High Overseas Exposure → High Exchange Rate → High Profit Outlook

National Pension Service May Surpass Last Year's Returns... Possible 150 Trillion KRW Profit

Overseas Investment Sees 'Exchange Rate Effect' and Record High Stock and Bond Gains

Due to the soaring won-dollar exchange rate, pension funds and mutual aid associations with high overseas exposure are expected to close this year with 'record-breaking' returns. This is because the valuation of overseas assets invested in dollars, when converted into won, increases. Since the exchange rate rise is fully reflected in the valuation, the exchange rate is a crucial variable that determines the 'harvest' of the year.

On the 18th, a senior official from the investment banking (IB) industry said, "Depending on the exchange rate effect, the National Pension Service (NPS) is expected to achieve returns similar to or higher than last year." The NPS's return in 2023 was 14.14%, with earnings of 127 trillion won. This was the highest return since the fund's establishment in 1988. Assuming the same return as last year, this year's earnings are calculated at 146 trillion won. This amount exceeds three times the expected annual insurance premium expenditure of 45 trillion won. In other words, the one-year earnings fill a treasury that covers more than three years. Other pension funds and mutual aid associations with high overseas investment ratios are also expected to benefit from the 'tailwind' due to the exchange rate effect.

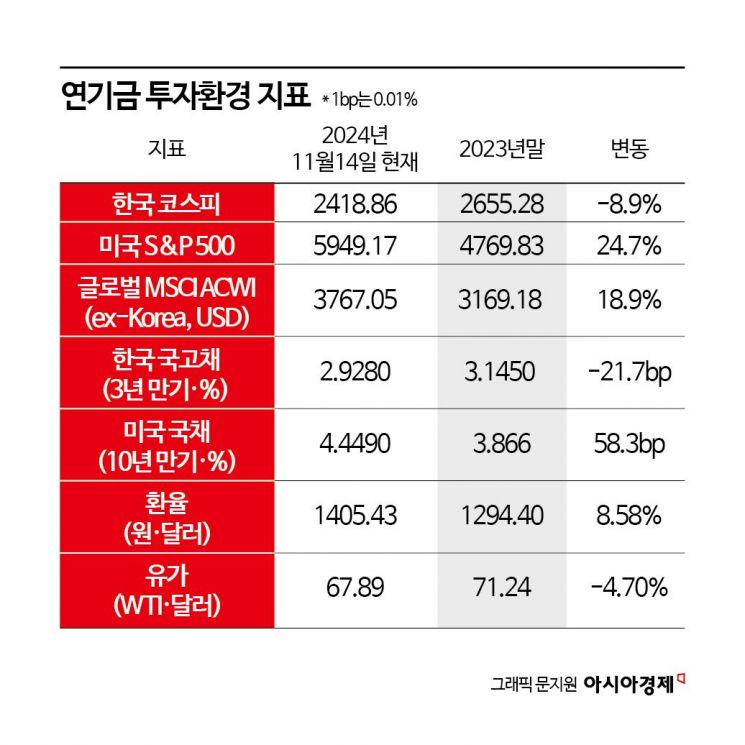

Overseas Investment Environment 'Record-Breaking'... Korea Takes a 'Backstep'

This year’s overseas investment environment is truly record-breaking. The won-dollar exchange rate rose 8.58% from 1,294.40 won at the end of last year to 1,405.43 won as of the 14th. Simply holding dollars yields a near double-digit return. During the same period, the S&P 500, one of the representative U.S. indices, rose 24.7%, and the MSCI (Morgan Stanley Capital International) international index, which aggregates stocks from 23 developed countries, increased by 18.9%. The 10-year U.S. Treasury yield reversed to an upward trend in the second half of the year, currently standing at 4.449%.

Considering this comprehensive environment, the benchmark return on overseas assets exceeds 20%. The NPS recorded a 9.71% operating return and earnings of 102 trillion won combining domestic and overseas assets in the first half (January to June). For overseas stocks, the return during this period was 20.47%. Although the domestic stock and bond markets were sluggish in the second half, the global stock markets including the U.S., the won-dollar exchange rate, and U.S. Treasury yields rose compared to the first half, more than compensating for the downturn. As of the end of August, the NPS holds assets worth 1,138 trillion won, of which domestic stocks and bonds total 486 trillion won (42.7%), and overseas stocks, bonds, and alternative investments total 651 trillion won (57.2%). The remaining approximately 1 trillion won is short-term funds for liquidity management.

Investment Fortunes Diverge Based on Overseas Exposure

Not only the NPS but also other pension funds with high overseas exposure are expected to achieve record returns. The Teachers’ Pension, with an overseas asset ratio (stocks, bonds, alternative investments) of 39.8%, is expected to maintain good returns this year following last year’s 13.5% operating return. The Government Employees Pension also has overseas exposure exceeding 40%. The Police Mutual Aid Association, Korea Teachers’ Mutual Aid Association, Administrative Mutual Aid Association, and Military Mutual Aid Association have alternative investment asset ratios exceeding 60% of their total assets, with more than half of these being overseas investments. Conversely, institutions with a high domestic investment ratio are facing a 'crisis' in returns. A chief investment officer (CIO) of one institution said, "The exchange rate is the most important risk and opportunity for the year’s harvest," adding, "It will significantly influence next year’s capital contribution plans."

Meanwhile, there are expectations that it will be difficult to immediately increase new overseas capital contributions due to the high exchange rate. Not only are prices burdensome to purchase in cash, but there is also the need to watch the foreign exchange authorities closely. In the market, the theory of the NPS 'stepping in' is continuously raised. The NPS has a currency swap agreement with the Bank of Korea worth 50 billion dollars annually, and its strategic foreign exchange hedge ratio can be up to 10%. In the event of an exchange rate emergency, it can convert up to 10% (over 40 billion dollars) of its overseas assets into won to hedge the exchange rate. An NPS official said, "If the price reaches the trigger level, the hedge will be executed," adding, "So far, we have not received any contact from the foreign exchange authorities regarding this." The 'trigger price' is confidential because even disclosing it could affect the market.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)