Publication of the Report on "Corporate Preparation Strategies for Natural Capital Disclosure"

As international discussions to jointly address nature-related crises are active, on the 13th, Samil PwC published the report ‘Corporate Preparedness Strategies for Nature Capital Disclosure’ and emphasized that “proactive corporate response strategies are crucial.”

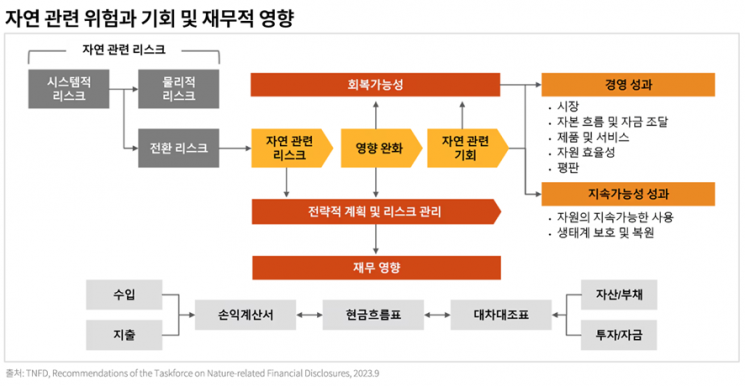

The report covered ▲the background of the emergence of the nature-related information disclosure framework (TNFD) ▲an explanation of the interaction between natural capital and corporate business ▲guidelines for nature capital-related disclosures ▲and three preparation steps for nature-related disclosures.

The TNFD recommendations define nature capital issues by categorizing them into four elements (DIRO): Dependencies of companies on nature, Impacts of corporate activities on nature, Risks from natural capital loss and biodiversity decline, and Opportunities. These are identified, assessed, managed, and reported. Dependencies are considered the most distinguishing element compared to the Task Force on Climate-related Financial Disclosures (TCFD). Unlike TCFD, which focuses more on risks and opportunities related to climate change, TNFD regards assessing how much a company depends on natural capital as a core element.

Currently, 502 companies worldwide have committed to disclosures based on the TNFD recommendations. According to official TNFD statements, the total market capitalization of these companies is approximately $6.5 trillion (about 8,900 trillion KRW). There are 129 financial institutions committed to disclosure, with total assets under management amounting to $17.7 trillion (about 24,200 trillion KRW). Accordingly, corporate natural capital disclosures are expected to become more active in the future.

The report emphasized the need to prepare in advance for natural capital disclosures to mitigate nature-related risks and seek opportunities for new value creation. First, it is essential for governance bodies to recognize the interaction between their business activities and natural capital. Additionally, companies should establish a comprehensive sustainability strategy that considers existing disclosure standards based on an accurate understanding of the TNFD recommendations. Furthermore, before preparing disclosures, it is recommended to conduct internal due diligence using the LEAP (Locate, Evaluate, Assess, and Prepare) approach proposed by the TNFD recommendations.

Steven Kang, Sustainability Platform Leader at Samil PwC, stated, “This is a time when governments and companies must cooperate in the international efforts to restore natural capital and biodiversity,” adding, “Following climate change, nature-related disclosures can serve not as a burden but as new business opportunities for companies, so they should proactively prepare while monitoring global trends.” Detailed information on the report can be found on the Samil PwC website.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)