November FOMC Minutes Released

"If Inflation Remains High, Easing Will Stop"

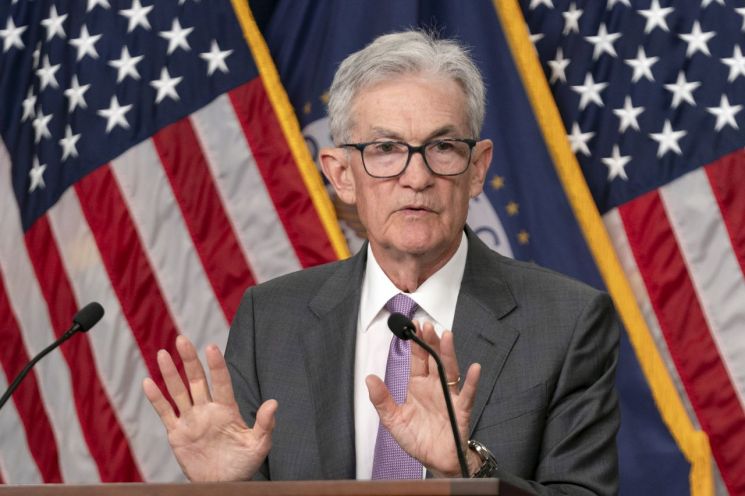

Members of the U.S. Federal Reserve (Fed) indicated at this month's Federal Open Market Committee (FOMC) regular meeting that if the decline in inflation slows, there may be a need to slow down or temporarily pause the pace of monetary easing. This aligns with Fed Chair Jerome Powell's earlier remarks that rate cuts would not be rushed, suggesting that if the U.S. economy continues its solid growth, the pace of monetary easing is expected to slow.

The minutes of the November FOMC meeting released by the Fed on the 26th (local time) stated, "Participants expected that it would be appropriate to gradually move toward a more neutral policy stance if data came out as anticipated, inflation sustainably declined to 2%, and the economy continued near maximum employment."

Earlier, on the 7th, the Fed lowered the benchmark interest rate by 0.25 percentage points to 4.5?4.75%. This marked the second consecutive rate cut following the initiation of the monetary easing cycle with a 0.5 percentage point cut from the peak of 5.25?5.5% in September. All 19 Fed members agreed to the 0.25 percentage point rate cut.

Fed members viewed the reduced risk of a significant slowdown in the labor market and economy, along with considerable uncertainty about the level of the neutral rate, as reasons to adopt a cautious stance on the pace of monetary easing. The neutral rate is a theoretical interest rate level that allows the economy to achieve its potential growth rate without overheating or recession.

The minutes noted, "Many participants judged that uncertainty about the level of the neutral rate complicated the assessment of policy constraints and made it appropriate to gradually reduce policy accommodation."

Some Fed members also left open the possibility of temporarily pausing rate cuts. The minutes stated, "Some participants mentioned that if inflation remained elevated, the Committee could pause policy rate easing and maintain rates at a restrictive level," while "some said that if the labor market weakened or economic activity became unstable, the pace of easing could be accelerated."

The released FOMC minutes align with Chair Powell's recent remarks about not rushing rate cuts. At an event in Dallas on the 14th, he said, "The U.S. economy is by far the strongest among major countries worldwide," and "the economy is not sending any signals that we need to rush rate cuts." This was interpreted as meaning that if there are no signs of an economic downturn, the pace of monetary easing could be slowed. The possibility of "Trumflation" (inflation caused by policies of President-elect Donald Trump) is also cited as a factor prompting the Fed to proceed cautiously with rate cuts. The market views Trump's pledged tariff increases and illegal immigration restrictions as potential causes of inflation.

With the FOMC minutes suggesting gradual rate cuts, the market increasingly expects the Fed to implement a small cut (0.25 percentage points) next month. According to the Chicago Mercantile Exchange (CME) FedWatch, the federal funds futures market on this day priced in a 63.1% chance of a 0.25 percentage point rate cut at the December FOMC meeting and a 36.9% chance of rates remaining unchanged. For next year, the market forecasts three rate cuts instead of the four 0.25 percentage point cuts indicated in the September dot plot.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)