NVIDIA to Announce Earnings After Market Close

"More Important for Year-End Market Direction Than December FOMC"

Ford to Cut 4,000 Jobs in Europe Amid Electric Vehicle Chasm

The three major indices of the U.S. New York Stock Exchange showed mixed movements in the early session on the 20th (local time), hovering around the flat line. Although geopolitical tensions rose due to Ukraine's missile attack on Russian mainland the previous day, investors appeared to be cautious, focusing on Nvidia's earnings report to be released after the market close.

As of 9:32 a.m. in the New York stock market, the blue-chip-focused Dow Jones Industrial Average was up 0.15% from the previous trading day, standing at 43,332.65. The large-cap-focused S&P 500 index was down 0.03% at 5,915.13, and the tech-heavy Nasdaq index was down 0.12% at 18,964.2.

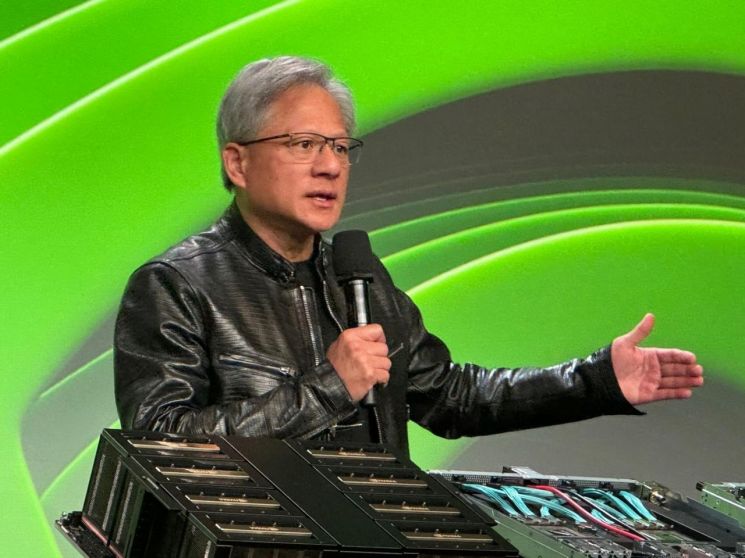

Investor attention is centered on Nvidia's earnings announcement. Nvidia's earnings report could determine the main direction of the stock market for the remainder of this week and the year-end period. If Nvidia delivers better-than-expected results and outlook, it could provide a rebound opportunity in the market, which has seen the 'Trump rally' lose momentum. Barclays expects Nvidia's earnings to be a more important catalyst for the year-end market than the Federal Reserve's interest rate decision next month. Wall Street is particularly watching the demand outlook for Nvidia's latest artificial intelligence (AI) chip, Blackwell.

Chris Senek, strategist at Wolfe Research, said, "Like most investors, we will closely monitor Nvidia's earnings report today," adding, "We can get clues about how AI spending is coming back." He further noted, "We believe there is a risk that negative news or disappointing spending trends could delay or even reverse the year-end stock price surge."

Fed officials are also scheduled to speak today. Fed Governors Lisa Cook and Michelle Bowman, as well as Susan Collins, President of the Boston Federal Reserve Bank, will deliver speeches. Following Fed Chair Jerome Powell's statement on the 14th that the U.S. economy is strong and there is no need to rush rate cuts, attention is on whether Fed officials will make similar remarks.

Currently, market expectations for rate cuts have somewhat diminished. According to the Chicago Mercantile Exchange (CME) FedWatch, the federal funds futures market reflects a 59.1% probability that the Fed will cut rates by 0.25 percentage points at the December Federal Open Market Committee (FOMC) meeting, down from 82.5% a week ago. The probability of a rate hold next month rose from 17.5% a week ago to 40.9% today.

By individual stocks, retailer Target is plunging 18.03% due to disappointing earnings and a downward revision of its annual outlook. Global media company Comcast is down 0.4% after announcing plans to spin off MSNBC and CNBC, a process expected to take about a year. Nvidia, which will report earnings after the market close, is down 1.33%. Ford, which announced plans to cut an additional 4,000 jobs in Europe, is down 0.68%.

Following Ukraine's missile launch against Russia the previous day, demand for safe-haven assets surged, causing bond yields to fall; however, yields have been rising today. The U.S. 10-year Treasury yield, a global bond yield benchmark, rose 4 basis points (1bp = 0.01 percentage points) to 4.42%, while the 2-year Treasury yield, sensitive to monetary policy, increased 3 basis points to around 4.31%.

International oil prices are rising amid escalating tensions between Russia and Ukraine. West Texas Intermediate (WTI) crude oil rose $0.67 (0.97%) to $69.91 per barrel, and Brent crude, the global oil price benchmark, increased $0.50 (0.68%) to $73.81 per barrel.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)