"Necessary to Promote Sound Management According to Market Conditions"

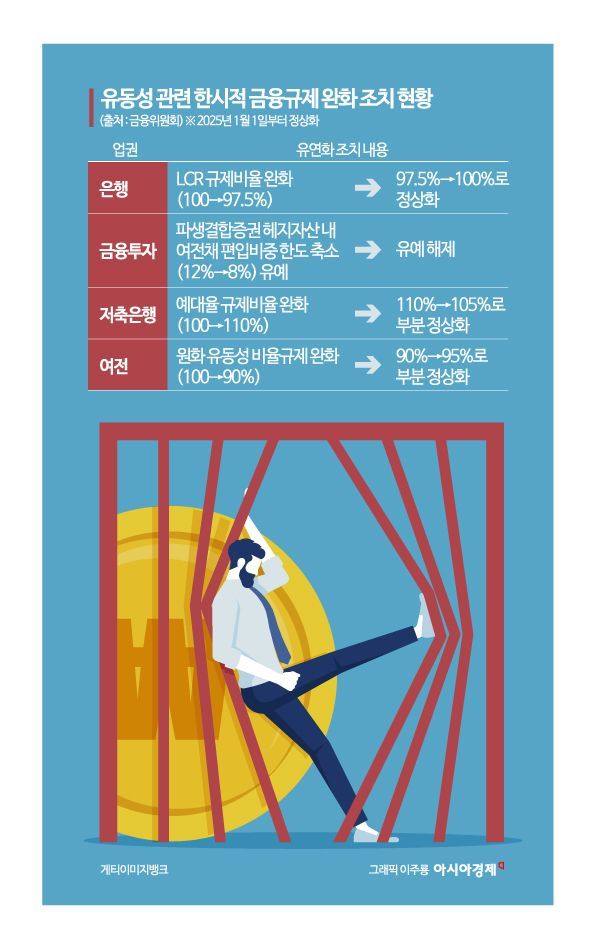

Financial authorities will gradually normalize the financial regulatory measures that were temporarily relaxed in relation to liquidity. Accordingly, the asset ratio that banks must maintain to respond to liquidity crises will be restored from 97.5% to 100%.

On the 29th, the Financial Services Commission held a meeting to review the financial regulatory relaxation measures with the Financial Supervisory Service, the Bank of Korea, and financial associations, chaired by Ahn Chang-guk, Director of the Financial Industry Bureau. At the meeting, they discussed future plans for the financial regulatory relaxation measures for banks, financial investment firms, credit finance companies, and savings banks, which are set to expire at the end of December this year.

The attendees agreed on the need for a phased normalization of the temporary liquidity-related regulatory easing measures introduced during market instability. This consideration was based on the expectation that funding market conditions will improve and that, as of September this year, the liquidity ratios and other regulations subject to relaxation measures across all sectors still exceed normal regulatory levels.

First, the regulatory ratio for banks’ short-term Liquidity Coverage Ratio (LCR), currently maintained at 97.5%, will be restored to 100% starting January 1 next year. The LCR is the minimum mandatory holding ratio that requires banks to hold enough easily liquidated assets to cope with a liquidity crisis for 30 days in case of urgent liquidity shocks such as fund withdrawals. The limit on the proportion of credit finance company bonds included in the hedge assets of derivative-linked securities held by financial investment companies will also be reduced from 12% to 8% starting next year.

The savings banks’ loan-to-deposit ratio regulation and the credit finance companies’ won liquidity ratio regulation will be normalized in phases. For savings banks’ loan-to-deposit ratio, a 10% partial normalization of the regulation will be applied from January to June next year. Similarly, for credit finance companies’ won liquidity ratio, a 95% partial normalization will be applied during the same period. Considering financial market conditions and sector circumstances, a decision will be made in the second quarter of next year on whether to further extend the temporary regulatory easing measures or fully normalize them.

Ahn Chang-guk, Director of the Financial Industry Bureau at the Financial Services Commission, stated, “The temporary financial regulatory relaxation measures related to liquidity were exceptional and provisional measures introduced to respond to market instability, and normalization of regulations is necessary to guide sound management of financial companies according to market conditions.” He added, “Since financial companies have secured stable liquidity and soundness, and the government and related agencies are equipped with the ability to maintain market stability in emergencies, we will continue to promote regulatory normalization in line with market conditions.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)