Average Operating Profit Margin of Food Companies 7% Until Q3 This Year

Distribution 3 Companies 1.4%... Setback Due to Discount Competition

Food Companies, Overseas Sales Drive Price Increase Effect

Domestic food manufacturers that implemented major price increases on key products this year have significantly improved their profitability. While food manufacturers offset sluggish domestic demand with overseas exports and benefited from new product launches, distributors engaged in discount competitions to thaw frozen consumer sentiment, resulting in stagnant operating profit margins.

According to the industry on the 21st, major domestic food manufacturers widened the gap in operating profit margins compared to distributors. The operating profit margin of 17 major listed food companies, including CJ CheilJedang, Nongshim, and Daesang, was 6.9% in the first to third quarters of this year, up 0.9 percentage points from 6% in the same period last year. Among these food manufacturers, 13 companies saw their operating profits increase year-on-year in the first to third quarters. Nongshim (142.6 billion KRW) and Ottogi (198.3 billion KRW) saw their operating profits decrease by 17.6% and 6.8%, respectively, compared to the previous year.

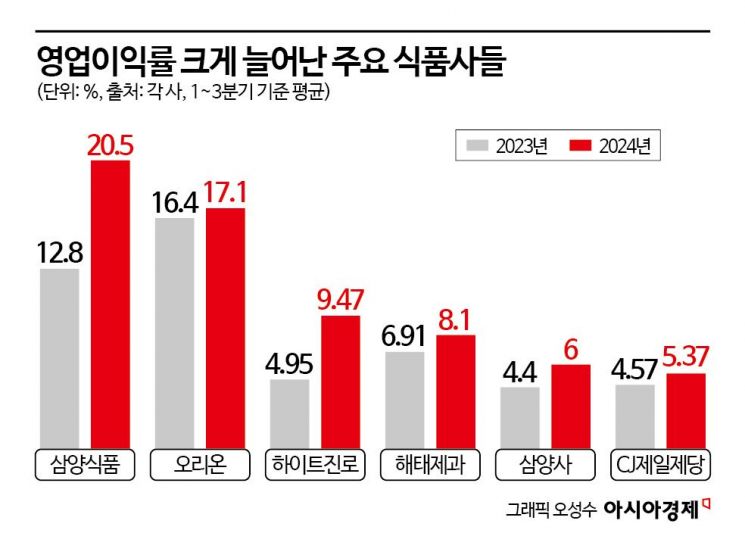

The company with the largest increase in operating profit, a key profitability indicator, was Samyang Foods. It recorded a cumulative operating profit margin of 20.5% for the first to third quarters of this year. This was followed by Orion (17.1%), HiteJinro (9.47%), Haitai Confectionery & Foods (8.1%), and Samyang Corporation (6%). CJ CheilJedang also recorded 5.37%, a significant increase from 4.57% the previous year. Notably, of Samyang Foods’ cumulative operating profit of 342.8 billion KRW in the first to third quarters, 78.5 billion KRW came from overseas sales, a 43% increase compared to the same period last year. An industry insider said, "Due to the global strong dollar phenomenon and the won’s depreciation, the burden of raw materials has increased, leading to an overall decline in the performance of food companies in the domestic market."

On the other hand, major domestic distributors saw their operating profit margins fall below the mid-1% range. The so-called "Imarotku," referring to Emart, Lotte Shopping, and Coupang, had an average operating profit margin of 1.4% in the first to third quarters of this year, down 0.2 percentage points from the same period last year. By company, Coupang (0.5%) and Emart (0.6%) failed to surpass the 1% operating profit margin barrier through the third quarter, while Lotte Shopping maintained a relatively respectable 3%.

Looking at the third quarter alone, Emart recorded its highest quarterly operating profit in three years at 111.7 billion KRW, but its operating profit margin was only 1.5%. Coupang, after incurring an operating loss in the second quarter due to a fine of 162.8 billion KRW imposed by the Fair Trade Commission over allegations of search algorithm manipulation, returned to profitability in the third quarter, but its operating profit margin was only 1.38%.

Domestic distributors saw sales rise from the second half of last year as food manufacturers consecutively raised prices. However, analysts say that excessive discounting amid this year’s consumption slump has rather worsened profitability. According to the Statistics Korea’s Industrial Activity Trend, the retail sales index for the third quarter of this year was 100.7, down 1.9% from the same quarter last year. Retail sales have declined for ten consecutive quarters since the second quarter of 2022 (-0.2%), reflecting frozen consumer sentiment.

An industry official said, "Distributors are aggressively implementing discounts to attract consumers, such as Coupang’s Wow membership discounts and Emart’s price reversal project," adding, "They are expected to continue loss-leading marketing through discount events like Black Friday, SSG Day, and Thank You Day until the end of the year to minimize consumer resistance."

Price increases by food manufacturers continue. Dongseo Food has raised prices of instant coffee and Maxim coffee mix by an average of 8.9% since the 15th. Ottogi raised prices of 24 products, including ketchup, sesame oil, and roasted sesame, by up to 15% starting in September. Pulmuone increased seasoning products such as Chadol Doenjang Jjigae seasoning from 2,000 KRW to 2,500 KRW, and Maeil Dairy’s ice cream products like Sangha Milk Pint also rose by an average of 10.4%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)