FOMC This Afternoon... Interest Rate Expected to Drop by 0.25%P

Focus on Powell's Message... Outlook for Trump's Second-Term Economy

Decline in Treasury Yields... Dollar Value Also Falls

The three major indices of the U.S. New York Stock Exchange are showing an upward trend in the early trading hours on the 7th (local time). After rallying and hitting record highs following the confirmation of Donald Trump as the U.S. President-elect the previous day, the market appears to be taking a breather. Investors are awaiting the Federal Reserve's (Fed) November Federal Open Market Committee (FOMC) interest rate decision scheduled for the afternoon. Attention is focused on what message Chairman Powell will deliver regarding the economic outlook following the start of Trump's second term.

As of 10:54 a.m. in New York stock market trading, the Dow Jones Industrial Average, centered on blue-chip stocks, is up 0.11% from the previous trading day at 43,775.98. The S&P 500, focused on large-cap stocks, is trading 0.64% higher at 5,967.16, and the tech-heavy Nasdaq Composite is up 1.27% at 19,225.18.

The previous day, the New York stock market surged nearly 3%, with all three major indices hitting record highs, buoyed by the resolution of election uncertainties and expectations for Trump’s pro-business policies. Expectations that Trump’s pledges, including corporate tax cuts, deregulation, and protectionism, would greatly benefit companies served as the driving force. With the Republican Party likely to secure the majority in both the Senate and the House following the elections held alongside the presidential election on the 5th, speculation that Trump’s pledges could be realized also increased. Despite the anticipation of a 'Trump rally,' the market is taking a breather today.

Scott Helfstein, Chief Investment Strategist at Global X ETFs, analyzed, "The results are out, and the financial markets can now breathe a little easier without the ongoing concerns about the election process." He added, "Investors still need to be cautious about overreacting or underreacting to geopolitical news. Such events typically cause significant volatility in asset prices, but fundamentals will prevail over time."

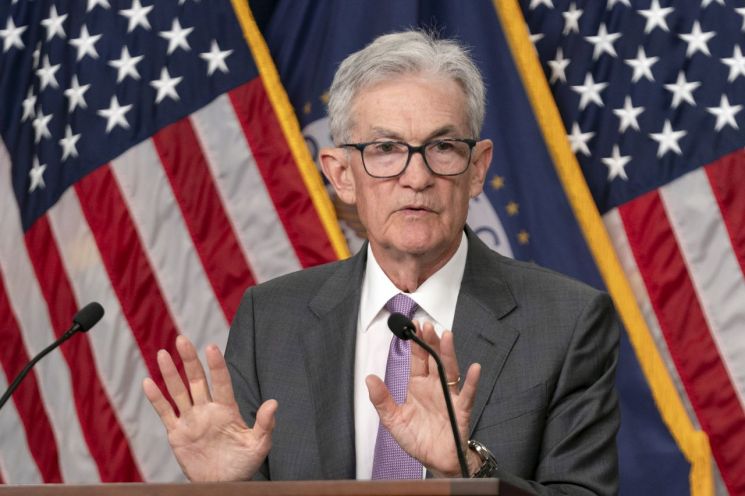

Investors’ attention is focused on the Fed’s interest rate decision today. The Fed will announce the results of the FOMC regular meeting at 2 p.m. Eastern Time (4 a.m. Korean Time on the 8th). Fed Chair Jerome Powell will hold a press conference starting at 2:30 p.m. to explain the rationale behind the rate decision. The market expects the Fed to cut rates by another 0.25 percentage points after the first cut from 5.25-5.5% to 4.75-5.0% in September. According to the Chicago Mercantile Exchange (CME) FedWatch tool, the federal funds futures market reflects a 98.7% probability of a 0.25 percentage point rate cut at the November FOMC meeting.

The biggest focus for investors is likely to be on the message from Chair Powell that will provide hints about the pace of future rate cuts rather than the size of the current cut. Particularly, attention is drawn to this press conference as Trump has repeatedly expressed dissatisfaction with Powell’s high-interest-rate policy and has indicated intentions to dismiss Powell upon re-entering the White House. Powell is expected to face questions about growth and inflation forecasts following the start of Trump’s second term.

James Bockins, Portfolio Manager at Aviva Investors, assessed, "The market’s focus is more on communication in December and next year than on the rate cut itself." He emphasized, "Powell will face a very difficult situation, and managing communication will become very challenging. It is important to avoid taking too firm a stance in any particular direction."

By individual stocks, Tesla, a 'Trump beneficiary stock,' is up 2.97% today following a 14.75% jump the previous day. Trump Media & Technology (DJT), which rose nearly 6% the day before, is showing extreme volatility, dropping 19.18%. Bank stocks, which had been strong due to expectations of high interest rates under Trump’s second term, are weak. JP Morgan is down 2.99%, while Bank of America (BoA) and Wells Fargo are down 0.54% and 2.24%, respectively.

Following the impact of Trump’s election, Treasury yields and the dollar, which surged the previous day, are weakening. The U.S. 10-year Treasury yield, a global bond yield benchmark, is currently down 7 basis points (bp) (1 bp = 0.01 percentage points) from the previous trading day at 4.35%, and the 2-year Treasury yield, sensitive to monetary policy, is down 5 bp at 4.21%. The dollar index, which measures the value of the dollar against six major currencies, is fluctuating around 104.19, up 0.75% from the previous day. The market expects that Trump’s promised tariff hikes and tax cuts will lead to inflation and a widening fiscal deficit, stimulating interest rates and the dollar’s value.

International oil prices are declining. West Texas Intermediate (WTI) crude oil is trading at $71.34 per barrel, down $0.35 (0.49%) from the previous trading day, and Brent crude, the global oil price benchmark, is down $0.27 (0.36%) at $74.65 per barrel.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)