Samjong KPMG announced on the 28th that it will hold a 'Tax Management Seminar for Overseas Expansion Companies' on the 9th of next month at the Samjong KPMG headquarters in Yeoksam-dong, Gangnam-gu, Seoul, targeting domestic companies.

As tax authorities around the world strengthen their taxing rights through international cooperation, the income tax reporting and tax equalization settlement for employees dispatched overseas are becoming increasingly complex. This seminar will cover key tax issues and the latest trends to consider when domestic company employees are dispatched overseas, and introduce tax authority trends regarding income tax on dispatched employees.

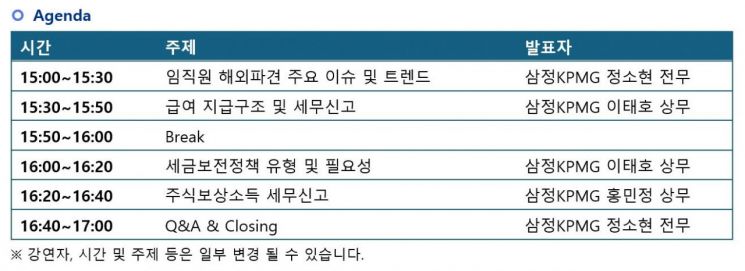

First, Sohyun Jeong, Executive Director at Samjong KPMG, will present on major issues and trends when employees are dispatched overseas. Taehong Lee, Managing Director at Samjong KPMG, will introduce the salary payment structure and tax reporting for overseas dispatched employees, along with types of tax equalization policies. Minjung Hong, Managing Director at Samjong KPMG, will explain the income tax treatment of stock compensation standards provided to employees, such as stock options and restricted stock units (RSUs).

Kyungmi Kim, Deputy Head of the Tax Advisory Division at Samjong KPMG, said, “The salary and compensation system for overseas dispatched employees is complex due to issues such as after-tax income guarantees and institutional differences between the home and host countries,” adding, “We hope this seminar will provide an opportunity to address various tax risks, including cross-border double taxation issues.”

The seminar is free to attend, and applications can be made through the Samjong KPMG website and contact points.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.