Pernod Ricard Korea's Dividend Reaches 40 Billion KRW Last Year

99.9% of Net Profit Transferred to Overseas Headquarters

Dividend Surge Since 2018 Restructuring Controversy

On the 27th, the Valentine 40-Year Masterclass Collection The Waiting was introduced at Casa Alexis Dosan Branch in Gangnam-gu, Seoul. Photo by Jo Yong-jun

On the 27th, the Valentine 40-Year Masterclass Collection The Waiting was introduced at Casa Alexis Dosan Branch in Gangnam-gu, Seoul. Photo by Jo Yong-jun

"When I heard the news that the Valentine 40-year product, introduced for the first time last year, was completely sold out in Korea, I honestly was not surprised. I know how much Koreans love Valentine, and I also believe that Korea is an equally important market."

Sandy Hislop, Master Blender of Valentine and Royal Salute at Pernod Ricard, the producer of the Scotch whisky 'Valentine,' said this at the 'Valentine 40-Year Masterclass Collection - The Waiting' launch press conference held on the 27th in Nonhyeon-dong, Gangnam-gu, Seoul.

The Valentine 40-year, introduced this time by Pernod Ricard Korea, the Korean subsidiary of the French liquor company, is a high-priced product with a price reaching around 20 million KRW per bottle. A total of 108 bottles were produced, of which 15 bottles were allocated to Korea. This is the largest quantity allocated to a single country. The Valentine 40-year product, first introduced last year, sold out on the first day of its release.

Pernod Ricard, which achieved great success in the Korean market like this, has been criticized for transferring most of its net profit to its headquarters under the name of dividends.

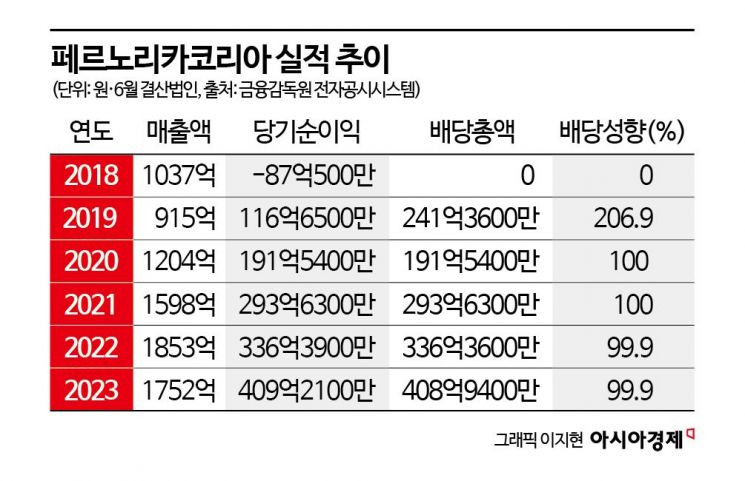

According to the Financial Supervisory Service's electronic disclosure system (DART) on the 29th, Pernod Ricard Korea, a corporation with a fiscal year ending in June, recorded sales of 175.16 billion KRW for the 2023 fiscal year (July 2023 to June 2024), down 5.5% from the previous year (185.26 billion KRW) due to a recent decline in domestic whisky consumption. However, the total amount of dividends increased by 21.6% to 40.89 billion KRW compared to the same period last year (33.64 billion KRW).

Out of the net profit of 40.92 billion KRW, all except about 30 million KRW of retained earnings carried forward to the next period were paid out as dividends to shareholders, resulting in a dividend payout ratio of 99.93%, which is the ratio of dividends paid in cash to net profit. All dividends are paid to Pernod Ricard Asia, the parent company that owns 100% of Pernod Ricard Korea's shares. This means that virtually all profits earned in Korea last year were transferred overseas.

Pernod Ricard Korea has maintained a high dividend policy, paying out most of its net profit as dividends in recent years. Pernod Ricard Korea stopped paying dividends to the headquarters in 2018 due to a shift to losses and resulting labor-management conflicts caused by restructuring. However, starting from the 2019 fiscal year, it began to benefit fully from the COVID-19 pandemic, raising the dividend payout ratio to over 200%, and from the 2020 fiscal year, it has remitted virtually all net profits overseas to the headquarters for four consecutive years.

In particular, despite a decrease in sales in the recent fiscal year, Pernod Ricard Korea increased net profit by reducing costs, thereby increasing the dividend amount. In fact, Pernod Ricard Korea's net profit for this fiscal year was 40.9 billion KRW, a 21.7% increase from 33.6 billion KRW a year earlier. The biggest factors contributing to improved profitability were reductions in cost of sales and selling and administrative expenses, which decreased by 11.2% and 10.9% respectively compared to the previous year.

Cost of sales decreased from 47.3 billion KRW in the previous fiscal year to 42.0 billion KRW this fiscal year, as most major affiliates reduced their product purchases. The volume imported from 'Chivas Brothers International,' which handles the flagship whisky brands Valentine and Royal Salute, dropped 42.9% from 31.2 billion KRW last year to 17.8 billion KRW this year. Purchases from 'The Absolut Company,' which handles the vodka brand 'Absolut,' also decreased by 48.7%, from 7.2 billion KRW to 3.7 billion KRW. During the same period, purchases of the flagship champagne brand 'Perrier-Jou?t' were halved from 3.1 billion KRW to 1.5 billion KRW.

However, the recent fluctuations in the whisky market are seen as a normalizing adjustment process following rapid growth during the COVID-19 period due to revenge consumption and other factors, both in Korea and globally, and Pernod Ricard Korea maintains a positive outlook on the domestic whisky and related markets.

Franz Horton, CEO of Pernod Ricard Korea, said at the press conference, "During the COVID-19 period, alcohol consumption increased as consumption areas were limited, but now it is dispersing due to travel and other factors, normalizing the super cycle." He added, "However, compared to other countries, Korea's whisky market growth was much larger, so the recent adjustment feels abrupt. In the short term, it may seem like a decline, but from a long-term perspective, the market is more active than ever and will continue to grow."

While maintaining a high dividend policy, Pernod Ricard Korea has been stingy in social contributions such as donations. Pernod Ricard Korea's donations for this fiscal year amounted to about 146 million KRW, which is only 0.08% of sales. Although ESG (Environmental, Social, and Governance) has become a constant in corporate management recently, the company is effectively neglecting its social responsibility.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)