Domestic Big 4 Entertainment Market Cap Up 15% in a Month

ETF Returns Also 'Soaring'

Top Entertainment Stock: 'HYBE'

"Fandom cannot be stopped."

Kim Jong-min, Senior Research Fellow at Samsung Securities, recently cited entertainment content with the advantage of fandom (IP) as an industry that can grow while avoiding the tariff policies of President-elect Donald Trump in a report titled "Theme Investment Strategy for the Trump 2.0 Era." If the second Trump administration actually implements universal tariffs, it would inevitably be a significant burden on South Korea's export-oriented economic structure, but fandom cannot be affected even by tariffs. In fact, during this month when the Korean stock market suffered from Trump-related risks, the market capitalization of the four major domestic entertainment stocks?HYBE, YG Entertainment, SM Entertainment, and JYP Entertainment?all rose simultaneously, and related exchange-traded funds (ETFs) also showed an upward trend.

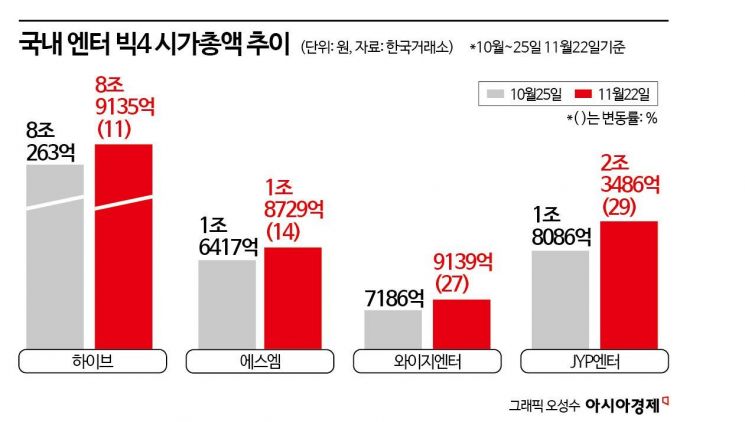

According to the Korea Exchange on the 26th, the combined market capitalization of representative domestic entertainment stocks such as JYP Entertainment, YG Entertainment, SM Entertainment, and HYBE was 14.05 trillion KRW as of the 22nd, a 15% increase from 12.1952 trillion KRW on the 25th of last month. Looking at individual stocks, JYP Entertainment's market capitalization grew the most by 29%, followed by YG Entertainment at 27%, SM Entertainment at 14%, and HYBE at 11%.

While the foreign policy risks of the second Trump administration pressured the domestic stock market, entertainment stocks instead rose. JYP Entertainment, which had the largest increase in market capitalization, saw its stock price rise about 35% this month, and YG Entertainment rose 28%. HYBE and SM Entertainment recorded increases of 15% and 13%, respectively. In the past month, institutional investors net purchased HYBE shares worth 140.9 billion KRW, ranking it eighth among the most bought stocks by institutions.

Lim Su-jin, a researcher at Daishin Securities, explained, "With the guaranteed album sales and concert revenue growth from the comebacks of BTS and BLACKPINK, the two groups accounted for 14% of the entire domestic album market in 2023, and the expected attendance for their world tours exceeds the combined attendance of all artists under their agencies, indicating a significant revenue growth is expected."

The combined YouTube subscribers of BTS and BLACKPINK total 170 million. Considering this, Researcher Lim said that not only the comeback albums of the two groups but also the overall interest in K-pop is expected to spread. Additionally, the competitive psychology of fandom is likely to expand gradually like a domino effect to senior groups, so if fandom competition recovers, a rebound in album sales is anticipated.

Lee Nam-soo, a researcher at Kiwoom Securities, also said, "Global artists like BTS and BLACKPINK are expected to make comebacks next year," and predicted, "The business model centered on album sales and concert revenue will expand."

In the securities industry, HYBE was identified as the top preferred stock among entertainment sectors. Most securities firms, including Daishin Securities, Hana Securities, and Hanwha Investment & Securities, have marked HYBE as the leading stock.

Lee Hwa-jung, a researcher at NH Investment & Securities, explained, "A new full-group BTS album is scheduled for release in the second half of next year, and a world tour is planned for 2026," adding, "Direct sales from albums, music, and concerts, as well as indirect sales from fan clubs and merchandise (MD), are expected to grow immediately."

With the entertainment industry gaining momentum, related ETFs are also achieving favorable returns. According to the Korea Exchange, the ACE KPOP Focus ETF rose 21.3% this month, recording the third-highest return among all ETFs. HANARO Fn K-POP & Media rose 15.67%, and TIGER Media Contents rose 12.68%.

The earnings outlook for next year is also bright. Securities firms forecast that the combined sales of the four entertainment companies will reach 4.8 trillion KRW next year, a 16.4% increase from the previous year, and operating profit will increase by 60.6% to 661.3 billion KRW during the same period. As positive earnings forecasts dominate the entertainment industry, target stock prices for entertainment stocks have also risen simultaneously. Seven out of ten securities firms raised the target price for JYP Entertainment. Seven securities firms, including Daishin Securities, raised the target price for YG Entertainment. Hyundai Motor Securities, Daol Investment & Securities, and NH Investment & Securities all raised the target price for HYBE in reports released this month, and NH Investment & Securities raised the target price for SM Entertainment.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)