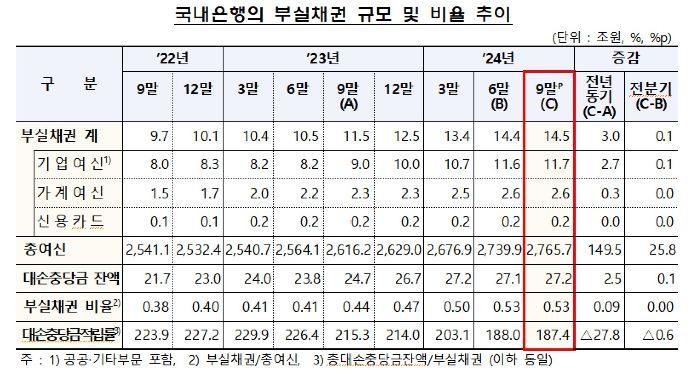

3 Trillion KRW Increase Since Late September Last Year

Non-Performing Loan Ratio 0.53%, Same as Previous Quarter

Non-Performing Loan Resolution Amount 5 Trillion KRW, 400 Billion KRW Decrease from Previous Quarter

The scale of non-performing loans (NPLs) at domestic banks as of the end of September reached 14.5 trillion KRW, an increase of 100 billion KRW compared to the end of June. During the same period, the NPL ratio remained unchanged at 0.53%.

According to the Financial Supervisory Service (FSS) on the 29th, the NPL ratio of domestic banks at the end of September was 0.53%, the same as at the end of the previous quarter (0.53%). The scale of NPLs was 14.5 trillion KRW, up 100 billion KRW from the previous quarter and 3 trillion KRW compared to the end of September last year. By sector, corporate loans accounted for 11.7 trillion KRW, household loans 2.6 trillion KRW, and credit card receivables 200 billion KRW. While the scale of NPLs in household loans and credit card receivables remained stagnant, corporate loans continued to increase.

Additionally, the balance of loan loss provisions stood at 27.2 trillion KRW, an increase of 100 billion KRW from the end of the previous quarter. However, due to the increase in NPLs, the loan loss provision coverage ratio fell by 0.6 percentage points from 188.0% at the end of the previous quarter to 187.4%. An FSS official explained, "The NPL ratio of domestic banks remained at the same level as the end of the previous quarter as the scale of NPL disposals decreased but the amount of new NPLs also declined. The decrease in new corporate loan NPLs has slowed the previous upward trend in the NPL ratio, and the loan loss provision coverage ratio remained similar to the previous quarter."

Newly generated NPLs in the third quarter amounted to 5.1 trillion KRW, down 1.3 trillion KRW from 6.4 trillion KRW in the previous quarter. New corporate loan NPLs were 3.7 trillion KRW, a decrease of 1.3 trillion KRW from 5 trillion KRW in the previous quarter.

Large corporations (400 billion KRW) saw a decrease of 100 billion KRW compared to the previous quarter (500 billion KRW), and small and medium-sized enterprises (3.3 trillion KRW) decreased by 1.2 trillion KRW from 4.5 trillion KRW in the previous quarter. New household loan NPLs were 1.2 trillion KRW, down 100 billion KRW from 1.3 trillion KRW in the previous quarter.

The scale of NPL disposals was 5 trillion KRW, a decrease of 400 billion KRW from 5.4 trillion KRW in the previous quarter. By category, write-offs and sales (loan write-offs 1.2 trillion KRW, sales 1.8 trillion KRW) accounted for 3 trillion KRW, loan recovery through collateral disposal was 900 billion KRW, and loan normalization was 700 billion KRW.

The corporate loan NPL ratio (0.65%) was similar to the end of the previous quarter (0.65%). The large corporate loan NPL ratio (0.43%) decreased by 0.01 percentage points from 0.44% at the end of the previous quarter, while the small and medium-sized enterprise loan NPL ratio (0.78%) increased by 0.01 percentage points from 0.77%. The small corporation NPL ratio (0.99%) decreased by 0.01 percentage points from 1.00%, and the individual business loan NPL ratio (0.48%) increased by 0.04 percentage points from 0.44%.

The household loan NPL ratio (0.27%) was also similar to the end of the previous quarter (0.27%). The mortgage loan NPL ratio (0.18%) remained steady compared to the previous quarter (0.18%), while other unsecured loans (0.53%) decreased by 0.01 percentage points from 0.54%. The credit card receivables NPL ratio (1.55%) fell by 0.05 percentage points from 1.60% at the end of the previous quarter.

The FSS plans to continue encouraging domestic banks to enhance their loss absorption capacity. An FSS official stated, "The delinquency rate is maintaining an upward trend, and the scale of new NPLs remains at a high level compared to previous years, so it is necessary to prepare for the possibility of increased credit risk due to domestic and external uncertainties. We will continue to promote the enhancement of loss absorption capacity by ensuring sufficient loan loss provisions for vulnerable sectors, reflecting economic outlooks adequately."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)