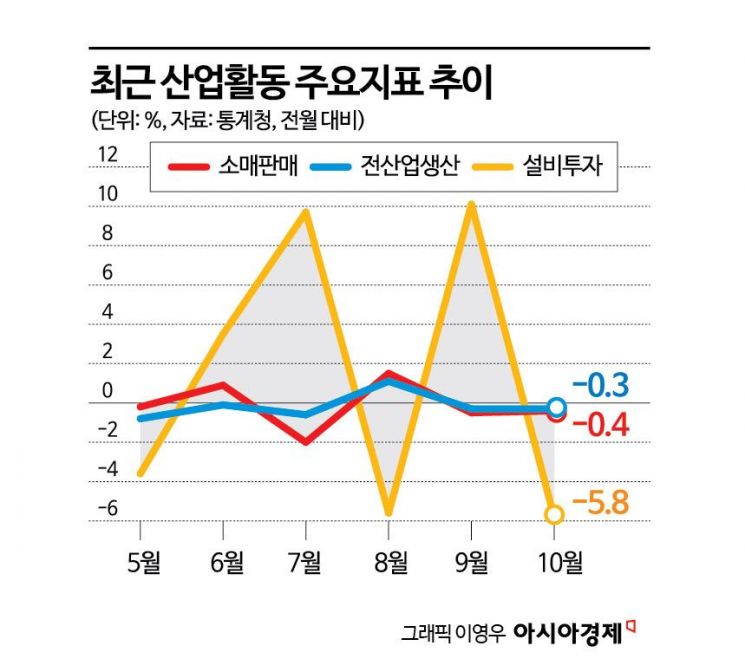

Production, consumption, and investment indicators reflecting South Korea's economic situation all declined simultaneously. This marks the first 'triple decline' in five months since last May. In particular, construction production fell for six consecutive months, and construction performance also continued to decrease. Indices representing the economy either stagnated or showed slight declines.

Construction Production Falls for Six Consecutive Months, Consumption and Investment Also Decline Simultaneously

According to the 'October 2024 Industrial Activity Trends' released by Statistics Korea on the 29th, total industrial production last month decreased by 0.3% compared to the previous month. Total industrial production had consecutively declined in May (-0.8%), June (-0.1%), and July (-0.6%), then turned to an increase in August (1.1%), but continued a two-month negative streak with a 0.3% decrease in September.

The decline in production was led by public administration (-3.8%) and construction (-4.0%). The public administration sector saw the largest drop since June due to decreased rental fees from local governments and public institutions. Construction recorded a 4.0% decline, marking six consecutive months of downturn. This is the longest period of stagnation in 16 years and 4 months. Mi-sook Gong, Economic Trend Statistics Officer at Statistics Korea, evaluated, “The construction sector is very difficult. Negative figures continue to appear.”

The manufacturing and mining sector remained flat. Automobile production fell by 6.3% due to disruptions caused by strikes at vehicle parts suppliers and fire accidents. Machinery equipment (-3.8%) and pharmaceuticals (-4.7%) also showed weakness. However, declines were offset by increases in South Korea's key products such as semiconductors (8.4%) and medical precision science (4.0%). Manufacturing inventories rose by 1.2% compared to the previous month. Statistics Korea explained that although semiconductor production increased significantly, shipments were delayed. The average operating rate dropped by 0.9 percentage points to 72.5% compared to the previous month.

Consumption continued its negative streak following the previous month. Retail sales, which indicate consumption trends, decreased by 0.4% month-on-month. Sales increased in semi-durable goods such as clothing (4.1%) and non-durable goods such as food and beverages (0.6%), but decreased in durable goods such as home appliances (-5.8%). The prolonged heatwave until October significantly affected lower sales of heating products.

Facility investment decreased by 5.8% compared to the previous month. Both machinery such as semiconductor manufacturing equipment (-5.4%) and transportation equipment such as automobiles (-7.2%) declined. This is the largest decrease in nine months since January. There was a base effect from the 10.1% increase in facility investment in September. Construction performance fell by 4.0% month-on-month as construction results decreased in civil engineering (-9.5%) and architecture (-1.9%).

The composite economic index showed a sideways movement without meaningful rebound. The coincident composite index, which reflects the current economy, remained unchanged at 98.1, halting a seven-month consecutive decline. Although the rate of decline has slowed, considering other indicators, it is difficult to guarantee an upward trend in the future. The leading index, which forecasts future economic conditions, decreased by 0.1 points to 100.6 compared to the previous month.

"Economic Flow Has Not Changed," but Growing External Uncertainties

The government assessed that the economy has not yet entered a downturn. Kwi-beom Kim, Head of Economic Analysis at the Ministry of Economy and Finance, analyzed, “The economic flow itself has not changed significantly,” adding, “Production remains at a high level and is stable, but when looking closely at consumption and investment, there are some positive aspects.” Except for the public administration sector which led the decline in production, the overall production sector is favorable, and although there are differences in consumption and investment, various base effects have played a role.

However, recent announcements from fiscal and monetary authorities reveal a perception that the growth recovery is slower than expected. The Ministry of Economy and Finance had evaluated in the Economic Trends (Green Book) that domestic demand showed signs of recovery from May to October, but this expression was removed in the recent November issue. Although the judgment on domestic demand has not changed significantly, this reflects the increased uncertainty in the economy. The diagnosis of a “recovery trend” was also changed to a “gradual economic recovery” as the real GDP growth in the third quarter was only 0.1%.

The Bank of Korea's Monetary Policy Committee lowered the base interest rate from 3.25% to 3.00% the day before. This 0.25 percentage point cut, which surprised the market, is interpreted as a response to increased downside risks to the economy, including export uncertainties. Along with the interest rate decision, the Bank of Korea also released a revised economic outlook. The economic growth rate forecast for this year was lowered by 0.2 percentage points from 2.4%. The growth rate for next year was also revised down from 2.1% to 1.9%.

This perception is related to the expansion of uncertainties such as the protectionist policies anticipated by U.S. President-elect Donald Trump. Sang-mok Choi, Deputy Prime Minister and Minister of Economy and Finance, emphasized at the external economic ministers' meeting on the 22nd that “external uncertainties are also greatly expanding,” referring to the inauguration of the new U.S. administration. Bank of Korea Governor Chang-yong Lee also explained the day before, “We expected the warmth spreading from exports to domestic demand to decrease, so we lowered the interest rate thinking it would affect domestic demand,” adding, “Exports are greatly influenced by external conditions.”

The government stated, “We plan to make every effort to revitalize the economy,” and added, “We will activate a whole-of-government response system in the three major areas of finance and foreign exchange, trade, and industry to proactively respond to external uncertainties, while strengthening policy responses so that small business owners and self-employed individuals can quickly feel the recovery of domestic demand and livelihoods through additional support measures.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.