There is an analysis that the strong performance of the card industry in the third quarter of this year is merely an optical illusion. Although card companies have earned a net profit exceeding 2 trillion won this year and slightly lowered delinquency rates, it is explained that profitability and soundness were maintained through cost reduction and loan refinancing.

According to each card company on the 17th, the cumulative net profit (based on controlling shareholder equity) of the eight domestic full-service card companies (Shinhan, Samsung, KB Kookmin, Hyundai, Lotte, Hana, BC, and Woori Card) in the third quarter of this year was recorded at 2.2469 trillion won. This is an 8.3% increase compared to the same period last year (2.0747 trillion won).

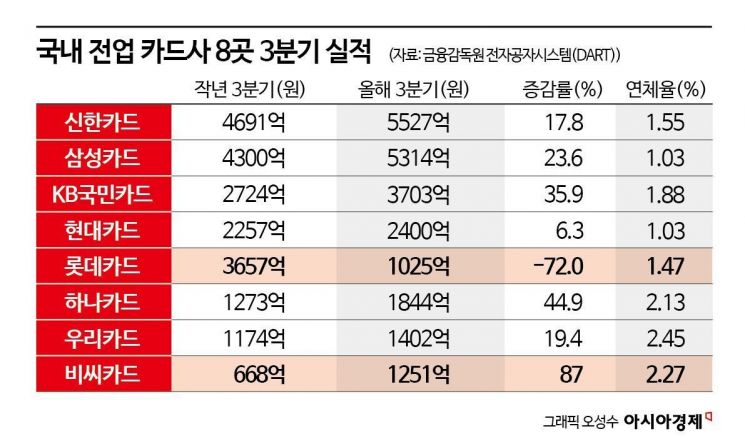

Looking at each card company, the performance of seven card companies except Lotte Card improved. Shinhan Card, the number one credit card company, recorded a net profit of 552.7 billion won from the first to the third quarter this year, an increase of 17.8% compared to last year. Samsung Card's net profit was recorded at 531.5 billion won, up 23.6%. KB Kookmin Card's net profit grew by 36% to 370.4 billion won, and Hyundai Card's net profit increased by 6.4% to 240.1 billion won.

Lotte Card's net profit from the first to the third quarter this year decreased by 72% from 365.7 billion won in the same period last year to 102.5 billion won. Even excluding the one-time disposal gain effect from the sale of subsidiaries in the first half of last year, it decreased by 38.9% compared to the same period last year (167.6 billion won). A Lotte Card official said, "Net profit decreased due to increased funding costs caused by the prolonged high interest rate environment across the market," adding, "Since the beginning of this year, the upward trend of performance growth compared to the previous quarter has continued, and the annual net profit is expected to be at last year's level excluding the one-time disposal gain effect."

In the third quarter of this year, the soundness of card companies also improved in tandem. The actual delinquency rate of the eight card companies as of the end of September was recorded at 1.73% (arithmetic average). This is a slightly stabilized figure compared to the end of June (1.76%). The actual delinquency rate is an indicator that shows the ratio of loans overdue by more than one month, including refinancing loan receivables. However, BC Card's delinquency rate rose by 0.45 percentage points to 2.27% during the loan receivables rebalancing process.

There is an analysis that this strong performance is more of an optical illusion than an improvement in the business environment. Profitability was achieved through cost reduction rather than operations, and soundness was possible through refinancing loans (loan switching). When delinquent loans are converted into new loans due to refinancing, the delinquency rate tends to decline.

An industry insider described this year's performance as a "recession-type surplus created by squeezing costs." They added, "As long as merchant fees remain unchanged, there is no room for profitability improvement," and explained, "Most card companies with declining delinquency rates are likely those with increased refinancing loans."

Seo Ji-yong, president of the Credit Card Association and professor of business administration at Sangmyung University, said, "In the third quarter of this year, profitability and soundness improvements were possible through cost reduction and refinancing loans, but it will be difficult in the 'Trump 2nd term' going forward," adding, "With the delay in the base interest rate cut, it will be difficult to lower funding costs, and as the high interest rate situation continues, delinquent loans may increase significantly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)