"The Paid-in Capital Increase of Korea Zinc Should Not Have Been Proceeded from the Start" Mention

"Will Normalize the Ineffective Board of Directors and Introduce an Executive Officer System"

Yeongpung and MBK Partners stated on the 13th regarding the withdrawal decision of Korea Zinc's rights offering, "As the largest shareholder of Korea Zinc, we regret that the general public rights offering, which began by disregarding the trust of the capital market and shareholders, caused great confusion in the capital market and harmed existing shareholders before being belatedly withdrawn." They added, "The general public rights offering should not have been conducted in the first place."

They continued, "Capital market stakeholders, Korea Zinc shareholders, Korea Zinc executives and employees, and the general public have directly witnessed through the series of processes including Korea Zinc's tender offer for treasury shares and the rights offering how severely the governance system, which is Korea Zinc's operation and supervision framework, was damaged due to the arbitrary actions of Chairman Choi Yoon-beom," and said, "We have once again realized that the tender offer for treasury shares led by Chairman Choi Yoon-beom and promoted by the Korea Zinc board caused significant damage to the company."

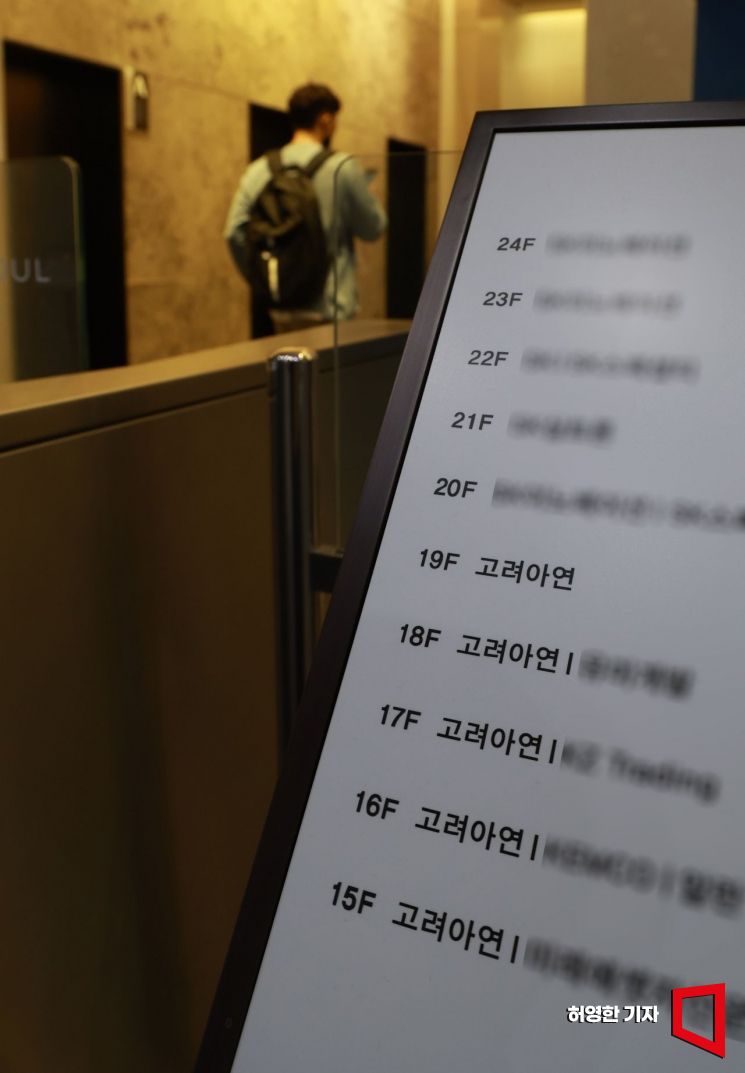

On the 13th, when the board meeting to decide whether to withdraw the paid-in capital increase of Korea Zinc is held, people are entering the Korea Zinc headquarters building in Jongno-gu, Seoul.

On the 13th, when the board meeting to decide whether to withdraw the paid-in capital increase of Korea Zinc is held, people are entering the Korea Zinc headquarters building in Jongno-gu, Seoul.

Regarding future plans, they stated, "MBK and Yeongpung, as the largest shareholders of Korea Zinc, intend to normalize the ineffective Korea Zinc board functions by holding an extraordinary general meeting of shareholders to appoint new directors and to swiftly establish a new and transparent governance system at Korea Zinc by introducing an ‘executive officer system’."

Meanwhile, Korea Zinc resolved to withdraw the general public rights offering at an extraordinary board meeting held that morning. Korea Zinc explained the background by saying, "At the time of resolving the general public rights offering, we had not anticipated the concerns of shareholders and market participants, but we have continuously listened to these concerns with a humble attitude. After an independent deliberation process centered on outside directors, we finally re-examined the agenda and decided to withdraw it."

On the 30th of last month, Korea Zinc announced a large-scale rights offering plan to newly issue 3,732,650 common shares, equivalent to about 20% of the issued shares, at 670,000 KRW per share. However, after the tender offer for treasury shares, the announcement of a rights offering with an opposing nature led the Financial Supervisory Service to launch an investigation citing 'possibility of unfair trading,' and on the 6th, they requested Korea Zinc to submit a correction report. Korea Zinc bowed its head during the recent Q3 earnings conference call, stating, "Such market reactions and changes in circumstances were difficult to predict sufficiently when we initially pursued the general public rights offering."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)