National Tax Service Launches Tax Investigation on 37 Members of Saju Family

Using Company Funds to Purchase Luxury Overseas Homes, Supercars, and Yachts for Personal Use

Also Favoring Sons' and Daughters' Companies with 'Prime Contracts'

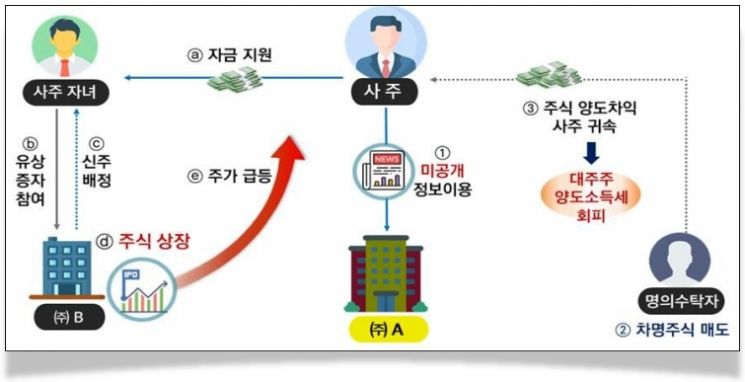

The owner of manufacturing company A facilitated the acquisition of shares in its affiliate B, which is pursuing a public listing, by providing funds to their children in advance. Subsequently, company B was successfully listed, and the owner's children gained enormous stock price appreciation profits worth dozens of times their acquisition cost. Additionally, the owner personally used favorable information about A's large-scale contract wins to purchase shares under a third party's name and then sold them to secure capital gains. Through this, the owner also evaded capital gains tax liabilities that major shareholders are required to pay. The National Tax Service (NTS) plans to conduct a strict investigation into the unfair asset accumulation allegations involving the owner's family, including profits from stock listings using undisclosed information.

On the 27th, the NTS announced that it will begin tax audits on 37 suspects accused of tax evasion by obtaining unfair capital gains through the use of undisclosed corporate information, misappropriating company funds for personal use, and funneling lucrative contracts to their children and others.

The National Tax Service announced on the 27th that it will begin tax investigations on 37 suspects accused of tax evasion who monopolized corporate profits through self-serving management and moral hazard while avoiding rightful taxes. Min Juwon, Director of the Investigation Bureau of the National Tax Service, is giving a related briefing at the Government Sejong Complex on the same day.

The National Tax Service announced on the 27th that it will begin tax investigations on 37 suspects accused of tax evasion who monopolized corporate profits through self-serving management and moral hazard while avoiding rightful taxes. Min Juwon, Director of the Investigation Bureau of the National Tax Service, is giving a related briefing at the Government Sejong Complex on the same day.

Min Juwon, Director of the NTS Investigation Bureau, stated, "This tax audit aims to focus on the deviant behaviors of certain companies and their owners that run counter to the virtuous cycle of 'investment → growth → fair profit distribution.' Unfair practices that seek profits exclusively for the owner's family by exploiting corporate assets and undisclosed corporate information distort a healthy capitalist system that should coexist with consumers, small business owners, and minority shareholders," he emphasized.

The types of cases under investigation include: ▲using company funds as personal money (14 cases), ▲funneling lucrative contracts (16 cases), and ▲unfair gains from undisclosed corporate information (7 cases). First, the NTS targeted companies and their owners who unfairly obtained capital gains by using undisclosed information related to initial public offerings (IPOs) and new business ventures. According to the NTS, these parties monopolized the benefits of stock value appreciation that should have been shared with ordinary small investors and the general public, while failing to report related gift taxes. When shares gifted by the major shareholder parents are listed within five years and generate stock price gains, gift tax is imposed on the children. The owners of the companies under investigation acquired unlisted shares scheduled for listing or mergers and acquisitions, realizing an average stock price gain of 20 times the acquisition cost.

There were also companies and their owners who misappropriated company assets for private use and enjoyed luxurious lifestyles while disguising these expenses as legitimate costs to evade taxes. Among the subjects of this investigation are cases of 'moral hazard,' where corporate profits obtained from ordinary consumers were used to acquire high-value corporate assets such as overseas luxury homes and sports cars for private use, or where the corporation bore the costs of overseas stays and luxury expenses for the owner's children. The total value of assets suspected to have been used privately includes luxury homes and high-end luxury goods amounting to 138.4 billion KRW.

Companies and owners who funneled lucrative contracts to 'son and daughter companies' are also subject to tax audits. They transferred profitable businesses or guaranteed high-return contracts to their children’s companies, thereby concentrating 'wealth accumulation opportunities' for their children and passing on wealth through illicit means. The children under investigation started with an average gifted seed money of 6.6 billion KRW and, through unfair support, increased their assets to an average of 103.6 billion KRW (up to 602 billion KRW) within five years, yet failed to properly report gift taxes as required by tax law.

Director Min said, "We will actively utilize all available means, including domestic and international information, financial tracking, and digital forensics. If any cases of tax evasion through fraud or illicit methods are confirmed, we will without exception convert the investigation into a criminal probe under the Tax Offense Punishment Act and refer the cases to the prosecution. Even after this investigation, we will continuously monitor and thoroughly respond to unfair practices by owners that cause direct or indirect harm to consumers, small business owners, SMEs, and minority investors," he concluded.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.