Increase in Housing Mortgage Loans Due to Rising Home Sales Transactions

BOK "Managing Within Nominal GDP Growth Rate"

Household Debt Growth Expected to Slow in Q4

In the third quarter, household credit (debt) in South Korea increased at the largest rate in three years, reaching a record high. This was due to an increase in mortgage loans as housing sales transactions rose, mainly in the Seoul metropolitan area.

Housing sales transactions are typically reflected in mortgage loans with a lag of 2 to 3 months. Since real estate transactions have slowed down since July this year, the growth rate of household debt is expected to decelerate going forward.

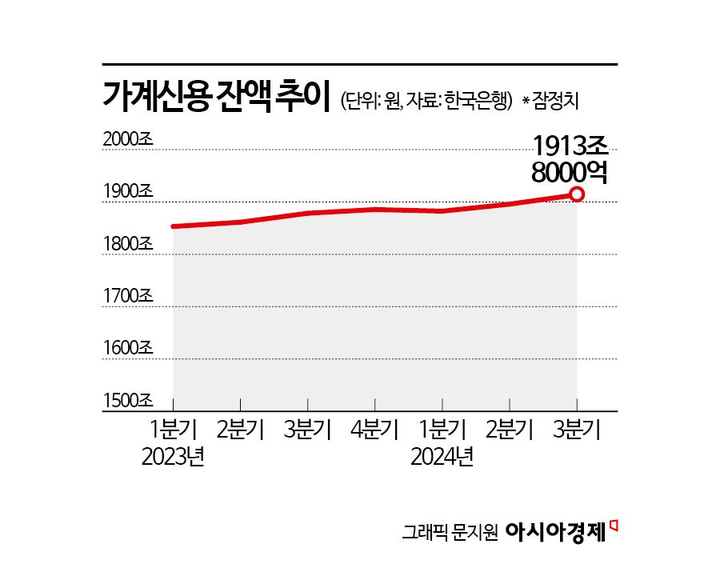

According to the "2024 Q3 Household Credit (Preliminary)" report released by the Bank of Korea on the 19th, the household credit balance at the end of the third quarter was 1,913.8 trillion won, an increase of 18 trillion won from the previous quarter. This is the largest increase since the third quarter of 2021 (35 trillion won).

Household credit refers to comprehensive household debt, which includes loans received by households from banks, insurance companies, and lending institutions, plus pre-settlement credit card usage (sales credit).

South Korea's household credit balance continuously increased in the second quarter (8.2 trillion won), third quarter (17.1 trillion won), and fourth quarter (7 trillion won) of last year, then decreased by 3.1 trillion won in the first quarter of this year, but rose again by 13.4 trillion won in the second quarter. The household credit balance, which recorded a record high in the previous quarter, broke the record again in the third quarter.

The household loan balance excluding credit card payments (sales credit) was 1,795.8 trillion won at the end of the third quarter, up 16 trillion won from the previous quarter. The increase was larger than the previous quarter's 13.3 trillion won. This was largely due to mortgage loans increasing by 19.4 trillion won from the previous quarter as housing sales transactions rose, mainly in the Seoul metropolitan area. Other loans such as unsecured loans decreased by 3.4 trillion won from the previous quarter due to a reduction in securities firms' credit extensions, marking the 12th consecutive quarter of decline.

The mortgage loan balance was 1,112.1 trillion won, an increase of 19.4 trillion won from the previous quarter. The increase was larger than the previous quarter's 16 trillion won and was the largest increase since the third quarter of 2021 (20.9 trillion won).

Kim Min-su, head of the Financial Statistics Team at the Bank of Korea, commented on the third quarter household credit, saying, "The increase in household credit in the third quarter was below the long-term average increase of 22.2 trillion won from 2015 to 2023, and the cumulative growth rate of household credit is being managed within the nominal GDP growth rate of 1.5%. This is attributed to macroprudential policies such as the implementation of the second phase of the stress total debt service ratio (DSR) in September and the banking sector's efforts to manage household loans, which led to a slowdown in household debt growth in September."

Regarding the outlook for household debt over the next three months, he added, "Since real estate transactions have slowed down mainly in the Seoul metropolitan area since July, the deceleration in household debt growth, which follows housing transactions, is expected to continue for the time being."

By loan channel, the household loan balance at deposit banks was 959.2 trillion won, an increase of 22.7 trillion won from the previous quarter. Mortgage loans increased by 22.2 trillion won, and other loans increased by 0.5 trillion won. The increase in mortgage loans at deposit banks was the largest since the statistics began to be published in the fourth quarter of 2002.

On the other hand, the household loan balance at non-bank deposit-taking institutions such as mutual finance, mutual savings banks, and credit cooperatives was 304.3 trillion won, down 1.7 trillion won from the previous quarter.

The household loan balance at other financial institutions such as insurance, securities, and asset securitization companies was 532.4 trillion won, down 4.9 trillion won from the previous quarter.

The sales credit (credit card payments) balance within household credit in the third quarter was 118 trillion won, an increase of 2 trillion won from the previous quarter. This was due to an increase in individual credit card usage during the Chuseok holiday period.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)