3.4 Percentage Points Decline Year-on-Year

China Leading with LFP Eyes European Market

Total Usage 599.0 GWh, Up 23.4% Year-on-Year

The market share of electric vehicle batteries from the three domestic battery companies in Korea from January to September fell by 3.4 percentage points compared to the same period last year, recording 20.8%. Chinese companies are leveraging the solid domestic Chinese market and using lithium iron phosphate (LFP) batteries to target the European market as well.

According to the global electric vehicle battery usage report for January to September released by SNE Research on the 6th, the global electric vehicle battery usage of the three domestic companies?LG Energy Solution, SK On, and Samsung SDI?grew compared to the same period last year.

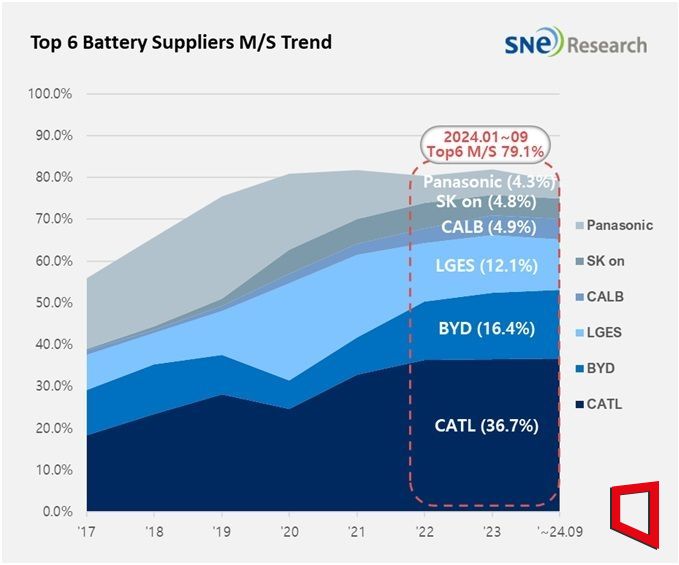

Market Share of Six Global Battery Companies from January to September 2024 (Provided by SNE Research)

Market Share of Six Global Battery Companies from January to September 2024 (Provided by SNE Research)

LG Energy Solution recorded 72.4 GWh, an increase of 4.3% compared to the same period last year, maintaining its 3rd place in market share ranking.

Vehicles equipped with LG Energy Solution batteries, such as Tesla Model 3 and Y, Volkswagen ID.4, Ford Mustang Mach-E, and GM Cadillac Lyriq, which are highly popular in Europe and North America, showed steady sales, sustaining the growth in battery usage. Additionally, sales of Hyundai Motor Company's Ioniq 6 and Kona Electric in Europe also increased significantly compared to the same period last year.

SK On, ranked 5th, grew by 12.4% to 28.5 GWh. The recovery in sales of Hyundai Motor Company's Ioniq 5, EV6, EV9, as well as Mercedes-Benz EQA, EQB, and Ford F-150 Lightning, which showed sluggish sales at the beginning of the year, led SK On's growth.

Samsung SDI, ranked 7th, recorded 23.9 GWh, achieving a growth rate of 5.4%. Strong sales of BMW and Rivian, along with steady sales of Audi Q8 e-tron and Jeep Wrangler PHEV (plug-in hybrid electric vehicle), contributed to this growth.

On the other hand, Chinese company CATL maintained its 1st place with a usage volume of 219.6 GWh, up 26.5% compared to the same period last year, and BYD, ranked 2nd, increased by 28.0% to 98.5 GWh. BYD is rapidly securing market share by expanding into Asian and European markets.

Panasonic, the only Japanese company in the top 10 and ranked 6th, recorded 25.7 GWh, showing a decline of 20.2% compared to the same period last year.

The total battery usage installed in electric vehicles (EV, PHEV, HEV) registered worldwide from January to September was approximately 599.0 GWh, growing 23.4% compared to the same period last year.

Regarding the third-quarter performance of battery companies, SNE Research stated, "The three Korean battery companies recorded relatively low sales and profit margins but are pursuing strategic diversification to respond to the mid- to long-term market." They added, "Strengthening strategic partnerships with OEMs in the U.S. and Europe and acquiring new customers have become increasingly important."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)