Hankyung Association & Peterson Institute Conference

Director Adam Posen: "US Tariffs Target China and Mexico"

"Korea Should Join 'US Fortress' but Diversify Markets Beyond US-China"

Hankyung Research Institute: "US Universal Tariffs Could Reduce Exports to US by Up to 22 Trillion Won"

The head of the Peterson Institute for International Economics (PIIE) in the U.S. suggested that South Korea needs to increase its investment in the U.S. even during the second term of the Trump administration. He emphasized that the targets of the U.S. tariff policy are China and Mexico, not South Korea. Rather, he said South Korea needs to be recognized for its high strategic value by the U.S.

Adam Posen, Director of the Peterson Institute for International Economics. Asia Economy DB

Adam Posen, Director of the Peterson Institute for International Economics. Asia Economy DB

The Korea Economic Association (KEA) announced on the 26th that it jointly held a conference with PIIE at the FKI Tower in Yeouido, Yeongdeungpo-gu, Seoul, under the theme "Trump's Turbulent Second Term and Korea's Survival Strategy." This was the first conference co-hosted by KEA and PIIE. PIIE is a U.S. think tank with world-class research capabilities and influence in the field of international economics.

Adam Posen, president of PIIE, forecasted the U.S. economic growth rate for next year at 2.0% in his keynote speech. He also mentioned the possibility of it being higher. Posen said, "The robust growth of the U.S. economy is due to improvements in labor productivity driven by technological advances such as artificial intelligence (AI)," and added, "There is also a risk of a rate hike in the second half of next year along with rising inflation."

Posen emphasized the need to distinguish whether Trump's universal tariff and other trade pledges are mere threats or will be implemented. He predicted that immigration policies would be executed immediately after inauguration. He said the tariff policy mainly targets China and Mexico. For other countries like South Korea, it is likely to be used only as a tool for negotiation.

Posen stated, "Fundamentally, U.S. economic growth will act as a positive factor for the Korean economy," and argued, "In the Trump 2.0 era, South Korea needs a strategy to expand direct investment in the U.S. and strengthen economic cooperation by entering the 'American fortress'." He also advised, "Diversification into markets outside the U.S. and China is necessary."

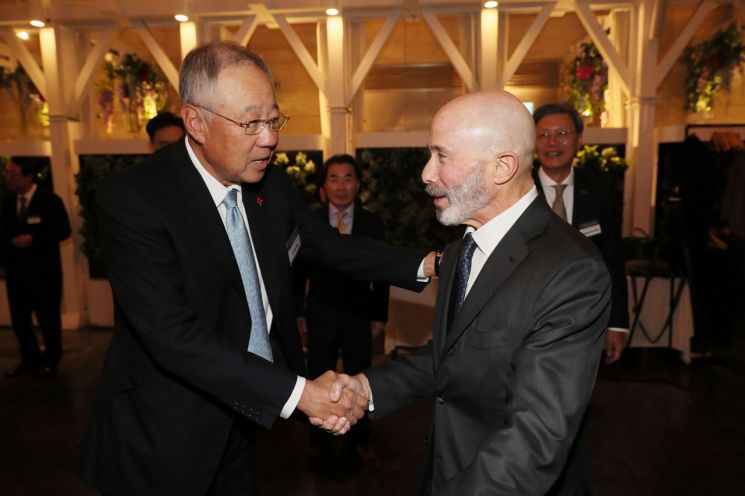

Ryu Jin, Chairman of the Korea Economic Association, and Evan Greenberg, Chairman of the US-Korea Business Council, are shaking hands at the 'Networking Reception hosted by the US-Korea Business Council' held on the 20th at the FKI Tower in Yeouido, Yeongdeungpo-gu, Seoul. Photo by Korea Economic Association, Yonhap News.

Ryu Jin, Chairman of the Korea Economic Association, and Evan Greenberg, Chairman of the US-Korea Business Council, are shaking hands at the 'Networking Reception hosted by the US-Korea Business Council' held on the 20th at the FKI Tower in Yeouido, Yeongdeungpo-gu, Seoul. Photo by Korea Economic Association, Yonhap News.

Ryu Jin, chairman of KEA, stressed the need to further strengthen Korea-U.S. economic cooperation. In his opening remarks, Chairman Ryu said, "In the recent global situation where the free trade order is shaken, the importance of close Korea-U.S. economic cooperation is greater than ever."

The government also plans to support the activation of private Korea-U.S. economic cooperation. Jeong In-gyo, head of the Trade Negotiation Office at the Ministry of Trade, Industry and Energy, said in his congratulatory speech, "The government will make every effort and provide support to activate private Korea-U.S. economic cooperation."

Analysis suggests that if the U.S. universal tariff policy is fully implemented, South Korea's exports to the U.S. could decrease by up to $15.8 billion (approximately 22 trillion KRW). Lee Tae-gyu, senior researcher at the Korea Economic Research Institute, said, "If the Trump administration's universal tariff policy is implemented, South Korea's exports to the U.S. could decrease by up to $15.8 billion (13.6%). We need to strengthen bilateral cooperation in defense industries, shipbuilding, nuclear power, which are difficult for the U.S. to replace, and prepare customized supply chain strategies for each industry."

Despite the Korea-U.S. Free Trade Agreement (FTA), advice was given that the U.S. tariff policy will be implemented regardless of allies or adversaries. Jeffrey Schott, senior fellow at PIIE, analyzed, "The U.S. tariff policy will not distinguish between allies and adversaries and may affect South Korea, which has an FTA with the U.S." Schott suggested proposing industrial cooperation items where both countries can achieve a 'win-win' in sectors such as automobiles, semiconductors, defense, and shipbuilding.

There is also a forecast that Korean companies may suffer disadvantages in key businesses such as semiconductors due to U.S. containment of China. Martin Chorzempa, senior fellow at PIIE, said, "U.S. export controls and technology regulations targeting China will negatively impact Korean companies entering the Chinese market, including in semiconductors." Yeon Won-ho, head of Hyundai Motor Group's Global Economic Security Office, said that unlike the U.S., which is pushing for decoupling from China, and the European Union (EU), which is pursuing risk removal related to China, South Korea has limited strategic options. Yeon proposed, "Korea's economic security strategy should focus on two pillars: a government-led strong industrial policy and strengthening partnerships with value-sharing countries."

There was also an opinion that Korean defense companies could benefit from increased weapons demand from NATO and the Middle East. Cullen Hendrix, senior fellow at PIIE, said, "Trump's second-term foreign and security policy is both a 'crisis and an opportunity' for South Korea," adding, "Pressure to share defense costs such as for U.S. Forces Korea is expected to act as a threat, but increased weapons demand from NATO and the Middle East could be an opportunity."

There was also a view that the Bank of Korea will find it burdensome to lower the base interest rate during the second term of the Trump administration. Kang Tae-soo, visiting researcher at the Korea Economic Research Institute and professor at KAIST, said, "After the second term of the Trump administration, there is a possibility of long-term interest rate increases due to the U.S. fiscal deficit, which could be a significant burden on the Bank of Korea's decision to lower the base interest rate." Yeo Han-gu, senior fellow at PIIE and former head of the Trade Negotiation Office under the Moon Jae-in administration, said, "Although various difficulties are expected during the Trump 2.0 administration, it will be an opportunity for our companies to take a step forward through structural reforms such as transitioning to a 'parallel export and investment system' and improving their resilience."

KEA said it plans to hold annual conferences with PIIE every year. Jeong Cheol, research director of KEA and president of the Korea Economic Research Institute, who organized the event, said, "We will expand exchanges and cooperation not only with PIIE but also with leading global think tanks worldwide," adding, "KEA, as a global think tank, will provide direction and insights for the Korean business community to navigate uncertain external environments."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)