Fair Trade Commission 'Status of Internal Transactions in Large Corporations'

Last year, the amount of internal transactions within the top 10 groups with controlling shareholders exceeded 194 trillion won. The higher the shareholding of the second generation of the conglomerate heads, the higher the proportion of internal transactions.

On the 26th, the Korea Fair Trade Commission (KFTC) disclosed the '2024 Status of Internal Transactions of Publicly Disclosed Business Groups' containing such information. The analysis covered the internal transaction status of 2,709 affiliates belonging to 88 publicly disclosed business groups last year. The investigation found that the total amount of internal transactions within these business groups was 704.4 trillion won. The proportion of internal transactions was 32.5%. Both the amount and proportion of internal transactions increased compared to the previous year (2.8 trillion won and 0.6 percentage points), showing a trend of increase for three consecutive years.

Among these, the amount (proportion) of internal transactions between domestic affiliates was 277.9 trillion won (12.8%). The amount of internal transactions between domestic affiliates of the top 10 groups with controlling shareholders was 194.8 trillion won. The groups with the largest amounts were Hyundai Motor (62.9 trillion won), SK (52 trillion won), Samsung (34.6 trillion won), POSCO (25.2 trillion won), and HD Hyundai (11.6 trillion won), in that order.

Considering all domestic and overseas affiliates, Samsung (201.1 trillion won), Hyundai Motor (157.9 trillion won), SK (103.6 trillion won), LG (57.2 trillion won), and POSCO (42.1 trillion won) ranked highest in internal transaction amounts. The KFTC explained, "The decrease in sales revenue compared to the previous year (-73.1 trillion won) exceeded the decrease in internal transaction amounts (-1.6 trillion won), resulting in a 0.6 percentage point increase in the proportion of internal transactions." Groups with high proportions of internal transactions were Celltrion (65.0%), Korea & Company Group (59.3%), Samsung (56.0%), Hyundai Motor (55.4%), and SK (51.5%), in that order.

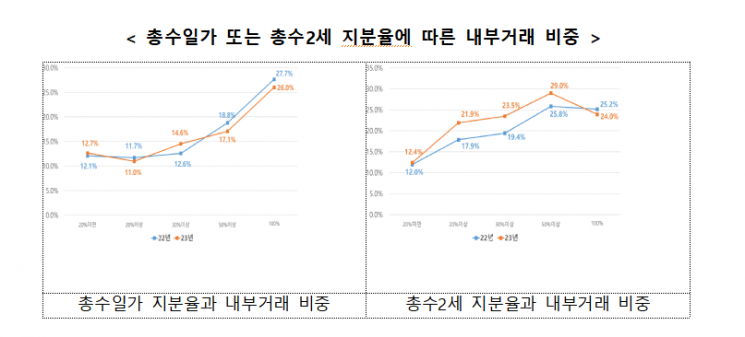

The tendency to rely more on internal transactions increased as the shareholding ratio of the controlling family or the second generation of the controlling shareholder increased. In particular, for the second generation, the proportion of internal transactions between domestic affiliates of companies where the second generation holds more than 50% of shares increased significantly (by 3.2 percentage points) compared to the previous year, showing a notable increase in most ranges of shareholding ratios except for 100%.

For companies subject to the KFTC's regulation on unfair profit provision by related parties, the proportion of internal transactions was 15.4% (amounting to 49.3 trillion won). Among domestic affiliate transactions, 89.6% were conducted through private contracts, with both the amount (-1.7 trillion won) and proportion (-1.2 percentage points) of private contracts decreasing compared to the previous year.

By industry, the proportion of internal transactions was high in repair and other personal services, business facility management, business support, and rental services, while the amount of internal transactions was high in manufacturing, transportation and warehousing, and construction industries.

Not all internal transactions within companies are illegal. The KFTC noted, "Considering the continued correlation between the controlling family's shareholding ratio and the proportion of internal transactions, as well as the significant proportion of private contracts related to internal transactions, periodic inspections of internal transactions between affiliates and continuous monitoring of unfair internal transactions are necessary."

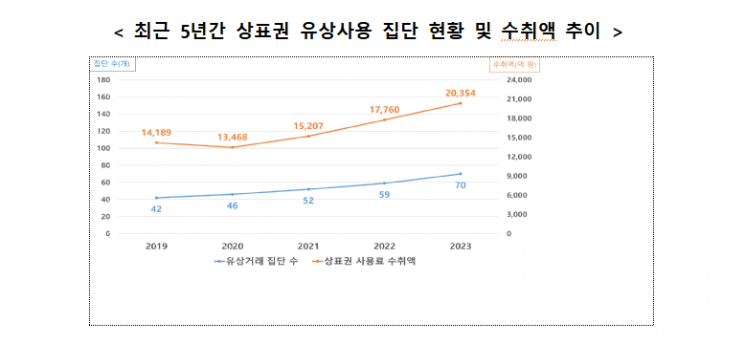

Meanwhile, the number of groups (70 groups, 111 companies) that have signed trademark usage contracts and pay fees, as well as the transaction scale (2.4 trillion won), increased compared to the previous year.

The proportion of paid trademark usage in groups with controlling shareholders was 80.8%, higher than the 70% in groups without controlling shareholders. Among the recipient companies (102 companies) belonging to groups with controlling shareholders, 55.9% (57 companies) had a controlling family shareholding ratio of 20% or more. Their trademark usage fee income (1.59 trillion won) accounted for 82.8% of the total trademark usage fee income (1.92 trillion won) of groups with controlling shareholders.

Analyzing trademark usage transactions, the KFTC assessed that the number of groups signing paid trademark usage contracts and the transaction scale continue to increase, indicating that trademark transaction practices are becoming more transparent. However, it pointed out that since companies with high controlling family shareholding ratios tend to have relatively high trademark usage fee income, continuous monitoring of trademark transaction status is necessary.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)