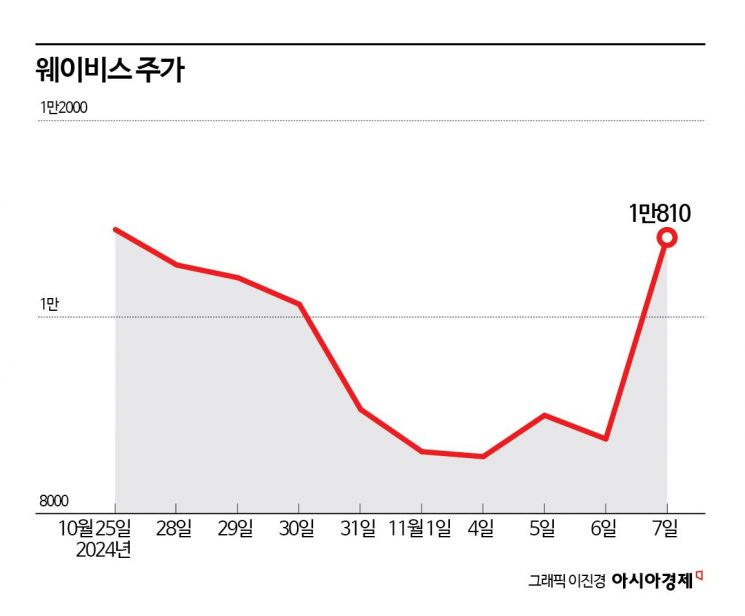

Listed at an IPO price of 15,000 KRW on the 25th of last month

Fell to 8,420 KRW on the 1st before rebounding

Expectations for Trump’s support of the aerospace industry

Wavevis, which entered the KOSDAQ market on the 25th of last month and saw its stock price halved compared to the initial public offering (IPO) price, has begun a full-fledged rebound after being included in the aerospace sector. This surge was driven by the fact that then President-elect Donald Trump identified the aerospace industry as a key campaign promise, causing related stocks to soar simultaneously. In particular, Wavevis is gaining attention as a company that can resolve supply shortages not only domestically but also internationally, as major countries including the United States, Japan, and Europe have designated gallium nitride (GaN) radio frequency (RF) semiconductors as strategic core materials and are controlling their exports.

According to the financial investment industry on the 8th, Wavevis’s stock price rose 23.4% the previous day. This was influenced by a 20% surge in aerospace-related stocks such as AP Satellite, Genoco, and HVM in the domestic stock market on the same day.

Wavevis was listed on the KOSDAQ market on the 25th of last month with an IPO price of 15,000 KRW. On the day of listing, the stock price rose to 18,500 KRW but closed at 10,890 KRW. The stock price fell below the IPO price and continued to decline daily, reaching 8,420 KRW on the 1st, marking a 43.8% drop compared to the IPO price.

As trading volume decreased and the stock was neglected, Wavevis’s stock price recovered to the 10,000 KRW level the previous day. The surge in aerospace-related stocks was due to expectations that President-elect Trump would actively promote the aerospace industry. It is interpreted that Wavevis joined the rally because it can produce GaN RF semiconductors necessary for the aerospace field.

Wavevis succeeded in mass-producing GaN RF semiconductor chips for the first time in Korea. After successfully domesticating GaN RF semiconductors, which were previously entirely imported, Wavevis is the only company in Korea that has fully internalized mass production capabilities. In the project to launch four reconnaissance radar satellites and one optical satellite, which has been underway since 2019, Wavevis manufactured and supplied the transmitter of the transceiver onboard the satellites. Based on its successful development of GaN RF semiconductor modules, Wavevis believes it is highly likely to participate in major satellite projects.

GaN RF semiconductor technology is becoming increasingly important as an irreplaceable core technology in various advanced industries, including satellites and aerospace. Compared to existing semiconductor materials such as silicon (Si), gallium arsenide (GaAs), and silicon carbide (SiC), GaN is advantageous for performing RF power amplification functions.

Demand for GaN RF semiconductors is increasing in various fields such as advanced weapon systems and satellites/aerospace. The related market size is expected to grow at an average annual rate of 13%, from 4.1 trillion KRW last year to 7.5 trillion KRW by 2028. Despite the growing demand, supply remains tight as major countries worldwide designate GaN RF semiconductors as strategic core materials and control their exports.

As advanced countries strictly control exports, efforts have been made under government leadership to domesticize GaN RF. Wavevis began developing GaN RF semiconductors in earnest after winning a contract from the Agency for Defense Development in 2015 to develop GaN RF power amplifier device processes. Based on the mass production technology of GaN RF semiconductor chips, Wavevis vertically integrated the value chain of RF power amplifier technology from chip to package transistor to module. While a few companies in the United States and Japan supply 100% of GaN chips, Wavevis’s start of mass production is helping to alleviate supply shortages.

Jongseon Park, a researcher at Eugene Investment & Securities, explained, "As of the first half of the year, we secured an order backlog of 38.3 billion KRW," adding, "We expect approximately 100 billion KRW in additional orders this year and next year." He further noted, "We are pursuing entry into the Indian market as well as global countries experiencing supply shortages."

Daishin Securities, the IPO underwriter, estimated that Wavevis’s sales will reach 41.6 billion KRW in 2025 and 54.9 billion KRW in 2026. Operating profit is expected to increase from 4 billion KRW to 12 billion KRW. Orders are increasing as Wavevis targets overseas markets such as India, which are experiencing supply shortages due to strong export control policies by advanced countries.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)