7.50% High-Interest Perpetual Bonds Issued for 50 Billion KRW

Purpose to Reduce Debt Ratio... Financial Improvement in Construction Industry

Change of Ssangyong Construction Support Entity from Global SeaA to SeaA Sangyeok

Global SeaA Deficit and Other Causes of Financial Deterioration

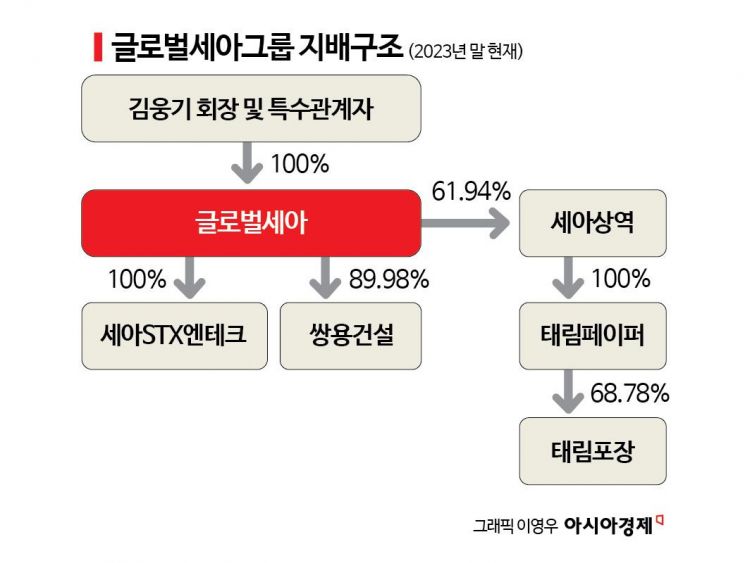

Ssangyong Construction, incorporated into the Global SeAH Group affiliates, has issued 50 billion KRW worth of hybrid capital securities (perpetual bonds). After improving its financial structure through a 150 billion KRW paid-in capital increase following the acquisition, it has taken additional steps to reduce its debt ratio. During the issuance of the perpetual bonds, SeAH Trading, the group's cash cow, provided side support. Recently, Global SeAH, the holding company, has been improving its structure by putting up SeAH STX Entech, which was acquired in the past but became insolvent, for sale and receiving financial support from Ssangyong Construction due to its own deteriorating performance. In this process, the support entity for Ssangyong Construction appears to be shifting from Global SeAH to SeAH Trading.

According to the investment banking (IB) industry on the 11th, Ssangyong Construction recently issued 50 billion KRW worth of perpetual bonds with an interest rate of 7.50%. The maturity is 30 years, but it has a call option allowing early redemption after one year. If the call option is not exercised after one year to repay the principal and interest, a penalty interest rate is added to the existing interest rate. Usually, the call option on perpetual bonds can be exercised five years after issuance. However, for companies with significant concerns about repayment stability, the call option exercise period is set shorter, such as 1 or 3 years, to attract investors.

Ssangyong Construction is in a situation where it is difficult to issue perpetual bonds based solely on its own credit rating. Therefore, SeAH Trading, a core affiliate of the group, provided a capital replenishment commitment for Ssangyong Construction's perpetual bonds. If Ssangyong Construction cannot repay the principal and interest on its own, SeAH Trading has promised investors to support Ssangyong Construction with the necessary funds for repayment.

Ssangyong Construction issued the perpetual bonds with side support from SeAH Trading to reduce its debt ratio. In the case of perpetual bonds, if the issuer continues not to exercise the call option, theoretically, it does not have to repay the principal and interest until maturity. Interest payments can also be deferred and accumulated to be paid later. Moreover, the maturity can be extended beyond 30 years. Considering these characteristics, under International Financial Reporting Standards (IFRS), perpetual bonds are treated as equity rather than liabilities in accounting.

Global SeAH, the holding company of the Global SeAH Group, acquired Ssangyong Construction from the Investment Corporation of Dubai (ICD) at the end of 2022. The plan is to grow Ssangyong Construction, which is facing difficulties, by expanding overseas orders through the group's networks in Latin America and Southeast Asia. An industry insider explained, "Global SeAH has secured extensive local political and governmental networks over decades by operating in underdeveloped Latin American countries in sectors such as oil and gas," adding, "The strategy is to grow construction by winning local projects through Ssangyong Construction."

After acquiring Ssangyong Construction, Global SeAH conducted a paid-in capital increase of 150 billion KRW last year to secure shares and improve the financial structure. With the inflow of new money, Global SeAH's stake in Ssangyong Construction increased to about 90%, and Ssangyong Construction's financial structure was significantly improved. As capital increased, the debt ratio, which had reached 840%, fell below 300%. By using the capital increase funds to repay borrowings, total borrowings decreased from 158.2 billion KRW at the end of 2022 to 75.6 billion KRW at the end of 2023. Last year, the company turned profitable after several years of consecutive losses.

Global SeAH is known as a group with many inter-affiliate financial transactions. In the past, Global SeAH often guaranteed or directly lent funds for SeAH Trading and Ssangyong Construction's financing. However, as Global SeAH's situation has recently worsened, the cash flow-strong SeAH Trading has been lending funds or supporting affiliates such as Ssangyong Construction.

SeAH Trading is known to be jointly owned by Global SeAH and the three daughters of Chairman Kim Woong-ki. Through previously acquired companies such as Taelim Paper and Taelim Packaging, it generates annual sales of around 30 trillion KRW and operating cash flow (OC) exceeding 200 billion KRW.

An IB industry insider said, "Global SeAH applied for court receivership for SeAH STX Entech, which it acquired in the past, putting it up for sale, and its own performance has deteriorated sharply, worsening cash flow," adding, "The entity providing financial support to Ssangyong Construction, which aims to grow through overseas projects, is shifting from Global SeAH to SeAH Trading, a company known to be owned by Chairman Kim Woong-ki's three daughters."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)