Not only domestic theme stocks but also Musk-related theme stocks

Political theme stocks surge sharply during election season

Lack of leading stocks due to semiconductor sector slump is the cause

The domestic stock market, lacking leading stocks, is experiencing wild fluctuations in theme stocks. With limited liquidity in the market and no clear leading stocks to drive the market, buying interest is concentrating on theme stocks. Experts advise caution against hasty chase buying, as theme stocks can see sharp declines once short-term catalysts disappear.

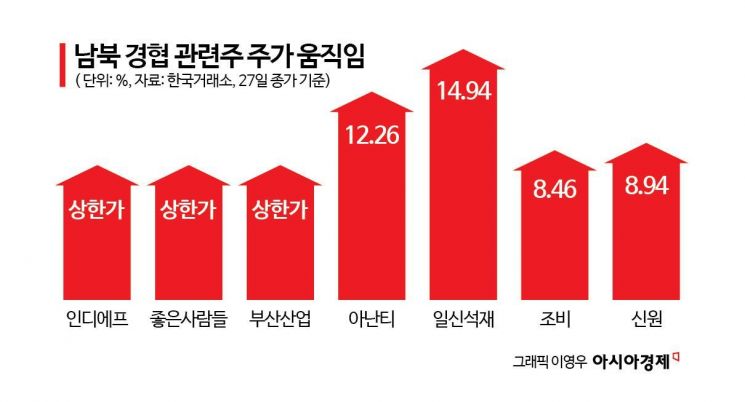

According to the Korea Exchange on the 28th, Indief and Joheun Saramdeul, former tenants of the Kaesong Industrial Complex, surged to their daily limit the previous day. Busan Industrial, a railway-related stock, also closed at 73,800 won, up 29.93%. Ananti (12.26%), Ilsin Stone (14.94%), Jobi (8.46%), and Shinwon (8.94%) also ended the day strong.

Foreign media reports that Donald Trump, the president-elect, and Kim Jong-un, Chairman of North Korea’s State Affairs Commission, are discussing direct dialogue pushed these companies’ stock prices higher. Citing two sources, the foreign media reported, "Trump’s transition team hopes that new diplomatic efforts can reduce the risk of military conflict with North Korea."

Recently, theme stocks related to Elon Musk, Tesla CEO and a key figure behind Trump’s election victory, have also risen. On the 11th, SpaceX-related theme stocks surged en masse. On that day, Georit Energy (30.00%), LK Samyang (29.83%), and N2Tech (29.79%) closed at their daily limits. This is interpreted as reflecting expectations that SpaceX’s business, led by Musk, will gain momentum following Trump’s confirmed election victory.

Theme stocks related to Ukraine’s reconstruction also surged amid expectations that the second Trump administration will push for an early end to the Ukraine war. On the 26th, Daedong closed at 11,130 won, up 7.02% from the previous day. Daedong is known to have entered Ukraine to promote sales of tractors and other agricultural machinery. Daedong Metal rose 16.76% from the previous day’s close, while Sambu Construction (6.04%) and TYM (3.27%) also increased. The buying interest is interpreted as driven by expectations that reconstruction stocks will benefit if the Ukraine war ends early.

Political theme stocks, which typically surge during election seasons, also joined the rally. On the 25th, after the Seoul Central District Court acquitted Lee Jae-myung, leader of the Democratic Party of Korea, on charges of perjury inducement, ATEC and Dongshin Construction immediately hit their daily limits. ATEC is classified as a Lee Jae-myung theme stock because its largest shareholder had ties with Lee during his time as mayor of Seongnam, while Dongshin Construction is classified as such because its headquarters is located in Andong, Lee’s hometown.

Stocks of companies embroiled in management disputes also fluctuated wildly. Korea Zinc is a representative case. On the 26th, Korea Zinc’s stock price reached 1,022,000 won, up 83% from 556,000 won before Youngpoong and MBK began a public tender offer. Hanmi Science’s stock price also jumped 63%, from 31,950 won on September 27 to 52,100 won on October 30, as the management dispute reignited.

Experts attribute the frequent surges in theme stocks to the 'absence of leading stocks.' While semiconductor stocks, which led the domestic market in the first half, have weakened, bio and defense stocks performed well but lost momentum due to uncertainties such as U.S. interest rates. With limited liquidity, a rotation market continues where investors sell sectors that have risen and buy those that have fallen significantly.

Kim Dae-jun, a researcher at Korea Investment & Securities, analyzed, "The characteristic of the market when theme stocks are rampant is the absence of leading stocks. The market continues to react sensitively to remarks by specific individuals such as President-elect Trump and Musk."

He warned that chase buying should be avoided given the rapid short-term price increases. Researcher Kim said, "It is better not to ride the wave of theme stocks but to build a portfolio with defensive and mid-to-long-term value stocks that can secure profits."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)