Q3 Operating Profit Falls Short of Expectations... Stock Price Down 20% from IPO Price

Last Month, 'Victory Goddess: Nike' Received Foreign Investment License in China

This year, Shift Up, which was considered a major player in the initial public offering (IPO) market, posted results below market expectations in the third quarter. The stock price hit its lowest level just four months after listing. The Yeouido securities market expects the third-quarter performance to be a temporary slump and forecasts improved results next year.

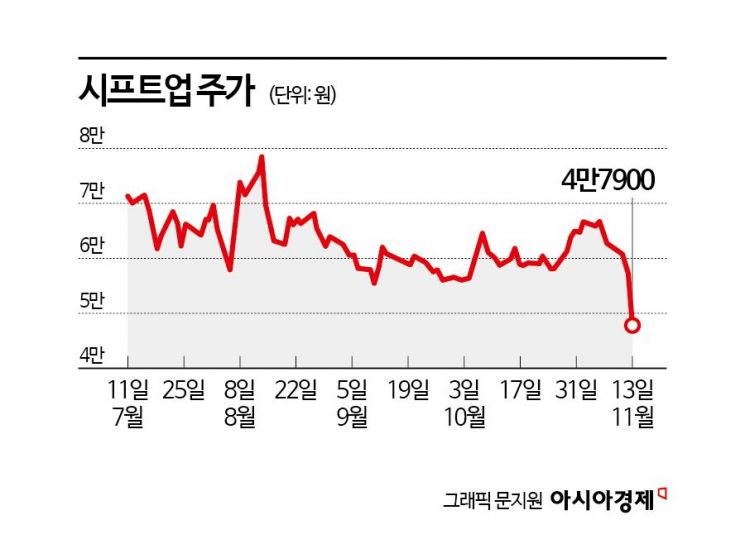

According to the financial investment industry on the 14th, Shift Up's stock price fell 20% compared to the public offering price of 60,000 KRW. The market capitalization decreased from 3.5 trillion KRW to 2.8 trillion KRW. During the previous day’s trading session, the price dropped to 47,550 KRW at one point, setting a new post-listing low. The previous low was 54,600 KRW, recorded on the 4th of last month.

Founded in 2013, Shift Up develops games serviced on major platforms such as mobile, PC, and consoles. After releasing its first title, "Destiny Child," in 2016, it launched "Goddess of Victory: NIKKE" in 2022. As NIKKE gained popularity, sales grew rapidly. Revenue increased by 155%, from 66.1 billion KRW in 2022 to 168.6 billion KRW last year.

In the third quarter of this year, the company recorded revenue of 58 billion KRW and operating profit of 35.6 billion KRW. These figures represent increases of 52.3% and 120.4%, respectively, compared to the same period last year. However, compared to the previous quarter, revenue and operating profit decreased by 11.0% and 21.0%, respectively. For the first three quarters, revenue and operating profit were 160.6 billion KRW and 106.5 billion KRW, up 30.8% and 35.4% year-on-year.

Hyojin Lee, a researcher at Meritz Securities, explained, "Shift Up's third-quarter operating profit of 35.6 billion KRW fell short of the market expectation of 39.4 billion KRW," adding, "The bonus related to the console game 'Stellar Blade' was paid earlier than expected in the third quarter."

Despite the stock price decline due to results below market expectations in the third quarter, market experts remain optimistic about the earnings outlook. Junho Lee, a researcher at Hana Securities, estimated, "This year, revenue will reach 217 billion KRW and operating profit 148.2 billion KRW," analyzing that "due to strong digital sales of Stellar Blade, earnings estimates have been raised from previous levels." He added, "Stellar Blade sales in the third quarter were about 400,000 units, with a cumulative 1.5 million units this year," and "annual sales are expected to exceed 1.65 million units."

While existing released games continue to serve as stable cash generators, expectations for entry into the Chinese gaming market are growing. On the 28th of last month, Shift Up received a game service license (판호) from the Chinese National Press and Publication Administration for "Goddess of Victory: NIKKE."

Seungho Choi, a researcher at Sangsangin Securities, explained, "The current stock price hardly reflects expectations for NIKKE in China," and added, "Considering the release schedule of competing titles and marketing plans, it is expected to launch in the second quarter of next year."

Heeseok Lim, a researcher at Mirae Asset Securities, predicted, "With Tencent's full-scale promotion, pre-launch indicators dispelling concerns about success will emerge," and forecasted, "When NIKKE is launched in the Chinese market, it will generate an average daily revenue of 1 billion KRW."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.