Game Companies Launch Collective Action Against Google and Apple Over In-App Purchase Fees

Increase in New Game Releases and Expected Improvement in Operating Profit

Blockbuster Games to Launch One After Another Starting Next Year... Stock Prices React Based on Performance

Game stocks are rebounding. This is interpreted as reflecting expectations for major releases next year along with app market commission reductions.

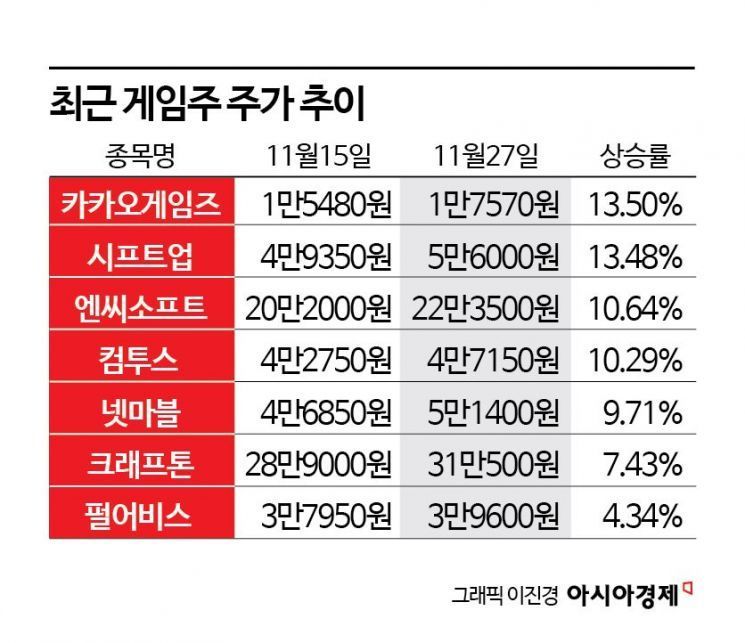

According to the Korea Exchange on the 28th, NCSoft's stock price, which was 202,000 won on the 15th of this month, recorded 223,500 won the day before. The increase rate during this period was 10.64%. During the same period, Kakao Games rose 13.50%, Shift Up 13.48%, Com2uS 10.29%, and Netmarble 9.71%, all showing upward trends.

This year, game stocks have been sluggish due to poor performance and lack of new releases. However, recently, stock prices have rebounded amid expectations of app market commission reductions. According to the industry, about 40 domestic game companies have initiated collective mediation against Google and Apple regarding monopolistic practices and excessive in-app payment commissions. They are known to claim that the 30% commission charged by Google and Apple on in-app payments is excessive.

The securities industry expects that if app market commission reductions become a reality, it will greatly contribute to improving the performance of domestic game companies. Heeseok Lim, a researcher at Mirae Asset Securities, analyzed, "Game companies are expected to see immediate profitability improvements," adding, "Assuming a mobile commission rate of 17% based on this year's performance, the operating profit margin of major domestic game companies would increase by an average of 7%."

More new releases are also expected. As commissions decrease, profits increase, allowing additional funds to be used for new game development. Researcher Lim explained, "If app commissions are reduced, the game industry is expected to see an expansion in the supply of new titles," adding, "The cost of making a triple-A game is about 100 billion won, and if the savings from mobile commission reductions are fully invested in new game development, 170 new pipelines would be created." He emphasized, "If the overall platform commission is reduced to 17%, we could expect 350 new pipelines."

Moreover, major games are scheduled for release starting next year. Representative titles include Pearl Abyss's Red Desert, Netmarble's The Seven Deadly Sins: Origin, Nexon's First Berserker: Kazan, and Krafton's inZOI. Hyoji Nam, a researcher at SK Securities, said, "Next year, highly anticipated titles that have undergone long development periods will be released to the market," adding, "The new releases scheduled for next year will target global users and will not be limited to the limited genres previously offered by domestic game companies, but will be presented in various genres. Most will be provided as cross-platform and will undergo validation in the global market." He emphasized, "Stock prices will respond sensitively depending on the success of the new releases."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)