20% Increase This Month

Q3 Earnings Release Resolves Negative Factors for Stock Price

Profitability Improvement Expected Next Year Through AI Utilization

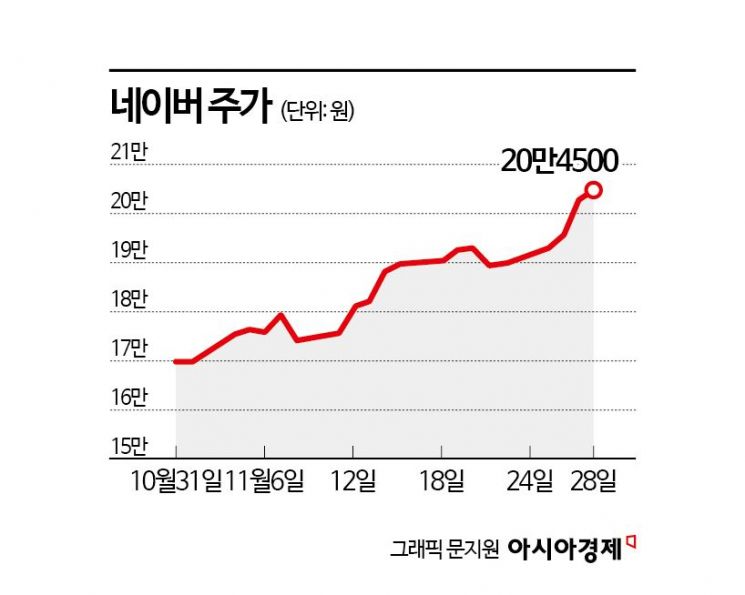

NAVER's stock price rebounded this month, recovering to 200,000 KRW. This is the first time in nine months since February. Market experts interpret that the recovery was influenced by alleviating concerns over sluggish sales growth, which had been a factor in NAVER's stock decline, as well as growing expectations for monetization through artificial intelligence (AI) utilization.

According to the financial investment industry on the 29th, NAVER's stock price rose by 20% this month. Considering that the KOSPI fell by 2% during the same period, the market-relative return reached 22 percentage points (P). The foreign ownership ratio increased from 42.8% at the end of last month to 46.0%. Net foreign purchases during this period amounted to 789.3 billion KRW. Institutional investors also supported the stock price rise with cumulative net purchases of 196.2 billion KRW. Meanwhile, individual investors recorded cumulative net sales of 944.2 billion KRW.

NAVER posted sales of 2.72 trillion KRW and operating profit of 525.3 billion KRW in the third quarter of this year. These figures represent increases of 11.1% and 38.2%, respectively, compared to the same period last year. The cumulative operating profit for the first three quarters reached 1.44 trillion KRW, up 32.7% year-on-year. The reason the profit growth rate exceeded the sales growth rate of 10.1% during the same period was due to effective cost control. Successful management of major fixed costs improved profitability.

So-hye Kim, a researcher at Hanwha Investment & Securities, said, "Both performance and business conditions have confirmed a bottom," adding, "There is significant room to raise the conservative earnings estimates for next year." She continued, "Recording double-digit advertising growth rates stands out among domestic and international companies," and "Going forward, we expect solid growth through advanced targeting using AI technology."

Ho-yoon Jung, a researcher at Korea Investment & Securities, analyzed, "The third-quarter results have largely alleviated concerns about declining advertising market share," and "Display advertising, which was a factor in last year's poor advertising performance, is recovering its growth rate through strengthening short-form videos and introducing performance-based advertising systems."

Hee-seok Lim, a researcher at Mirae Asset Securities, judged, "The endless decline trend in NAVER's dwell time, which was the biggest discount factor for the stock price, has come to an end," and "Uncertainty in the commerce sector has also decreased as the threat from direct purchases from China has diminished."

Expectations are growing that profitability will improve from next year through AI utilization. Jin-gu Kim, a researcher at Kiwoom Securities, expressed hope, saying, "Adding AI advertising-based real-time automatic solutions will improve advertising efficiency," and "Cost reduction is also possible by internalizing advertising agency functions."

Sung-man Yoo, a researcher at Leading Investment & Securities, said, "We expect to increase user dwell time and content exposure by integrating AI into NAVER's existing major services such as search, shopping, advertising, and places," and "NAVER advertising will also be reborn as the AI advertising platform 'AD Boost'." He explained, "The AI-based shopping application 'NAVER Plus Store' will be launched in the first half of next year," and "The 'Navigator,' which actively utilizes generative AI, will reduce product search time and speed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.