Allocated 0.206 New Shares per Old Share, Issuing 8.2 Million New Shares

Raised a Total of 94.8 Billion KRW for R&D and Debt Repayment Funds

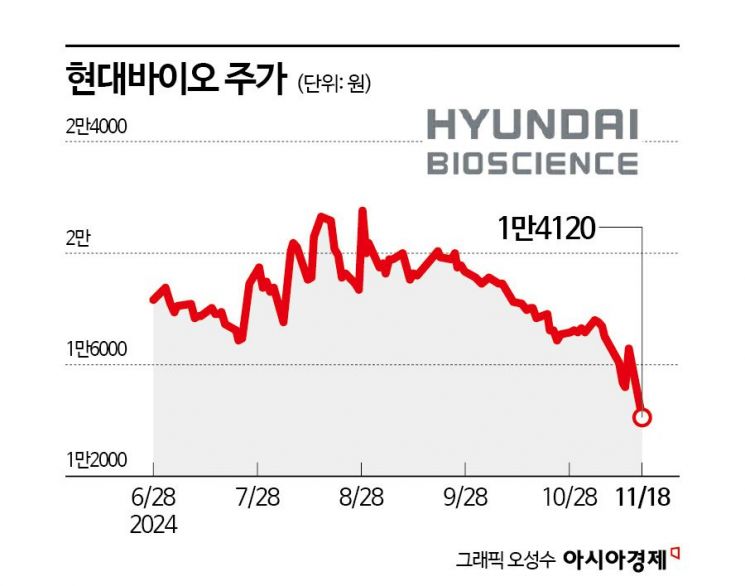

New drug developer Hyundai Bioscience has embarked on a large-scale fundraising effort. The funds raised will be used for clinical trial costs of the pancreatic cancer treatment 'Polytaxel' and debt repayment. Amid a steady decline in stock prices this year, the announcement of a rights offering has pushed the stock price to a new yearly low.

According to the Financial Supervisory Service's electronic disclosure system on the 19th, Hyundai Bioscience will issue 8.2 million new shares by allocating 0.206 new shares for every one existing share. The planned issue price per share is 11,560 KRW, raising a total of 94.8 billion KRW.

Of the funds raised, 49.8 billion KRW will be used for research and development of key pipelines and clinical trial expenses. Hyundai Bioscience is developing anticancer drugs and COVID-19 treatments.

Polytaxel, the pancreatic cancer treatment, is a new drug that combines the existing chemotherapy agent Docetaxel with Hyundai Bioscience's polymer drug delivery system. It enhances drug efficacy by increasing delivery rates to major organs while reducing side effects. Animal experiments comparing efficacy with Abraxane, a conventional pancreatic cancer chemotherapy drug, demonstrated that Polytaxel effectively kills cancer cells.

In the fourth quarter of this year, Hyundai Bioscience plans to submit an Investigational New Drug (IND) application for the Polytaxel pancreatic cancer phase 1 clinical trial to the Korean Ministry of Food and Drug Safety. Patient recruitment will begin in earnest from the second quarter of next year, with phase 1 clinical trials expected to conclude by the end of 2026. The company is also developing treatments for COVID-19 and dengue fever.

Hyundai Bioscience raised 21 billion KRW by issuing convertible bonds (CB) once each in May and June this year. The conversion prices were 14,675 KRW and 19,127 KRW respectively, both higher than Hyundai Bioscience's closing price of 14,120 KRW the previous day. If the stock price remains at the current level until May next year, when early redemption can be requested, funds will be needed to respond to the early redemption rights.

Amid the unavoidable fundraising, the largest shareholder CNPharm will subscribe to 100% of the allocated shares. Based on the planned issue price, this amounts to approximately 11.5 billion KRW. The acquisition scale may change once the new share issue price is finalized on January 31 next year.

Following news that the board of directors resolved the rights offering agenda, the stock price plunged. The previous day's closing price fell to 14,120 KRW. During the trading session, it dropped as low as 13,200 KRW, marking a yearly low. Hyundai Bioscience's stock price has fallen 45.9% this year. Considering that the KOSDAQ index fell 20.4% during the same period, the market-relative return is a poor -25.5 percentage points (P).

Prolonged deficit management and the long time remaining until clinical trial results are released have dampened investor sentiment. Hyundai Bioscience has recorded operating losses and net losses continuously over the past three years. On a consolidated basis, net losses were 20 billion KRW in 2021, 15.8 billion KRW in 2022, and 14.5 billion KRW in 2023, gradually decreasing.

Hyundai Bioscience has signed standby underwriting agreements with KB Securities, IM Securities, and others. If there are any unsubscribed shares after the rights offering and general public offering, the underwriting group will step in. The underwriting fee for unsubscribed shares amounts to 18% of the underwriting amount.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)