Battery Cells to Materials All Declining

Shift in Green Policies like IRA and Concerns over Interest Burden

Trump, Musk's Interests Highlight "Tesla Value Chain"

Secondary battery stocks are weak. This is due to concerns that Donald Trump, who won the 47th U.S. presidential election, will implement policies unfavorable to the secondary battery industry. While the securities industry acknowledges that these market concerns could materialize, it also warns against excessive pessimism.

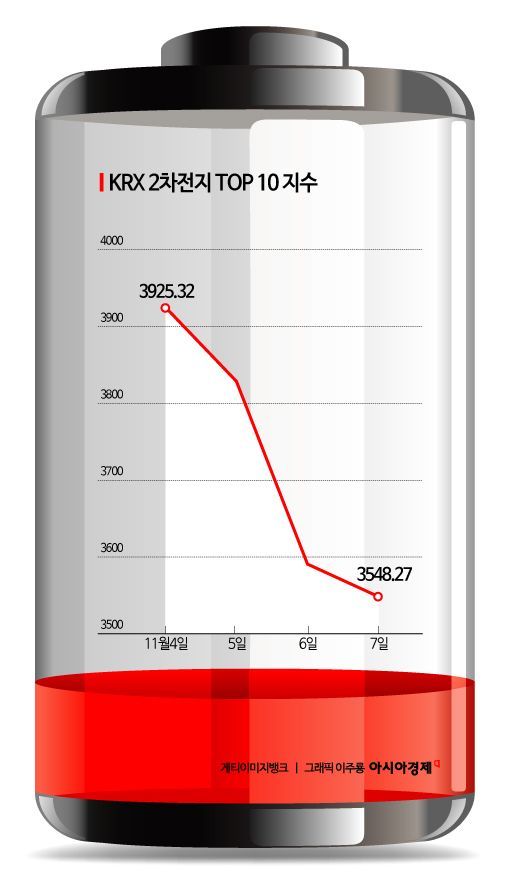

According to the Korea Exchange on the 8th, the 'KRX Secondary Battery TOP10' index closed at 3,548.27, down 42.39 points (-1.18%) from the previous day. Since November 6, when Trump's victory became foreseeable, the index has fallen by 7.43%. During the same period, all secondary battery-related stocks, from battery cells to materials, including Ecopro BM (-10.87%), Ecopro (-9.34%), Samsung SDI (-9.29%), LG Energy Solution (-8.10%), and LG Chem (-5.59%), showed a broad decline. The fear that Trump would reduce investment in the battery industry and cut subsidies triggered a 'panic sell-off.'

The securities industry pointed out risks that the domestic battery industry may face under Trump's administration, such as changes in eco-friendly policy directions and concerns over increased interest expenses. Jinsoo Jung, a researcher at Heungkuk Securities, said, "The Inflation Reduction Act (IRA) has potentially played a role in controlling the entry of Chinese batteries into the U.S. market. If these subsidies are reduced, not only will the price competitiveness of domestic companies' batteries be damaged, but the entry barriers for Chinese companies will be lowered, exposing the market to threats from Chinese batteries." He added, "Over the past three years, capital expenditures (CAPEX) and interest expenses in the secondary battery industry have increased more than fourfold. The longer the investment recovery period is delayed, the heavier the interest burden becomes. If the essence of Trump trading is inflation, the aftereffects of the massive expenditures so far could be amplified depending on future interest rate hikes."

However, Jung cautioned against excessive pessimism. He said, "The automotive industry is moving toward larger and heavier vehicles, requiring more efficient powertrain technology, and the solution to this is the electric motor. This clearly justifies the automotive OEMs' push for electrification. It is important to recognize that electrification at this point is not being forced by policy but is being proactively pursued by companies. Structural limits exist that prevent changes in policy environments from reversing the electrification paradigm shift."

Meanwhile, there is analysis that the fact that Elon Musk, CEO of the global electric vehicle company Tesla, has a direct stake with Trump could act as a variable. Noh Wooho, a researcher at Meritz Securities, said, "In his victory speech, Trump introduced his supporter Elon Musk as 'a star is born.' Contrary to market concerns that Trump will abolish EV mandates, Trump's influence on the EV transition is neutral." He added, "Tesla is the only automaker that has expressed an opinion of increased sales volume next year. Attention should be paid to the potential relative shipment increase of battery cell and material companies supplying Tesla within the pessimistic secondary battery sector."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)