Share Transfer Between Jang and Choi Amid Management Dispute

Focus on Temporary General Meeting Method as Turning Point

Yeongpung "Kim Kwang-il Appointed as Chairman of General Meeting"

Korea Zinc "Board to Decide on Holding General Meeting"

Jang Hyeong-jin, an advisor at Yeongpung, will transfer all Yeongpung shares he holds to his second son, Jang Se-hwan, former CEO of Seorin Sangsa. The Choi family is also stepping up to secure shares in Korea Zinc, creating a situation where the Korea Zinc and Yeongpung-MBK Partners alliance are engaged in a management rights dispute, with shareholding changes detected in both the Jang and Choi families.

According to industry sources on the 27th, Advisor Jang will sell all 12,504 treasury shares he currently holds, representing 0.68% of the shares, to former CEO Jang. The two will exchange shares through off-hours trading. The value of these shares, calculated at the closing price on the 26th (436,000 KRW), is approximately 5.4 billion KRW, with the transaction start date set for December 20 and the end date for January 17 of next year.

Currently, the largest shareholder of Yeongpung is Jang Se-jun, the eldest son of Advisor Jang and CEO of Korea Circuit, holding 16.89%. After the share transaction, the shareholding ratio of former CEO Jang, the second-largest shareholder, will increase from 11.15% to 11.83%. A Yeongpung official stated, "Shares have been passed on to the sons for a long time, and this is just to settle the remaining minority shares," adding, "It is not related to the conflict with Korea Zinc."

Choi Yun-beom, chairman of Korea Zinc, has slightly increased his shareholding through on-market purchases. The shares held by Chairman Choi and related parties increased from 17.05% to 17.18%, a 0.13 percentage point rise.

Yeongpung Precision, managed by Choi Chang-gyu, Chairman Choi’s uncle, acquired about 15,800 shares (0.08%), Yoo Joong-geun, director of the Kyungwon Cultural Foundation and mother of Chairman Choi, acquired about 3,000 shares (0.01%), and Yumi Development, classified as a Choi family company, acquired about 7,200 shares (0.03%). Their purchase period was from the 15th to the 22nd of this month, with acquisition prices ranging from a minimum of 929,938 KRW to a maximum of 1,017,993 KRW per share.

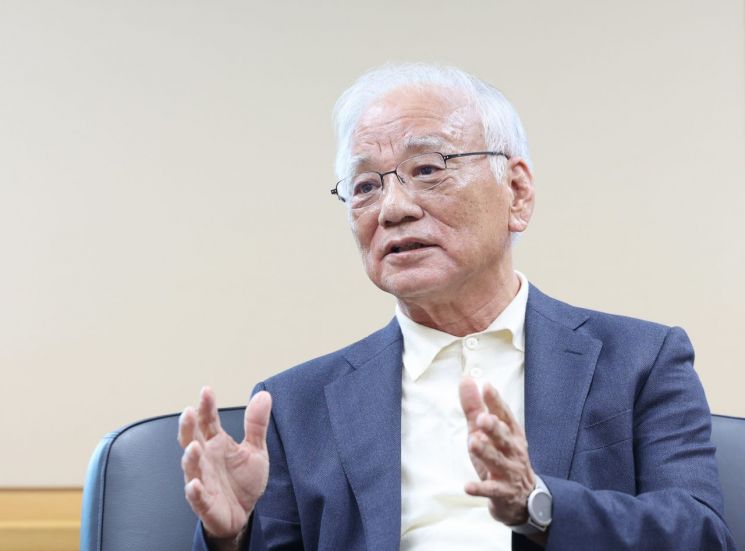

Choi Yoon-beom, Chairman of Korea Zinc, is speaking at a Korea Zinc press conference held on the 13th at the Korea Chamber of Commerce and Industry in Jung-gu, Seoul. On this day, Chairman Choi stated, "I will step down from the position of chairman of the board as soon as possible and have an outside director take over as chairman of the Korea Zinc board." Photo by Kim Hyun-min

Choi Yoon-beom, Chairman of Korea Zinc, is speaking at a Korea Zinc press conference held on the 13th at the Korea Chamber of Commerce and Industry in Jung-gu, Seoul. On this day, Chairman Choi stated, "I will step down from the position of chairman of the board as soon as possible and have an outside director take over as chairman of the Korea Zinc board." Photo by Kim Hyun-min

The shares held by MBK Partners and Yeongpung, who are currently engaged in the management rights dispute, amount to 39.83%.

Including friendly parties, Chairman Choi’s side’s shares increased from 35.4% to 35.53%, but it is reported that shares previously classified as friendly parties, such as Hankook Tire (0.8%) and Korea Investment & Securities (0.8%), were sold, resulting in an estimated difference of about 6% in shareholding ratios.

The Seoul Central District Court will conduct a hearing in the afternoon regarding Yeongpung’s application for permission to convene an extraordinary general meeting of Korea Zinc. Both Yeongpung and MBK plan to hold the extraordinary shareholders’ meeting as soon as possible, but Chairman Choi Yun-beom of Korea Zinc, who is at a significant shareholding disadvantage, needs to buy time to secure friendly shares.

Yeongpung has added to its permission application the appointment of Kim Kwang-il, Vice Chairman of MBK Partners, as the chairman of the shareholders’ meeting, laying the groundwork to gain a favorable position. There is also speculation that Korea Zinc might voluntarily convene the extraordinary shareholders’ meeting through its board of directors. In that case, the chairman would be a Korea Zinc representative.

Yeongpung is demanding the appointment of 14 new directors and amendments to the articles of incorporation to introduce an executive officer system as agenda items for the shareholders’ meeting. Korea Zinc has proposed agenda items including amendments to the articles of incorporation to have an outside director chair the board, the appointment of foreign outside directors, and the introduction of quarterly dividends.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)