Hankyung Association Survey on Expert Perceptions of Inheritance Tax Reform

Eight out of ten experts recognize the need for tax reform to ease inheritance tax.

According to the "Expert Perceptions on Inheritance Tax Reform" survey conducted by the Korea Economic Association among tax-related experts?including professors from economics and business departments nationwide, research fellows from government and private research institutes, accountants, and tax accountants (106 respondents)?82.1% viewed tax reform aimed at easing inheritance tax positively. Among them, 35.9% responded very positively, while 3.8% responded very negatively.

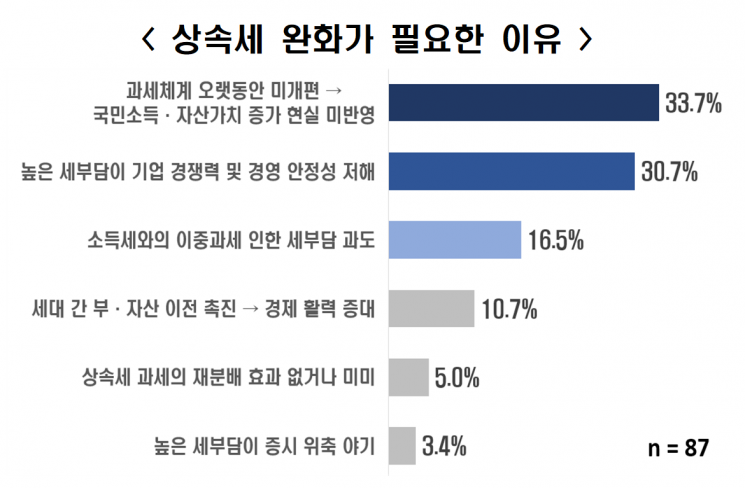

The main reasons for a positive view on easing inheritance tax were ▲the tax system has not been reformed for a long time and does not reflect the reality of rising national income and asset prices (33.7%) ▲high tax burden undermines corporate competitiveness and management stability (30.7%) ▲excessive tax burden due to double taxation with income tax (16.5%), among others.

73.6% of respondents said that easing inheritance tax would have a positive impact on the Korean economy. The Korea Economic Association analyzed this as reflecting experts’ perception that easing inheritance tax would reduce management uncertainties for companies and create a stable investment and employment environment, leading to economic revitalization. Additionally, 65.1% responded that easing inheritance tax would help resolve the "Korea Discount," where the Korean stock market is undervalued compared to major overseas markets.

Korea’s top inheritance tax rate is 50%, ranking second among 38 OECD countries, and including the premium valuation of major shareholder stocks, it rises to 60%, ranking first. 62.2% of respondents evaluated Korea’s inheritance tax system as having low global competitiveness (44.3%) or average (17.9%) compared to major overseas countries. Those who considered it highly competitive accounted for 37.8%. The biggest reason cited for Korea’s inheritance tax system lacking competitiveness was the high tax rate (39.9%). This was followed by ▲the 'estate tax' type taxation method contrary to global trends (18.2%) ▲insufficient personal deductions (12.1%) ▲inadequate tax support such as business succession deductions (11.1%) ▲and the irrationality of property valuation methods such as uniform premium valuation of major shareholder stocks (8.6%).

Korea is one of four countries (Korea, the United States, the United Kingdom, and Denmark) among 23 OECD countries that impose inheritance tax, adopting the estate tax method. Estate tax is levied based on the total assets left by the deceased. In contrast, most OECD countries adopt the inheritance acquisition tax method, which taxes based on the assets actually inherited by the heir. This method is evaluated as reducing the burden by reflecting the heir’s economic situation.

Among 38 OECD countries, 11 countries (including Canada, Australia, and Sweden) have abolished inheritance tax, and major countries such as the United States (2002?2012), Germany (2000), and Italy (2000) have lowered their top inheritance tax rates. The United States recently included easing inheritance tax in the campaign pledges of President-elect Trump.

Lee Sang-ho, Head of the Economic and Industrial Division at the Korea Economic Association, said, "Following the recent public survey on inheritance tax reform by the Korea Economic Association, this survey of tax experts also showed a consensus on easing inheritance tax," adding, "Korea should focus on improving the corporate management environment and attracting overseas investment through reforms of the tax system and other institutional changes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)